Updated: India’s Ministry of Finance has imposed a 25% safeguard duty on imports of solar cells and modules from Malaysia and the People’s Republic of China, starting tonight.

In keeping with the final recommendations proposed by the Directorate General of Trade Remedies (DGTR), the 25% duty will run for one year (from 30 July 2018 to 29 July 2019), then reduce to 20% for a six-month period (30 July 2019 to 29 January 2020), and to 15% for the final six-month period (30 January 2020 to 29 July 2020).

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

All levels of the duty will be imposed “ad valorem minus anti-dumping duty payable, if any” when imported during the relevant period, said the Gazette of India notification.

The notification stated: “Nothing contained in this notification shall apply to imports of subject goods from countries notified as developing countries vide notification No. 19/2016-Customs (N.T.) dated 5th February, 2016, except China PR, and Malaysia.”

The Indian solar industry currently sources more than 90% of its cells and modules from China and Malaysia.

However, last week, major Indian PV developer Acme Solar received a stay order from the Orissa High Court regarding the imposition of the safeguard duty.

Chinese solar manufacturers still set to benefit from India’s safeguard duties

The Indian government imposition of 25% import duties on solar cells and modules from China and Malaysia to safeguard domestic manufacturers does not include solar cells and modules imported from Indonesia and Vietnam, due to being classified as ‘developing countries.’

Further checks have indicated that Thailand and Philippines would also be classified as developing countries and therefore excluded from the duties. This would assist companies such as leading 'Silicon Module Super League' (SMSL) member JinkoSolar, which has a major manufacturing operation in Thailand.

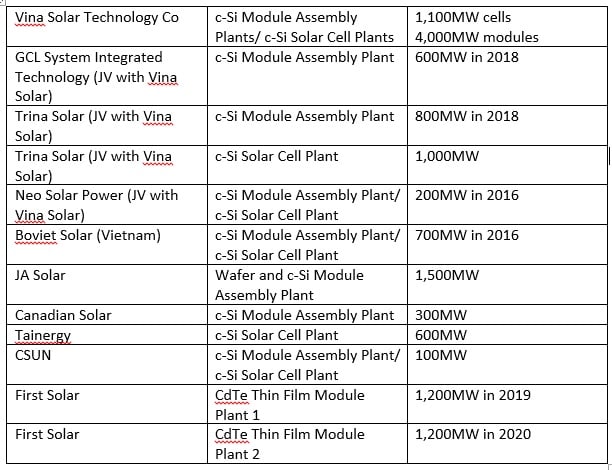

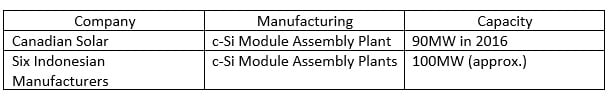

A number of Chinese PV manufacturers and other foreign suppliers have production operations in Indonesia and Vietnam, enabling them to supply solar products in India, without the import duty.

Leading integrated high-efficiency monocrystalline module manufacturer and ‘Silicon Module Super League’ (SMSL) member LONGi Green Energy Technology had already reignited previously suspended manufacturing plans in Andhra Pradesh, India.

LONGi is investing US$309 million, including around US$240 million in constructing a new facility with an initial nameplate capacity of 1,000MW of monocrystalline solar cells and expand its mothballed 500MW module assembly plant to 1GW.

Given the slim margins for suppliers into the Indian market, the exclusion from the safeguard duties could be a major competitive advantage over the next two years of the duties being imposed.

Further updates to follow.

Chinese PV manufacturers in Indonesia

Chinese and OEM PV manufacturers in Vietnam