‘Silicon Module Super League’ (SMSL) leader JinkoSolar is expecting to lower its capital expenditure (capex) in 2019 after almost tripling in-house capacity (ingot/wafer, cell and module), since 2015.

The company is currently reviewing its capex requirements for next year, according to management during its most recent quarterly earnings call, which is was not expected to be significant.

Manufacturing capex through the first nine months of 2018, reached US$385 million, however fourth quarter capex guidance was expected to be in the range of only US$15 million to US$16 million, according to the company.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

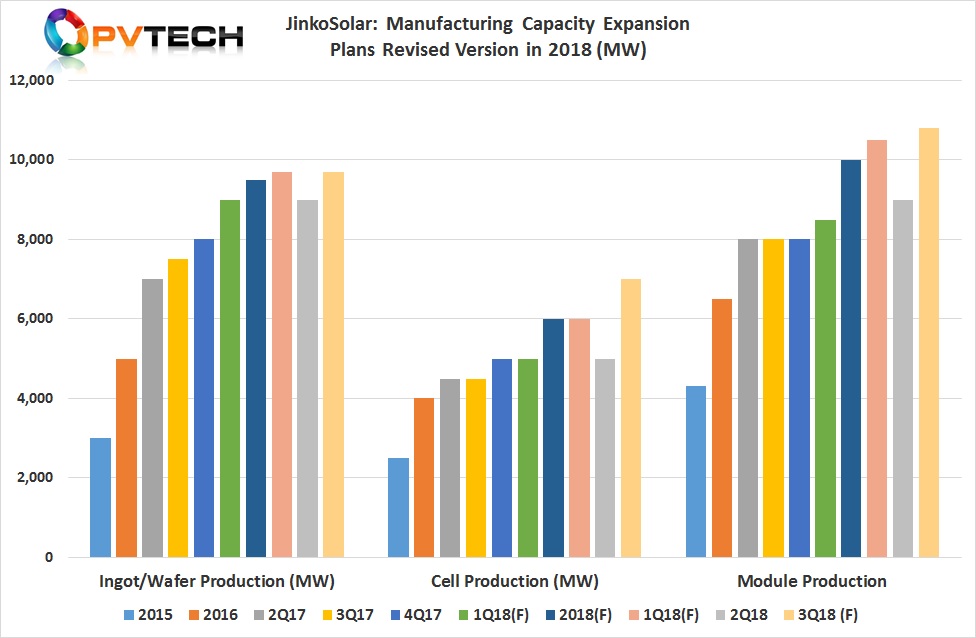

As of September 30, 2018, JinkoSolar’s in-house annual ingot/wafer, solar cell and solar module production capacity stood at 9.2GW, 6.5GW and 10.0GW, respectively.

The company expects ingot/wafer capacity to reach 9.7GW by year-end. Both solar cell and module assembly capacity increases have been the driver of capex in 2018, which is expected to reach 7.0GW and 10.8GW, respectively at the end of 2018.

The company reiterated that its new US module assembly plant has started pilot production and would be ramped to full capacity (400MW) in early 2019.

The slowdown in planned capacity expansions is in contrast to its optimistic forecast for global PV end-market demand in 2019. JinkoSolar expects a recovery in the China market next year (55GW plus) as well as growing demand across major markets such as India, US and Europe. Emerging markets are also expected to deliver growth such as Mexico and Latin America.

Well known for its large global footprint, JinkoSolar noted in the earnings call that its record module shipments in the third quarter of 2018 were due to shipments to almost 80 countries and guidance of shipments in the range of 3.7GW to 4.0GW for the fourth quarter, would be due to shipments closer to 90 countries.

Module shipment guidance for 2018 was lowered slightly to 11.5GW to 11.8GW.

The company also highlighted that its high-efficiency multi and mono modules remained in high-demand and were in short supply, noting a small ASP increase was expected in the fourth quarter and demand outstripped supply.

Management also noted that visibility into customer demand in 2019 was already stronger than in 2018, and its order books were in a good position and reflected expected growth in market demand.

With in-house capacity expansions slowing, JinkoSolar expects to continue to leverage third party capacity in 2019, not least due to the perceived overcapacity in China.

Part of the reason behind lower capex plans for 2019, could be related to gross margins.

Gross margins in 2018 have proven difficult to exceed 12% (excluding US Countervailing Duty (CVD) reversals) in 2018, compared to the previous two years, which averaged high-teens.

On a positive, gross margins have been relatively stable in 2018, despite China’s 531 New Deal, weakness in the India market and US Section 201 trade case issues, all contributing to module ASP pressures in the second-half of the year.

The company was able to lower manufacturing costs by 10% in the third quarter of 2018, supported by polysilicon prices hitting record lows of US$10/kg, with little outlook of price recovery into 2019 as new capacity comes on stream.