PV wafer and module manufacturer ReneSola reported lower than expected PV module shipments and revenue in 2015, while expanding wafer shipments.

Full-year 2015 revenue was guided to be between US$1.5 billion to US$1.6 billion, on lower external module shipments than in 2014 as the company shifted its business model downstream and entered the LED market.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

However, actual revenue was reported to be US$1.28 billion on external PV module shipments of 1.6GW, down 18.9%, compared the previous years and down compared to PV Tech estimates of 1.72GW. The company reported 2014 revenue of US$1.56 billion.

The company also guided 2016 revenue to be lower than last year at US$1 billion to US$1.2 billion, with the anticipation of lower module shipments to third parties.

Wafer capacity expansion

The company took full advantage of solar wafer tight supply and higher ASPs, shipping a total of 1.09GW of wafers, up 28.7% year-on-year. ReneSola also said it expected to increase wafer production capacity through technology improvements by 500MW to reach a nameplate capacity of 2.9GW by mid 2016.

Fourth quarter results

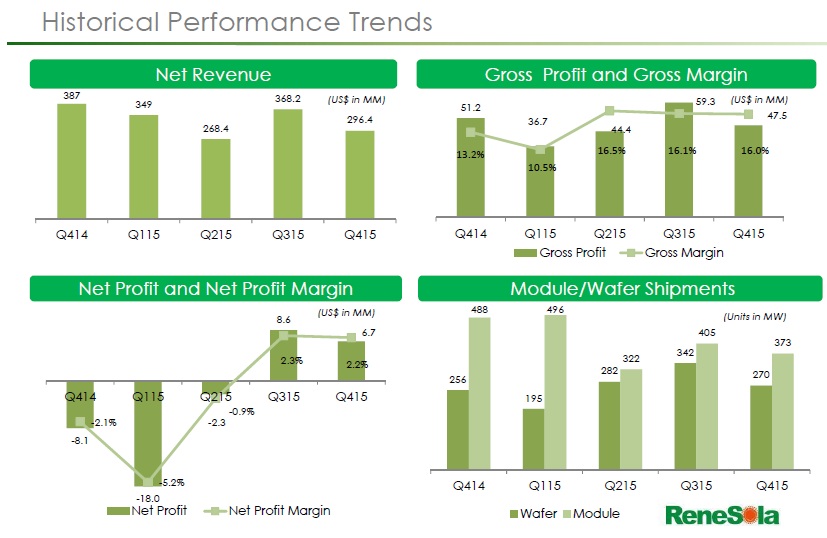

ReneSola reported fourth quarter 2015 revenue of US$296.4 million was down 19.5% from the previous quarter and down 23.4% year-on-year and slightly exceeded guidance of US$275-$295 million. The revenue decline was said to be due to lower ASP and lower shipments to external customers.

The company reported a gross profit of US$47.5 million, down 20.0% from the prior quarter and 7.3% in the prior year period. Gross margin expanded to 16.0% when compared to the fourth quarter of 2014, but was down slightly sequentially.

The increased gross margin was said to be due to reduced operating expenses, a reduction in debt by US$59 million and a shift to higher margin PV power plant building and selling outside China.

Net income in the quarter was US$6.7 million, which compares to a net income of US$8.6 million in Q3 of 2015 and a net loss of US$8.1 million in the prior-year period.

Full-year financial results

Although revenue was down 17.9% and gross profit down 10.2% (US$187.9 million) from the previous year, gross margin expanded to 14.7% from 13.4% in 2014, which was supported by lower operating expenses of US$158.6 million, or 12.4% of revenue, compared to US$201.1 million, or 12.9% in 2014.

Operating income for the full year was US$29.3 million, or 2.3% of revenue, compared to US$8.2 million, or 0.5% in 2014.

The company reported a net loss of US$5.1 million, compared to a net loss of US$33.6 million in 2014.

PV projects update

ReneSola reported that earnings from PV power plant project sales totalled US$110.7 million in 2015 with an average gross margin of over 23%.

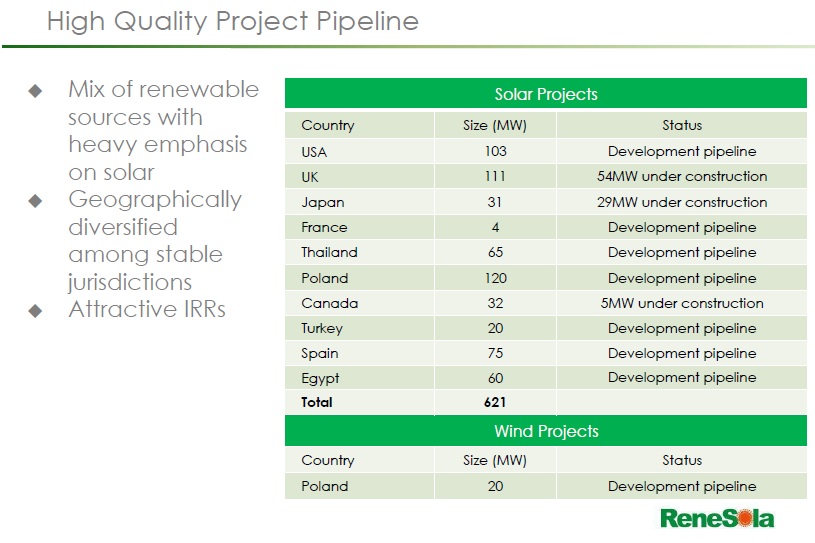

The company said it currently had 641MW of PV projects in various stages of development across a broad geographical mix outside China.