In a move to alleviate crippling electricity supply constraints and reduce the use of diesel peaking plants, South Africa’s government last August launched a technology-agnostic emergency tender for 2GW of generating capacity.

The Risk Mitigation Independent Power Producer Procurement Programme (RMIPPPP) specified that dispatchable power would need to be provided when it is most needed – between 5am and 9:30pm daily – to help reduce the shortfalls in capacity on the grid.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Reinforcing the need for the procurement round, South Africa went on to have its worst year ever of scheduled power cuts, otherwise known as load shedding, according to data from the country’s Council for Scientific and Industrial Research. The country was hit by 859 hours of load shedding, representing nearly 10% of 2020 without electricity.

With multiple generation facilities at different locations allowed to be bid as a single dispatchable project, the RMIPPPP initially closed with eight preferred bids that will provide a total of 1,845MW of contracted capacity from projects combining technologies such as solar PV, wind, liquified natural gas and battery storage.

Although those winning bids featured a total solar capacity of 1,147MW, each of those projects would combine PV with diesel, reciprocating gas engines or LGP. However, illustrating the potential of solar-plus-storage to provide dispatchable power, it was announced earlier this month that Scatec was awarded preferred bidder status for three plants of equal size totalling 150MW of contracted capacity that will feature PV with battery storage, making them the only facilities in the tender exclusively using renewable technology.

The Norwegian company, which has already completed six solar parks in South Africa under the country’s Renewable Energy Independent Power Producer Programme (REIPPP), will include 540MW of solar and 225MW / 1,140MWh of battery storage at the Kenhardt 1, 2 and 3 plants in the Northern Cape province.

To account for factors such as seasonality and inter-annual variations, Scatec oversized both solar and battery capacity at the plants, which will supply solar power to the grid during the daytime, with excess power used to charge batteries. Once they are charged and a single project is exporting 50MW, anything above that will be curtailed.

With winning RMIPPPP projects not permitted to sell excess power elsewhere, there is expected to be “a fair amount of curtailed energy” from the installations, according to Jan Fourie, Scatec’s general manager for Sub-Saharan Africa. He says the company’s renewables-only solution reduces the fuel risk for the country: “You don’t need to look in your crystal ball and guess what foreign exchange and commodity prices are going to do in the future.”

The tender rules call on the eight original preferred bidders to reach financial close by the end of July 2021, with the first projects expected to be connected to the grid as of August 2022. While there was a 65% local content requirement on aluminium frames for procured PV modules, this was recently scrapped due to insufficient aluminium supply in the domestic market, says David Núñez Blundell, co-founder of Seraphim Southern Africa, which currently operates a 300MW module assembly plant in the country’s Eastern Cape province.

With such a tight schedule to get projects financed and constructed, Núñez Blundell says it would have been risky for developers to rely on local aluminium production being ramped up in time: “I think it’s going to be easier for our IPP clients to reach financial close with this regulation being loosened because there was a lot of risk in relying on us finding local aluminium because it’s not available.”

The RMIPPPP could undergo further changes as Karpowership, a Turkish company that secured 60% of the total contracted capacity through three LNG powerships that will be docked at ports, is now facing a legal challenge by a rival bidder. With the firm offering to supply 1,220MW of capacity, critics have warned that its projects would lock in additional fossil fuel generation for the 20-year duration of the contract.

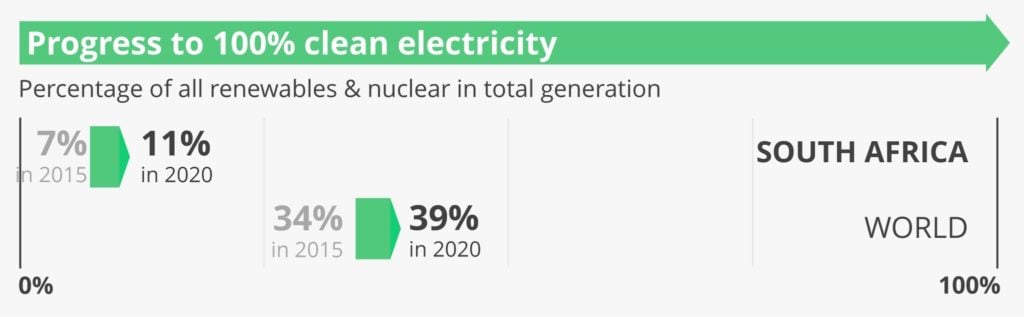

Last year, fossil fuels provided 89% of South Africa’s electricity, with the country topping the G20 for reliance on coal power, according to Ember. The think tank said in a recent report that the last decade has seen significant investment funnelled into new coal capacity, which has “suffered major cost increases and delays in being built”, causing increases in electricity tariffs for consumers, “driving a collapse in demand for electricity”.

Nonetheless, a total of 1.04GW of new solar and wind capacity was said to be installed in the country in 2020, the first year since 2016 that annual installations topped the gigawatt mark.

Niveshen Govender, COO of the South African Photovoltaic Industry Association (SAPVIA), says that while the trade body would have liked solar PV to feature more in the RMIPPPP, the government did “act with appropriate haste to ensure that much-needed energy is added to the distribution network”.

He says the requirements for dispatchable energy presented renewables with a challenge, however bids showed the “flexibility and innovation” of solar when combined with other renewables, gas and energy storage solutions.

Solar deployment is also being driven by demand from companies looking to protect themselves from ongoing load shedding. Earlier this year, petrochemical firm Sasol announced a partnership with French industrial gas supplier Air Liquide to jointly procure 900MW of renewable energy by 2030. Sasol said the transaction will be the largest clean energy procurement deal ever from South Africa’s private sector.

This year has also seen supermarket chain Shoprite complete rooftop solar installations at 19 sites in South Africa and neighbouring Namibia that will provide 12,300MWh of electricity a year, while mining company Gold Fields secured regulatory approvals for a 40MW PV project that will provide around 20% of the electricity needs at its South Deep mine.

Additional investment in solar capacity is set to be unlocked by reforms announced yesterday (Thursday) by President Cyril Ramaphosa that will increase the licensing threshold for embedded generation projects from 1MW to 100MW. Ramaphosa said the move reflects the government’s ambition to reduce the impact of load shedding on businesses and households.

The announcement builds on the government’s goal to procure 6GW of solar PV by 2030 through its integrated resource plan 2019, with the long-term aim of transitioning the country to net zero emissions by 2050.

According to Govender of SAPVIA, the RMIPPPP should be viewed together with the REIPPP, with the fifth bid window taking place this year. In the next year, he says, 1GW of solar PV is set to be procured through that bid window in addition to the construction of 2GW from RMIPPPP, adding: “The next 12 months are filled with fantastic promise for the solar PV sector.”