After a year which saw the average price for polysilicon more than double, sending solar module prices upwards and impacting global demand, the PV industry is eagerly anticipating a normalisation of prices throughout 2022.

Additions to the industry’s solar-grade polysilicon capacity from the likes of Xinte, Asia Silicon and Daqo are expected to come onstream over the course of the year, with overall capacity set to increase by up to 40% based on last year’s sum.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

But industry analysts are somewhat mixed on just how quickly prices for polysilicon could fall, indicative of the uncertainties between the rate of capacity expansion and demand for wafers, with numerous analysts noting the extent to which wafer capacity will outstrip cell production by the end of 2022.

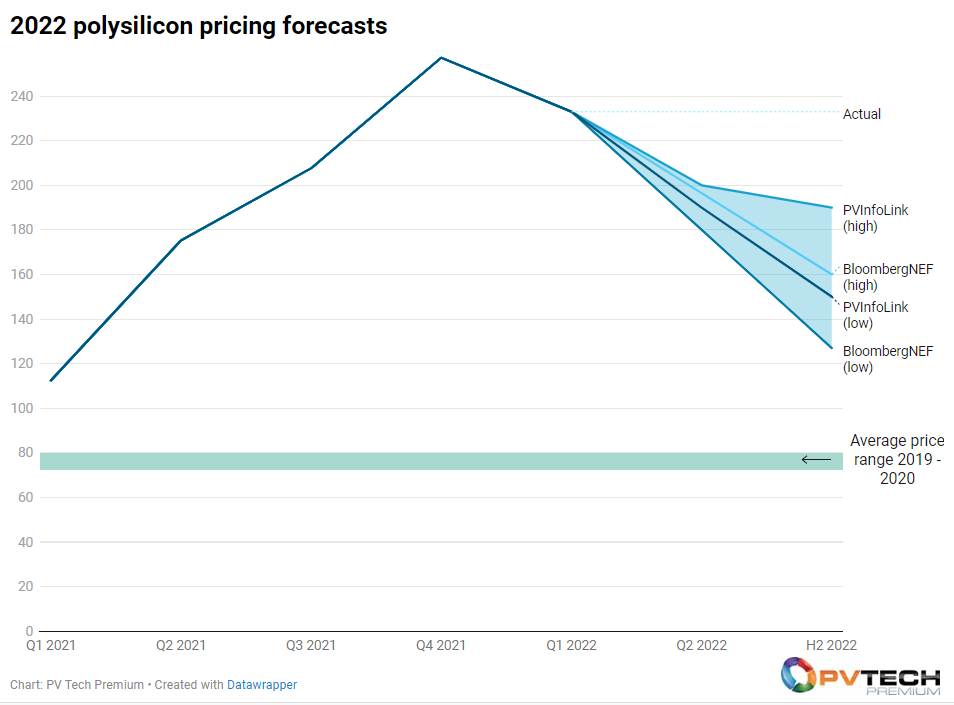

Price forecasts, especially out to the second half of 2022, are therefore diverging quite widely, as the below graph indicates.

The graph plots the average quarterly polysilicon price realised from Q1 2021 until Q1 2022 – although the average price indicated for Q1 2022 shows the average given in January 2022 – before illustrating the divergence of forecasts into H2 2022.

The green bar indicates the average price for polysilicon experienced between 2019 and 2020, acknowledging the impact of a steadier relationship between supply and demand and, indeed, that of the early stages of the COVID-19 pandemic.

All prices shown are in RMB and inclusive of China’s 20% sales tax.

The average price seen in Q1 2022 so far of RMB233/kg (US$36.61/kg, or RMB194.2/kg – US$30.5/kg – excluding China’s sales tax), is expected by pricing forecaster PVInfoLink to fall to between RMB190 – 200/kg in Q2 2022, dropping again to between RMB190 – 170/kg in Q3 2022. PV InfoLink’s forecast for Q4 2022 is for prices to remain above RMB150/kg.

Those figures would broadly align with those put forward by major polysilicon producer Daqo New Energy last year. Daqo has previously forecast for prices to stand at between US$30 – 36/kg in H1 2022, falling closer to US$30/kg in H2 but, crucially, remaining elevated.

BloombergNEF’s polysilicon pricing forecast for H2 2022 is more ambitious, with the research group expecting prices to fall to between RMB127 – 160/kg in the second half of the year.

Johannes Bernreuter of polysilicon pricing specialist Bernreuter Research, however, suggests the industry may have to wait until Q4 before prices fall materially, and prices could actually increase in Q3 as a recovery in demand outstrips the pace of capacity additions.

“Additional, significant capacities will only start up in the fourth quarter or at the very end of the year and thus likely have a limited impact on pricing in the early fourth quarter, due to the small volumes during initial ramp-up – similar to what we see right now. Maybe, prices will drop more strongly in December – that will also depend on when and how quickly new entrants will start up,” Bernreuter said.