India installed 6,794MW of solar PV in H1 (January – June) 2023, a 19% decrease year-on-year from 2022 according to energy analyst JMK Research.

Solar now accounts for 54% of the country’s total 129.6 GW renewable energy capacity, a 3% expansion from 51% over the last year. However, JMK said that greater deployments will be needed across all solar and wider renewables sectors, as well as a focus on establishing domestic PV manufacturing, if India is to reach its target of 500GW of clean energy by 2030.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Of the 6.7GW installed in H1, rooftop solar installations reached 2.29GW, which is more than the entire market size for the calendar year 2022. For context on the rooftop segment’s recent growth, H1 2021 saw 862MW of rooftop solar installed in India, which was a 210% increase on the same period in 2020.

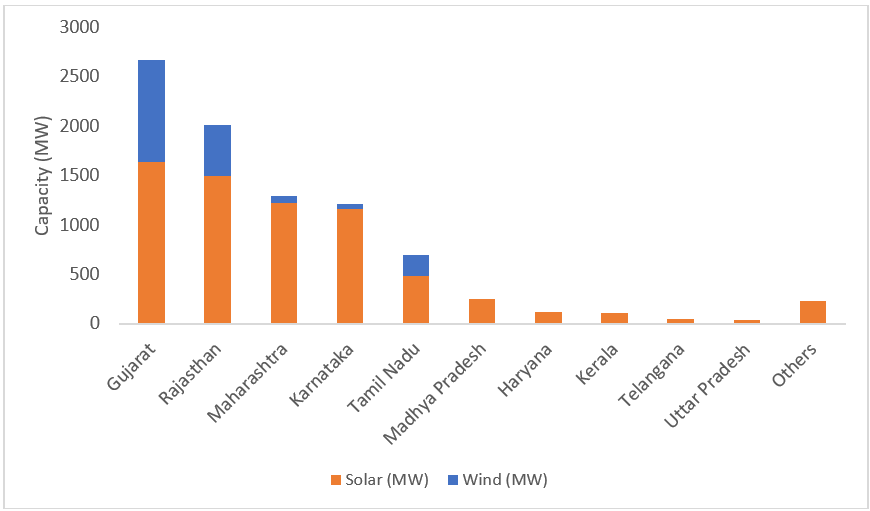

Gujarat added the most solar capacity of any state in the first half of the year – 1.6GW – followed by Rajasthan with around 1.5GW.

It is notable that Rajasthan wasn’t the top installer in H1 2023; for a long time the state has been the leader for Indian solar by some distance, and last year almost half of all capacity was installed or planned to be installed in Rajasthan.

India’s solar market has been facing some trouble of late. JMK reported that in FY2022 the country fell significantly short of its installation targets, reaching just 12.8GW of a forecast 20GW.

This is largely because of its attempt to shrug off dependence on Chinese imports and establish domestic manufacturing capacity. The basic customs duty (BCD) import tariff on Chinese PV and the Production-Linked Incentive (PLI) and Approved List of Models and Manufacturers (ALMM) designed to spur domestic production have led to a mismatch between demand and supply as domestic policies have struggled to account for the decline in imports.

Bridge To India – another analyst firm – said to PV Tech Premium at the start of 2023 that the ‘module supply crunch’ can be expected to continue through this year.

Looking forward, JMK said that H2 2023 should see deployments accelerate due to the falling cost of modules over the last few months and the relaxing of the ALMM requirements (effectively increasing the number of possible deployments in India) until FY2024.