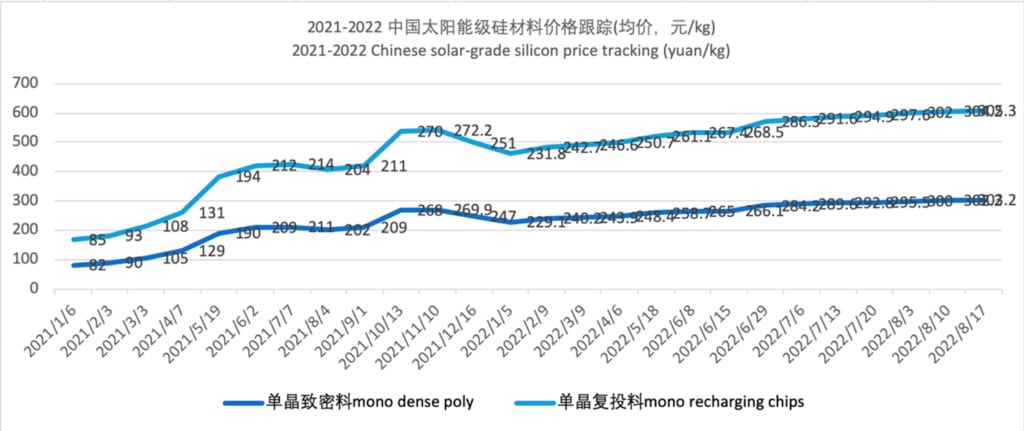

The average price of silicon materials in China continued to rise this week after power rationing was implemented in key Chinese provinces following extreme heat in much of the country, according to the Silicon Industry Branch of China Non-ferrous Metal Industry Association.

This has built on the trend of the last few weeks that has seen prices steadily climb. Earlier this month, the price of polysilicon in China rose across the board, despite signals that it may have stabilised, and this latest rise constitutes the 26th round of price increases this year alone.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The average price of mono recharging chips rose to RMB305,300/MT (US$44,950/MT), a weekly increase of 0.36%, with the highest price hitting RMB310,000/MT (US$45,640/MT). The average price of mono dense poly chips was RMB303,200/MT (US$44,640), up by 0.33% week-on-week, while the average price of popcorn chips was RMB300,500/MT (US$44,240), up by 0.33% week-on-week.

The price rise has been caused by two different factors. Firstly, silicon companies had locked-in nearly all the monthly orders at the start of the month. Since the vast majority of silicon companies have no space for more orders, negative inventory remained and the silicon shortage persisted, helping to keep prices rising.

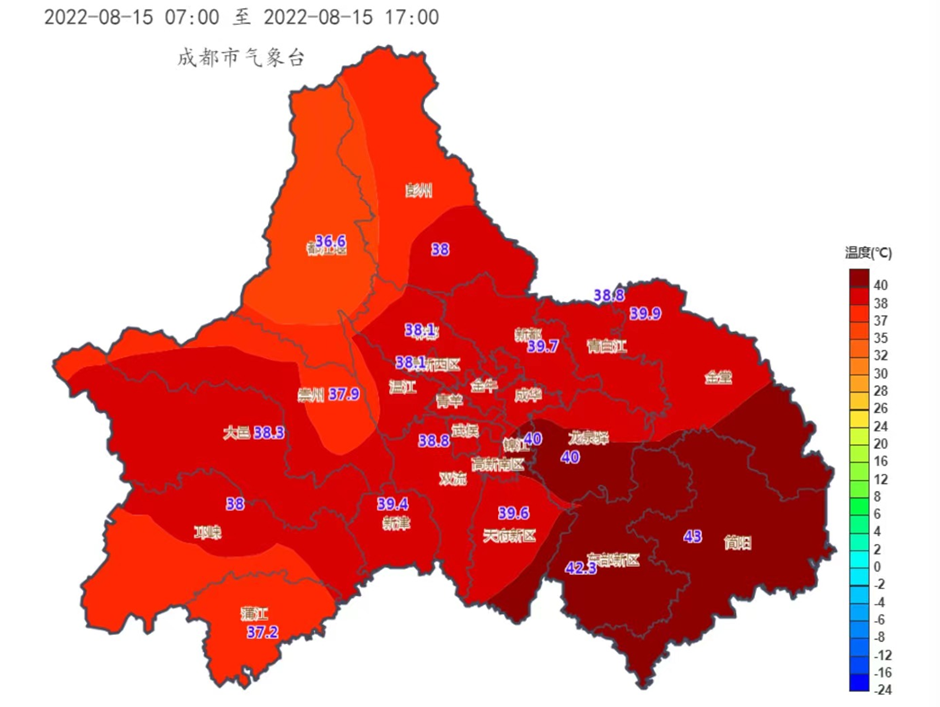

The second factor is related to power rationing. Since the beginning of the summer, record high temperatures have affected many regions of China, driving substantial increases of power load for cooling. In order to ensure the electricity consumption of residents, various places have implemented power rationing policy, as was seen in the country last year, and some PV companies have suspended production, or are at risk of facing suspension.

Moreover, the Chinese province of Sichuan’s was one of the worst affected. Sichuan is home to several PV manufacturing companies, and local silicon production accounts for about 10% of China’s total output. Tongwei, GCL, JinkoSolar, TrinaSolar and JYT all have production bases in Sichuan.

The Sichuan government recently issued an emergency notice on expanding the scope of distributing electricity from plants to households, requiring industries to halt production from 15 August to 20 August. Local companies producing industrial silicon, polysilicon and monosilicon had to significantly cut output expectations due to these power supply restriction.

This latest round of power rationing may further aggravate supply and demand in silicon market, which may cause silicon prices to rise further. And the scope of this rationing may expand further still.

The Silicon Industry Branch points out that polysilicon companies may take at least 10 to 15 days to resume and reach utilitsation rates following suspension and load reduction, during which time output will be affected. This problem is more acute for polysilicon producers over chip producers as the former take longer to get up to full capacity following a shut down.

At present, power rationing in Sichuan mainly affects GCL and Yongxiang’s two plants in Leshan, which are slowly suspending and reducing their output.

On 15 August, Tongwei said that power rationing will have an impact on their production of silicon material and cells, and it is actively cooperating with relevant departments to adjust the load. The specific terms of this are still under negotiation, and the scope of impact cannot be determined at present. But as the situation eases, the company’s power consumption will return to normal levels.

GCL technology’s management told the media that its Leshan granular silicon project recently received a notice of power supply restriction. The company will obey local government’s instructions to implement safe load operation mode on from 15 August to 20 August.

According to previous production expansion plans, China’s polysilicon supply shortage was expected to be alleviated in August. This is because of the resumption and added capacity of GCL Xinjiang and East Hope, as well as the expansion of GCL Leshan, Xinte Baotou, Tongwei Inner Mongolia Phase II, Qinghai Lihao, Inner Mongolia Dongli and other companies. But the recent notice of power rationing has cast the idea of increasing supply into uncertainty.

Currently, China’s total silicon supply is significantly lower than expected. Preliminary projections of August polysilicon production will be 8% lower than expected. At the same time, considering the impact of logistics and other factors such as saturated orders of some silicon enterprises lasting till September, demand will increasingly exceed supply in August.

Looking into the future, the Silicon Industry Branch predicts that it will take time to adjust market supply and demand following the lower output caused by rationing and, in the short term, the silicon price will maintain a modestly rising trend.