US-based PV installer RGS Energy (RGSE) has increased its cash burn and pushed-out its expected return to break-even revenue from the first to the second quarter of 2018, as it spends on expanding its sales force and builds PV module inventory ahead of the final determination on the US ITC Section 201 trade case.

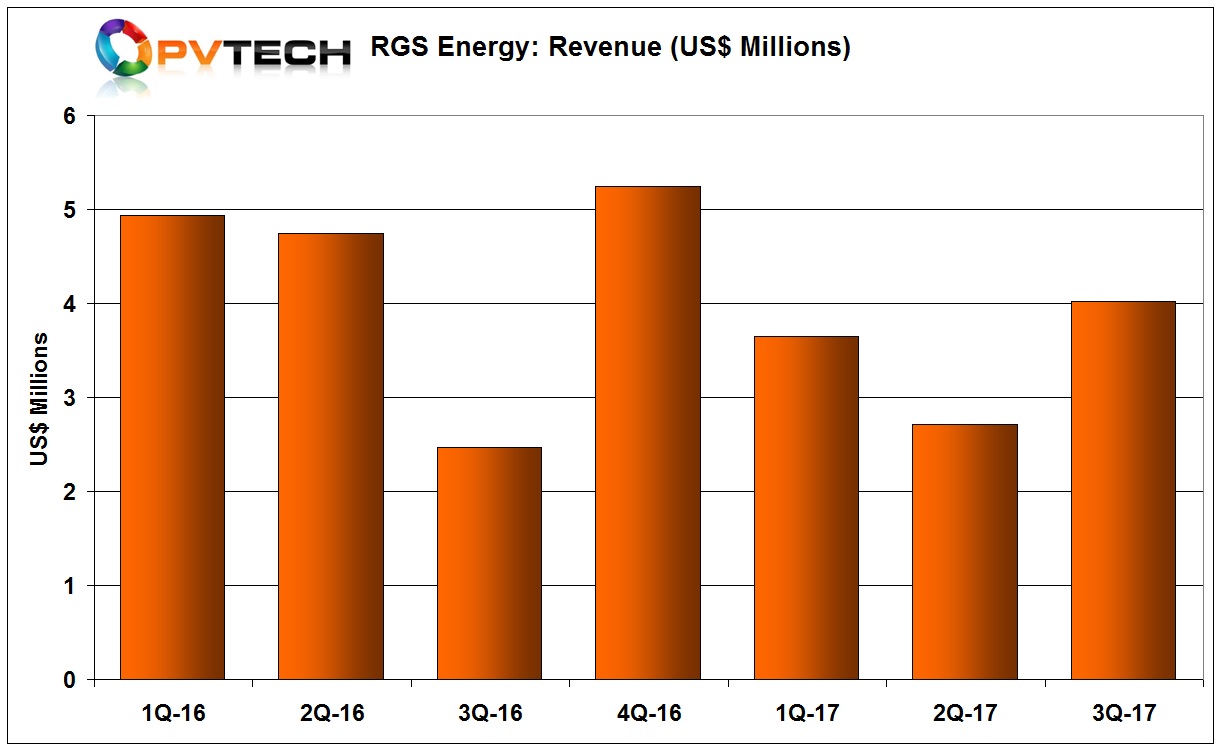

RGS Energy recently reported third quarter revenue of US$4.02 million, up from US$2.7 million in the previous quarter. However, net loss increased to US$4.42 million, compared to US$4.03 million in the previous quarter.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

RGS Energy had cash of US$4.658 million at the end of the third quarter of 2017, compared to US$9.745 million at the end of the second quarter of 2017, a cash burn of just over US$5 million, quarter-on-quarter.

Alan Fine, RGS Energy’s Chief Financial Officer and Treasurer said, “Our strategy has been to expend cash, investing it in a manner expected to allow us to meet and exceed our quarterly break-even results during 2018. Further, we will continue to expend cash during the fourth quarter of 2017 and, if as projected, we achieve revenue to operate profitably during the second quarter of 2018, our business will thereafter begin to operate on a positive cash flow basis. To achieve this outcome, we have been investing cash in our sales organization, marketing and a larger inventory of equipment for future installations. We project our cash balance at June 30, 2018, exclusive of cash expenditures related to our new ‘POWERHOUSE’ segment, to be approximately $2 million.”

RGS Energy’s management had previously guided in the last quarter that it was planning to have US$4.5 million in cash at the end of the first quarter of 2018.

In the earnings call to discuss third quarter results, Fine highlighted why targets had changed so quickly.

“Rhode Island NationalGrid renewable energy growth program has delayed conversion of backlog in the State of Rhode Island until second quarter of 2018,” noted Fine. “And as a result of that program, it has started new sales at Rhode Island that we were expecting during the fourth quarter of 2017 and the first quarter of 2018. In addition, we had a large commercial contract in our Sunetric pipeline that we had counted on that has not materialized.

“When we adjusted for each of these items, it precluded breakeven to Q1 of 2018. Although, we have less sales projected than when we first made the projection, the majority of the decline is projected cash arises. The majority of the decline in projected cash arises from maintaining a higher level of inventory for the 201 tariffs that I commented upon in the press release issued on Friday,” added Fine.

RGS Energy is still in recover mode from revenue declining US$17.4 million during 2016, primarily due to lack of liquidity from revenue of US$28.1 million in 2015, which resulted in installations falling to 4.1MW in 2016, down from 10.8MW in the prior year period.

Recently, RGS Energy acquired to exclusive rights to Dow Chemical’s to third generation (3.0) solar shingles under the ‘POWERHOUSE’ brand said to use conventional crystalline silicon solar cells rather than the original CIGS (Copper, Indium, Gallium, Selenide) thin-film substrates.

RGS Energy management said in the latest earnings call that it had capital resources sufficient to implement its revenue growth strategy as well as the roll-out of the POWERHOUSE 3.0 to homeowners and new home builders.

The company continues to undergo UL certification for the product and noted that its goal was to manufacture the product by a third party in China and sell the product starting the second quarter of 2018.