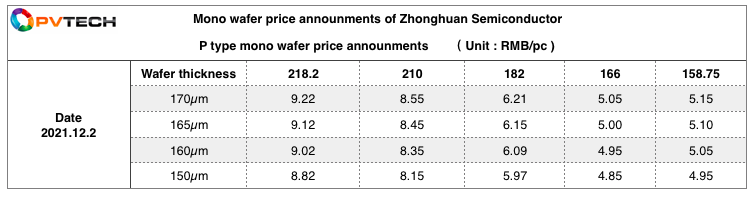

Tianjin Zhonghuan Semiconductor (TZS) has become the latest solar wafer manufacturer to cut prices, while also launching a new 218.2mm-size wafer.

Late yesterday TZS confirmed it had cut wafer prices by as much as 12.5%, with the starkest fall reserved for 166mm (M6) wafers. Perhaps most notably, however, is that TZS reduced the price of its 210mm (M12) wafers by 6%, falling to RMB8.55 per piece, the first time M12 wafer prices have been cheaper than RMB9/pc since mid-October.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

TZS also launched yesterday a new wafer size, taking the industry beyond the M12 210mm size with a 218.2mm wafer.

The new “super-large” wafers have been initially priced at RMB9.22/pc.

TZS said it had launched the new wafer size in response to customer demand for higher-power products, adding that the new size could be produced using the company’s existing 210mm wafer lines.

Earlier this week LONGi Solar cut its wafer prices across the board, with 182mm (M10) wafer prices falling by nearly 10%.

Price reductions by both manufacturers substantiate cuts forecasted in last week’s PV Price Watch.