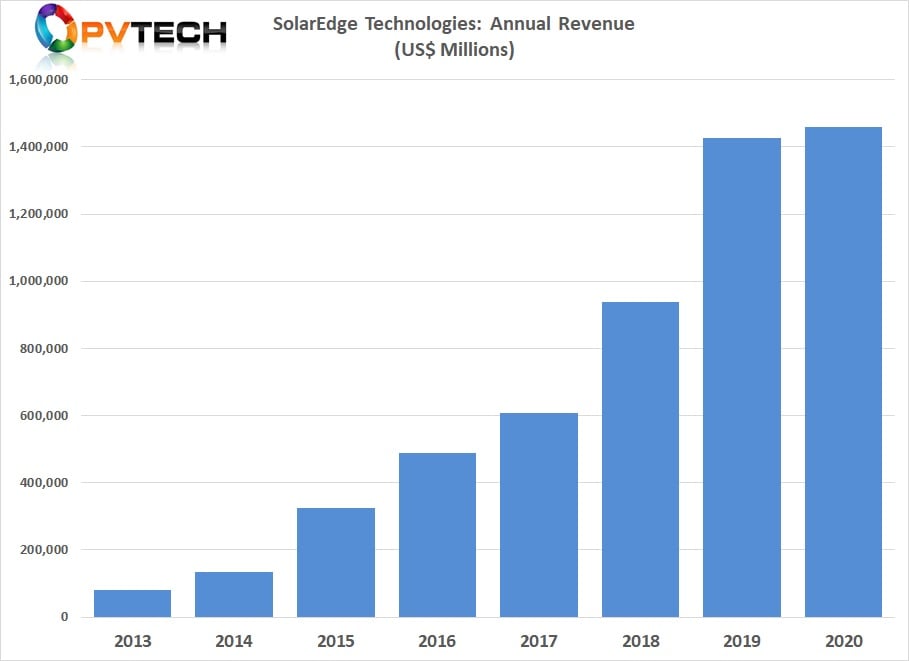

Major PV inverter manufacturer SolarEdge Technologies reported year-on-year revenue growth of just 2.4% in 2020, compared to growth rates of over 50% per annum in recent years.

SolarEdge reported record 2020 revenue of US$1.46 billion, up from US$1.42 billion in the previous year, equivalent to a 2.4% increase sequentially. By means of comparison, revenue grew by 52.1% in the previous reporting period.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

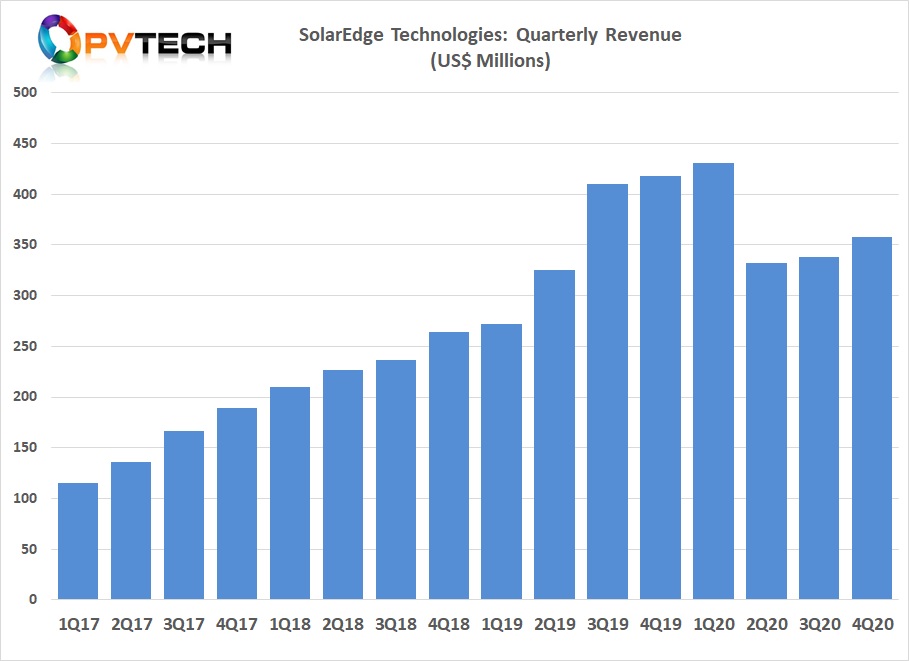

The year started well for SolarEdge, reporting Q1 2020 revenue of US$431.2 million, up 58.6% year-on-year and up 3.1%, quarter-on-quarter, setting a new record for the company. However, sales growth was already clearly slowing.

In the second quarter, SolarEdge was primarily impacted by COVID-19 spreading to its key markets of the US and Europe, notably the impact was seen in its residential markets as countries locked down.

The company reported Q2 2020 revenue of US$331.9 million, which was near the top end of guidance but down some 23% on the record quarterly revenue seen in Q1 2020. Revenue only edged up 2% year-on-year.

Although the impact of COVID-19 abated in the third quarter of 2020, revenue growth remained slow. SolarEdge reported total revenue of US$338.1 million, again up only 2% from the prior quarter and was therefore down 18% on the company’s revenue in the third quarter of 2019.

SolarEdge reported fourth quarter 2020 revenue of US$358.1 million, up 6% from the previous quarter but still down 14% from the prior year period.

“Our fourth quarter results are reflective of strength in the U.S. residential market and record revenues from outside of Europe and the U.S., led by Australia,” said Zvi Lando, CEO of SolarEdge.

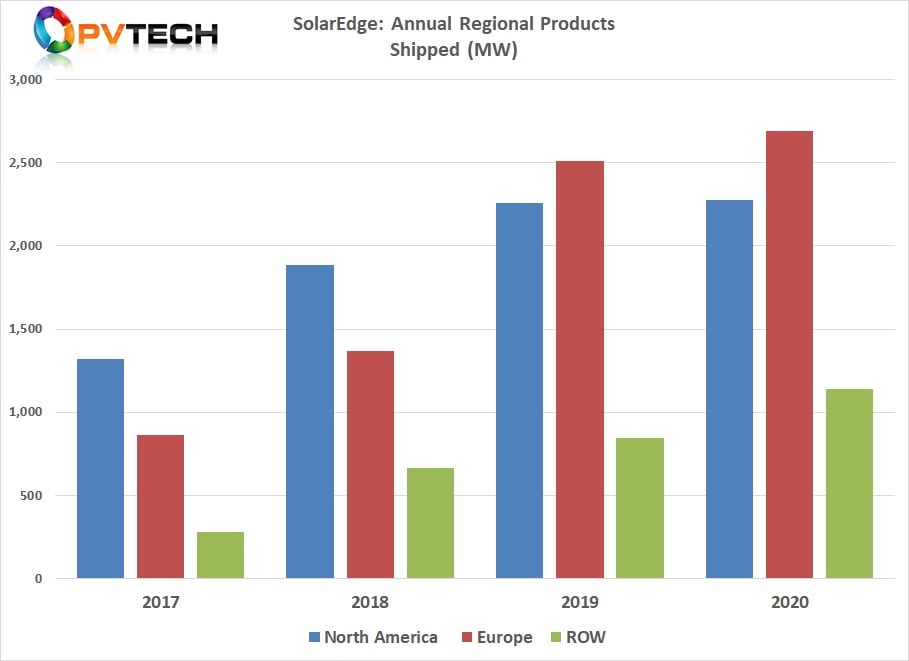

However, regional shipments to the US had peaked in the first quarter of 2020 at a record 926MW. US shipments in subsequent quarters dropped significantly. During the COVID-19 impacted Q2, shipments were 403MW, followed by a slight recovery to 490MW in Q3. In Q4 2020, US shipments slowed to 457MW.

Overall US shipments in 2020 were 2,276MW, up slightly from 2,260MW in the previous year.

Shipments to Europe and Rest-of-World (ROW) increased relatively strongly, year-on-year. Overall shipments to Europe reached 2,690MW in 2020, up from 2,513MW in 2019. ROW shipments were 1,139MW in 2020, up from 845MW in 2019.

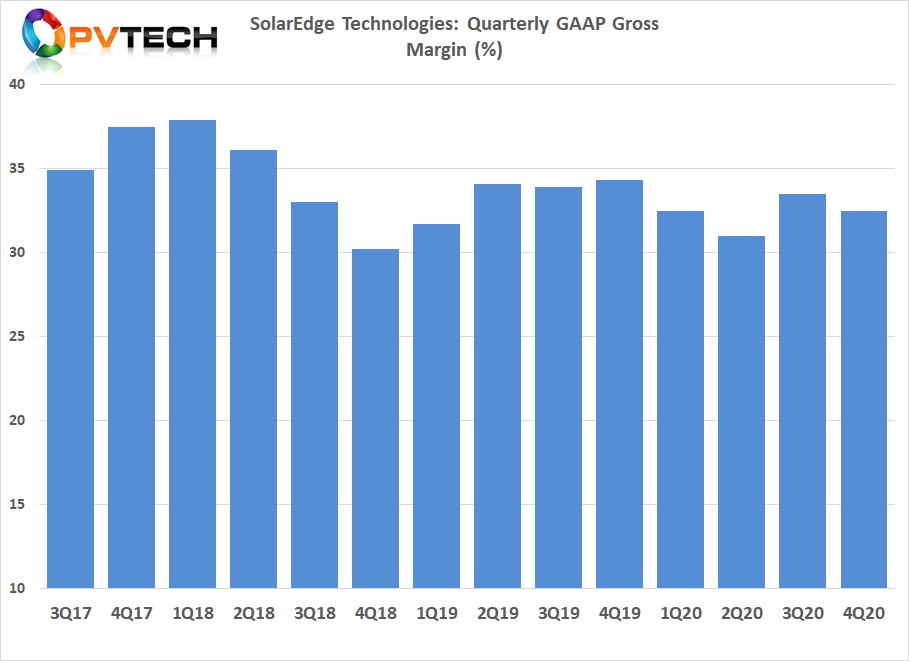

SolarEdge reported GAAP net income for 2020 of US$140.3 million, a 4.2% reduction compared to US$146.6 million in the prior year. GAAP gross margin was 31.6% compared to 33.6% in the prior year.

However, SolarEdge noted in its Q4 earnings call that its ongoing manufacturing footprint diversification away from China had resulted in 60% of shipments to the US in Q4 came from outside China, and therefore free of import tariffs. This is expected to reach 85% in Q1 2021.

Guidance

SolarEdge said that it expected first quarter 2021 revenue to be in the range of US$385 million to US$405 million. Revenues from the sale of solar products was expected to be within the range of US$360 million and US$375 million.

“Despite the global pandemic, we concluded the year with slight growth in revenues, healthy cash generation and are well positioned for 2021 and beyond, having invested significantly in development of new products to be released this year as well as development of our non-solar businesses, with readiness to supply full powertrain kits for the e-Mobility sector in Europe,” added Lando.