JinkoSolar has signed a deal to supply 600MW of its n-type Tiger Neo modules to Brazilian PV distributor Aldo Solar.

With the new panels expected to be available from Aldo Solar for pre-sale as of July, the deal represents the largest contract JinkoSolar has secured for its Tiger Neo portfolio to date.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

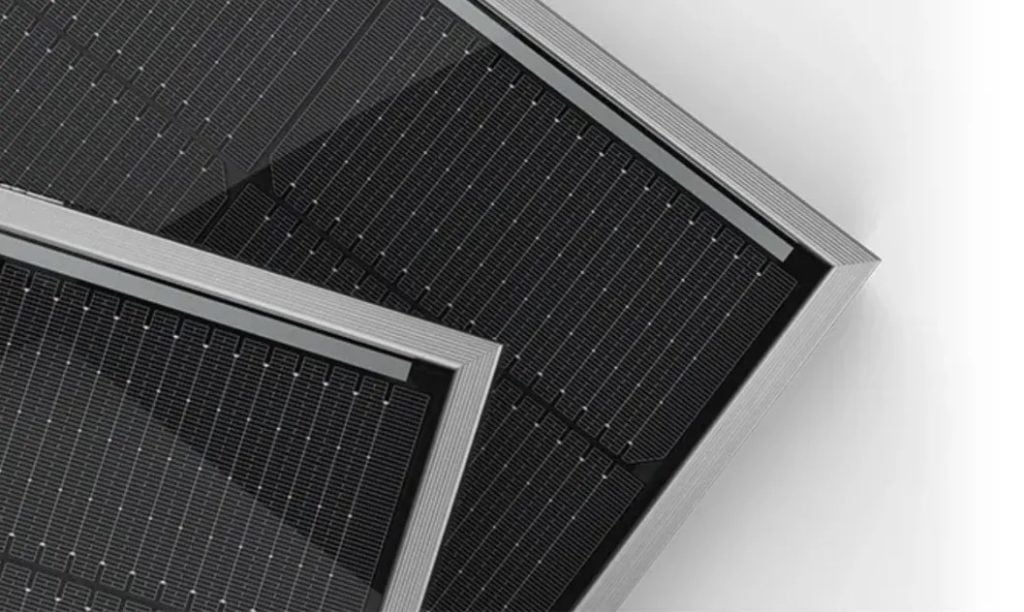

Launched last year, the series has n-type tunnel-oxide passivated contact (TOPCon) technology, a maximum power output of up to 620W in mass production and conversion efficiency of up to 22.3%.

Making Brazil the first Latin American market to have access to the modules, the deal between JinkoSolar and Aldo Solar comes after the companies signed a 2GW module supply agreement late last year.

Aldo Solar CEO Aldo Teixeira said at the time that the partnership with Jinko will be fundamental for the distributor to reach its goal of triple-digit growth in 2022, as it looks to reach BR$6 billion (US$1.05 billion) in sales. According to Aldo, it has a 31% share of Brazil’s distributed solar market.

With research organisation BloombergNEF forecasting that Brazil is set to add 8GW of solar this year, PV Tech has explored why the market’s PV sector is about to take off and what hurdles it needs to overcome.