Finlay Colville, head of market research at Solar Media, reveals the top ten PV module suppliers last year in the first of a two-part blog, exploring not just shipment volumes but also the overall supplier bankability.

During 2021, there were many moving targets for the solar PV industry, including question marks about upstream production and overall module shipment levels. Despite this, working out the top 10 ranking of PV module suppliers for the year has turned out to be rather straightforward.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

In part, this is coming from keeping track of production and shipment volumes through the year; but, the real reason is that there are significant gaps opening up between the top 10; especially, the top four.

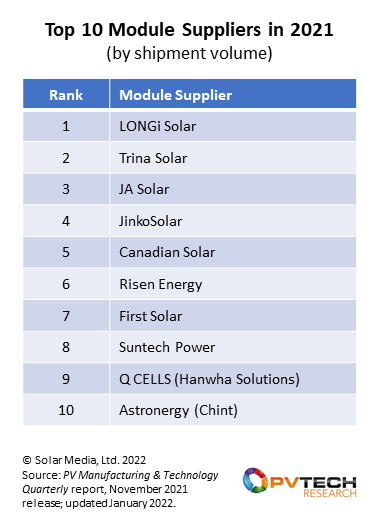

Over the next week, two articles on PV Tech will reveal the leading PV module suppliers in 2021: not just by merchant shipment volumes, but also for overall bankability. This is the first time this type of ‘dual’ top 10 ranking has been done, and offers a more useful means of benchmarking module suppliers, other than simply ranking them by the number of modules shipped.

The first article here focuses on the traditional means of top 10 ranking, looking purely at shipped modules.

Four module suppliers each shipped more than 20GW in 2021

Kudos used to be attached to module suppliers that passed through the 1GW barrier, in terms of annual shipments. Nowadays, this landmark moment is more likely to occur at 10GW, 20GW or even 30GW.

In fact, during 2021, no fewer than 24 companies had annual shipments above the 1GW level; and four of them were comfortably north of 20GW – the new level needed to be classed as a heavyweight in 2021.

Collectively, the top 10 shipped volumes close to 150GW during 2021. Anyone still harboring any thoughts that the industry as a whole did 140-160GW (as many of the incorrect forecasts from third-party organisations were telling us only very recently) then think again.

As I wrote in a blog on PV Tech last week, the PV industry comfortably produced and shipped in excess of 190GW during 2021. In fact, our initial forecasts done for 2021 (at the end of 2020) were very similar (185-195GW), showing that in 2021, things pretty much went as expected. To understand this, please read the blog I wrote on PV Tech last week, and the narrative surrounding what a production-led industry means (and why waiting to add up government data for deployment levels is now a really bad way to track the size of the PV industry).

Ranking the top 10 purely by shipment volume

Every year, I end up spelling out what counts as a module shipment: however, every year, I feel compelled to do this again, mainly because this most simple of concepts is still subject to debate.

Module shipments are based purely on product shipped to the ‘end market’; to distributors, installers or EPCs. Companies that undertake OEM work for others do not have their OEM quotas counted as a module shipment. Companies that ‘claim’ to be module manufacturers, but in fact buy product in China or elsewhere, are treated like distributors, and their claimed volumes do not count as shipments. Companies that lease their production lines for contract manufacturing also do not have this part of their volumes counted.

This affects companies’ real numbers both ways, up and down. For example, many of the global module suppliers have shipment volumes in excess of in-house module production, owing to their use of OEM providers. Alternatively, some module suppliers undertake OEM work in addition to own-brand shipments; here the module shipment value will be less than the overall in-house production level. Inventories also have a role to play, but as I noted in my blog last week, during 2021, there were no major cases of inventory build-up; in particular when looking at year-end 2020 and year-end 2021 values.

The table below now shows the top 10 module suppliers by shipment volume, as defined above.

Next week, we will post the top 10 module suppliers in 2021, by year-end Bankability Rating. This effectively combines manufacturing strength (within which module shipments has a strong weighting) and financial health. A more comprehensive discussion will follow that blog, looking also at what major changes are expected during 2022.

Each quarter, we release the PV Manufacturing & Technology Quarterly report. This includes in-house production and end-market shipments for the 100+ companies that make up about 98% of global manufacturing in the PV industry today. To understand how to access this report, please complete details at the report landing page here.