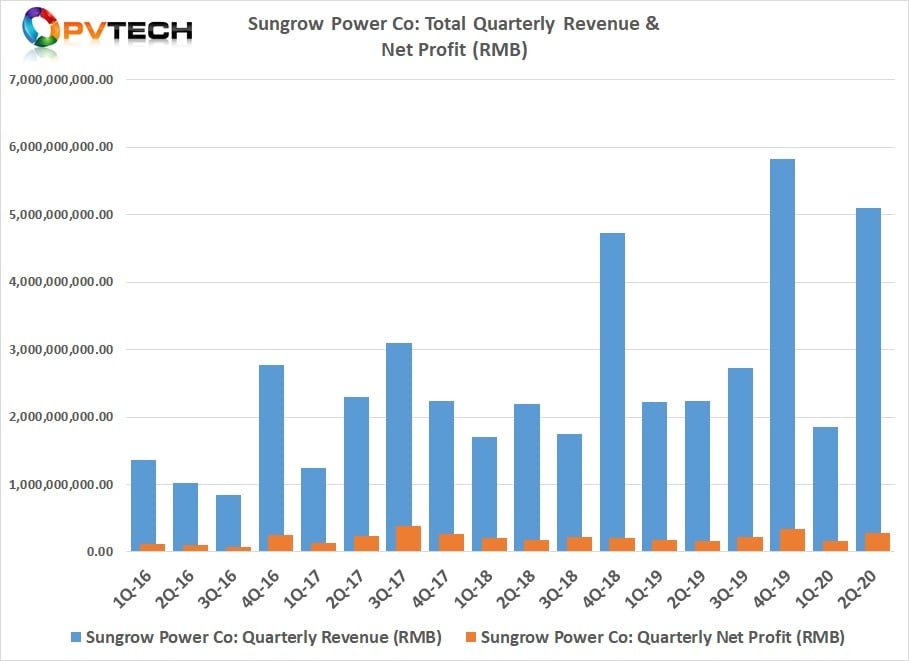

Major PV inverter manufacturer Sungrow has reported a significant recovery in revenue and profitability in the second quarter of 2020, after financial figures suffered in the first quarter, due to the impact of COVID-19 on both its PV project and EPC business and demand for PV inverters in China.

Sungrow’s total operating income (revenue) in the first quarter of 2020 fell to RMB 1,846 million (US$ 269.8 million), compared to record revenue of around US$850.4 million in the fourth quarter of 2019. Net profit had followed the same downward path, resulting in figures of US$23.3 million in the first quarter of 2020, compared to a net profit of US$49.4 million in the previous quarter.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

However, the second quarter of 2020 marked a complete turnaround with revenue reaching RMB 5,095 million (US$744.67 million), Sungrow’s second highest quarterly figures. Net profit was RMB 286.62 million (US$41.88 million).

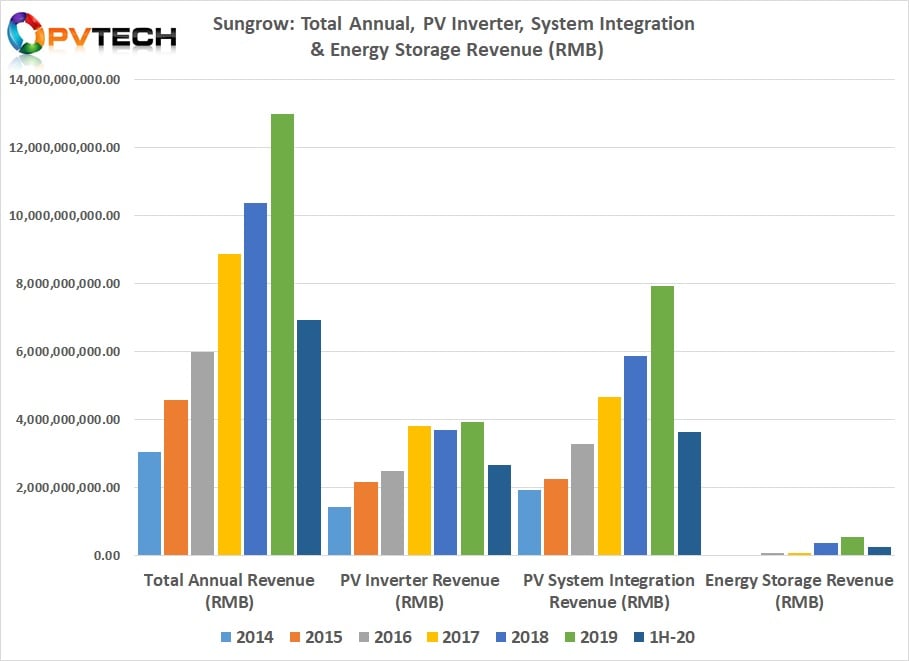

As a result, first half year revenue reached RMB 6,942 million (US$1,01 billion), a 55.57% increase over the prior year period, Net profit in the reporting period was RMB 446,13 million (US$65.2 million) 71.95% increase, year-on-year.

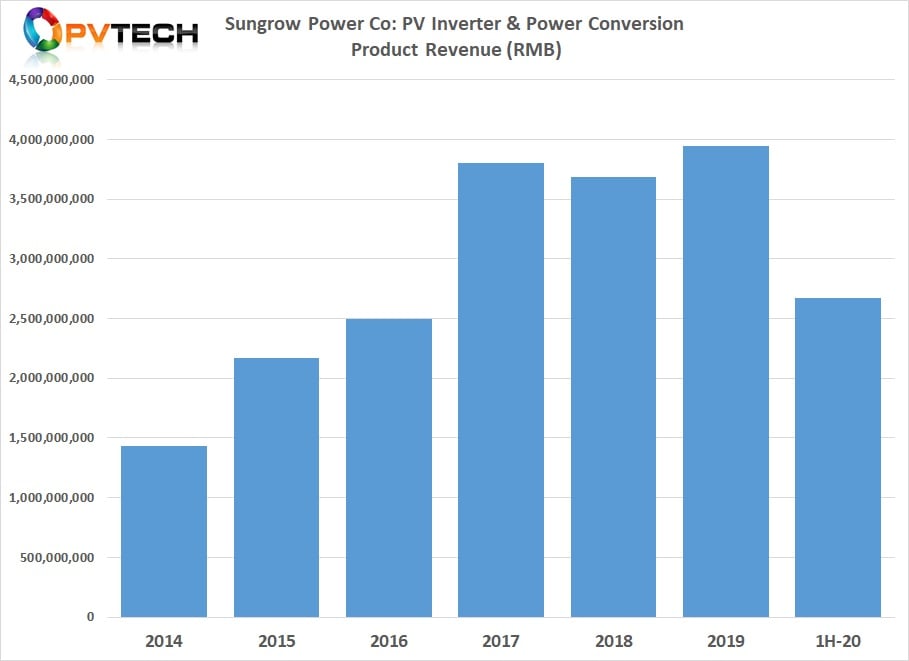

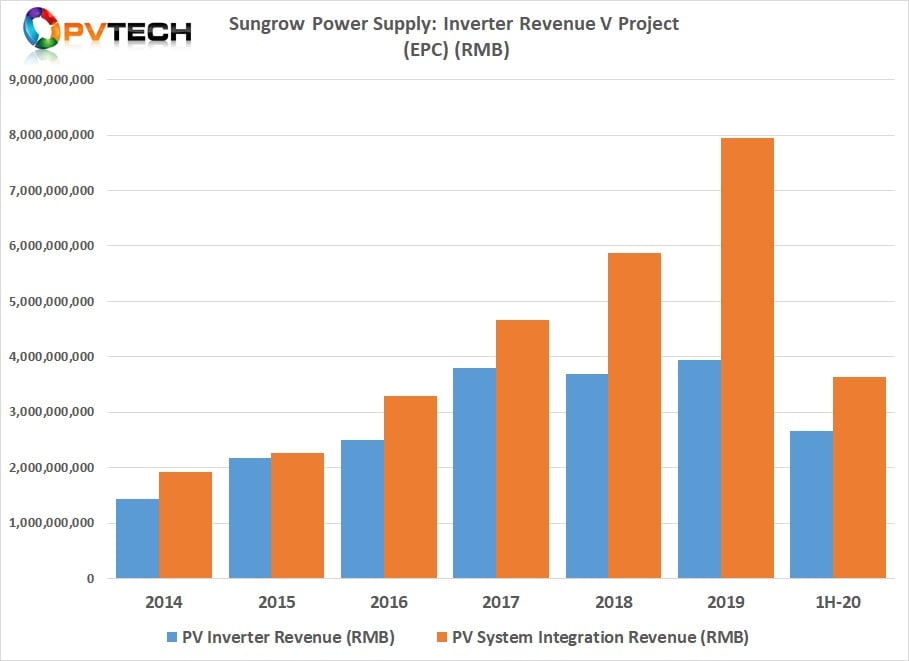

Key to the rebound was the growth in PV inverter sales within its PV Inverter & Power Conversion business segment, which reached around RMB 2,669 million (US$390.12 million) in the first half of 2020, compared to around US$243.3 million in the prior year period, a 60% increase, year-on-year.

Although a larger revenue segment, Sungrow’s Power Station System Integration division reported revenue of RMB 3,626 million (US$530 million), compared to around US$348.4 million in the prior year period, the gap between the two main divisions was the closest in the last two years.

Sungrow reported that its PV inverter sales growth was driven by strong performance in the Americas and Europe in the first half of 2020 as well as the restart of PV power plant projects, mainly in China.

PV Tech estimates that Sungrow’s Power Station System Integration division generated its revenue from around 10GW of active PV power plant projects in the reporting period and PV inverter shipments in the region of over 11GW.

Sungrow had previously reported PV inverter shipments of 17.1GW in 2019. Cumulative PV inverter shipments that only cover figures since listing in 2011 had reached approximately 85.89GW at the end of the first half 2020. The company previously announced it surpassed the 100GW shipment milestone in 2019, which included its years of shipments before going public.

A key strategy for Sungrow has been to boost its international PV inverter sales, while strengthening its sales and service operations in key markets such as the Americas and Europe. The company has claimed to be the leader in the Brazilian distributed generation (DG) market, the market share leader in Vietnam of around 40% and market shares of around 30% in Thailand, Malaysia, and the Philippines. The company also claims more than a 20% market share of the Australian residential market.

Overall sales in the reporting quarter were also boosted by its energy storage segment, which was claimed to have increased sales to around US$35.6 million, up almost 50% from the prior year period, according to the company.