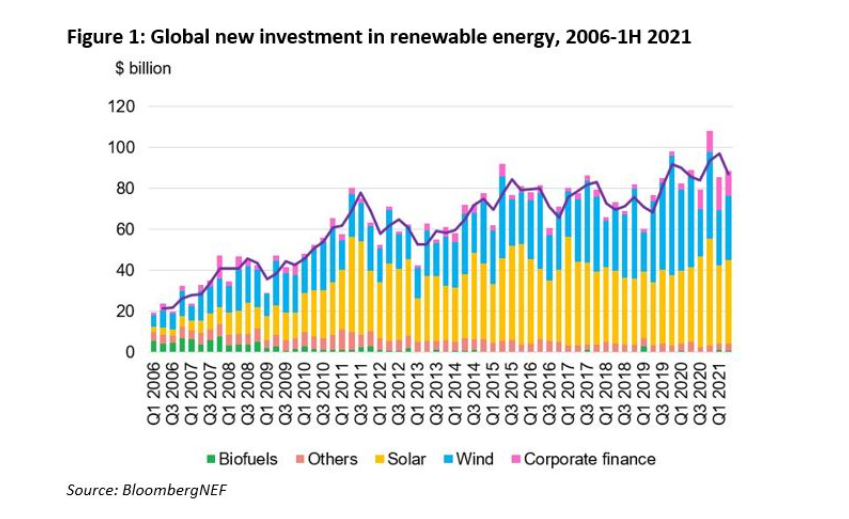

New investment in renewables reached a record US$174 billion in H1 2021, with renewable energy companies raising 509% more than H1 2020 and investment in solar projects being up 9%, according to the latest Renewable Energy Investment Tracker from BloombergNEF (BNEF).

This is the highest total ever recorded in the first half of a year and up 1.8% on a year ago. BNEF’s data showed how a decline in investment in new renewables projects was offset by public market financing, venture capital and private equity investments in renewable energy companies.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Renewable energy companies raised a total of US$28.2 billion on public markets in H1, up 509% from last year. Among the largest share offerings were Longi Green Energy (US$2.4 billion) and US fuel cell company Plug Power (US$2 billion).

While renewable project financing declined globally, investment in solar projects was up 9% year-on-year, rising to a record US$78.9 billion in H1 2021. These was mainly driven by major investments in large scale solar in the US, which invested US$11.7 billion in H1, and China, which spent US$7.7 billion.

Notably, ‘funds in circulation’, which includes the refinancing of renewable energy projects, mergers, acquisitions and buyouts, totalled US$68.3 billion in H1 2021, up almost 18% from a year earlier.

“This record first half for clean energy fundraising underlines the strength of appetite for sustainable investment opportunities aligned to a net zero future,” said Logan Goldie-Scot, head of clean power at BNEF.

Although investment is still 7% below the high water mark set in H2 2020, solar project investment often accelerates in the second half of a year to meet end-of-year targets and deadlines, said the report, suggesting greater investment in H2 2021.

Nonetheless, “a 1.8% year-on-year increase is nothing to write home about,” said Albert Cheung, head of analysis at BNEF. “An immediate acceleration in funding is needed if we are to get on track for global net zero.”

Last month BNEF released a report that showed how G20 countries are still investing in fossil fuels at levels that make reaching Paris Climate goals unachievable, giving more than US$3.3 trillion in subsidies for coal, gas and fossil-fuel power from 2015-2019.

It also found in another report that at least 455GW of new solar PV capacity will need to be installed each year by the end of this decade for the world to reach net zero status by 2050.