Having successfully completed its transition from a solar equipment provider to a heterojunction cell and module manufacturer, Meyer Burger is looking to build on a major supply deal last month as it works to ramp up production capacity in the US.

The Switzerland-headquartered company signed an agreement with D. E. Shaw Renewable Investments (DESRI) to supply at least 3.75GW of solar modules for the US independent power producer’s large-scale projects.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Due to be manufactured at Meyer Burger’s Goodyear facility in the US state of Arizona, the modules will be delivered between 2024 and 2029. DESRI has a first right of refusal to increase the contract quantity to 5GW as well as to enter into a contract extension beyond the five-year term.

The deal, Meyer Burger’s largest supply agreement to date, was signed less than one year after the company announced plans to set up a module production plant in the US.

Gunter Erfurt, CEO at Meyer Burger, tells PV Tech the agreement is “a very remarkable milestone” as it allows the company to enter the high-growth utility-scale solar segment with “one of the most renowned renewable energy players in the US”.

He says: “They’ve been around for a long time and are very experienced, they understand technology, they understand the business and we believe that’s a great partner to start with.”

As it builds its manufacturing footprint in the US, Meyer Burger is set to be boosted by provisions included in the recently passed Inflation Reduction Act (IRA), which features a US$0.07/Wdc manufacturing tax credit for the production of PV modules.

Erfurt explains that when the company started negotiations with DESRI there was no IRA, meaning the manufacturer was working under a pure business assumption that it could provide US-made utility-scale modules. “But of course, the Inflation Reduction Act is making things even a bit more beneficial, and also great for long-term planning,” he says.

When comparing IRA manufacturing tax credits for solar wafers, cells and modules, Erfurt says that support for module production is the most beneficial.

Manufacturing ramp-up

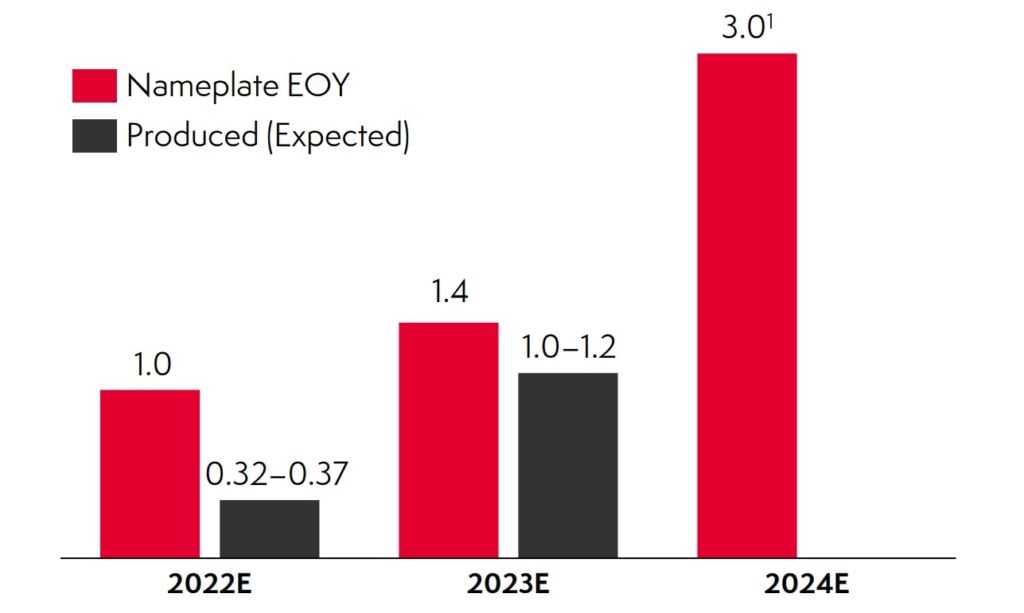

Meyer Burger opened its cell and module factories in Germany last year, with both starting production with annual capacities of 400MW.

As a result of the DESRI deal as well as high demand for rooftop solar modules, the company’s production capacities will be expanded ahead of schedule. Cell manufacturing capacity in Germany will increase to 3GW by the end of 2024, when the firm’s module production in the country will be 1.5GW.

The Arizona facility, meanwhile, is scheduled to reach 1.5GW of module production in 2024, with 1GW for the utility-scale segment and 0.5GW for rooftop systems.

As part of a revised financing plan, Meyer Burger is contemplating a potential CHF250 million (US$255 million) capital increase to be launched in the coming months to fund the accelerated capacity jump.

Erfurt says the module manufacturing segment split, with 2GW for residential and 1GW for utility, is “something we believe is very healthy. It should not flip too much to the other side, of having the focus on utility especially when the residential segment continues growing globally.”

He adds: “Could we sign more deals for utility? I would say so, but we are carefully assessing how we always keep a good balance between residential and utility.”

In its half-year report, published last month, Meyer Burger said it is looking to sell modules for utility-scale solar applications as an important additional pillar of its business, with offtake agreements being explored with interested parties in both the US and Europe.

The company manufactured about 110MW of modules in the first half of the year and is anticipating a further 210 – 260MW in H2. Its residential modules are currently sold across Europe as well as in the US, Australia and South Africa.

Erfurt says the biggest challenge for Meyer Burger is that market demand exceeds the available production volume, adding: “We are currently in allocation mode, so we are allocating our available production volumes to our customers. We do not, for the time being, really onboard additional customers beyond the relationships we have established.”

The company said in the H1 report that despite higher average sales prices than originally planned, demand for its residential modules has remained strong, as it allocates production volumes for Q2 2023 among its customers.

Consolidated revenues for the first half of 2022 increased 215% year-on-year to CHF56.7 million, with Meyer Burger claiming the results prove its ability to sell at premium prices and to pass on recent materials cost increases to its customers.

Questioned on the impact of soaring polysilicon prices, Erfurt says: “We all would have expected that the increased input costs would sooner or later reach a level that would basically affect the market demand. It never happened; the opposite happened.”

He adds: “Solar energy remains the cheapest source of electricity, regardless of whether or not the module is more expensive than it used to be.”