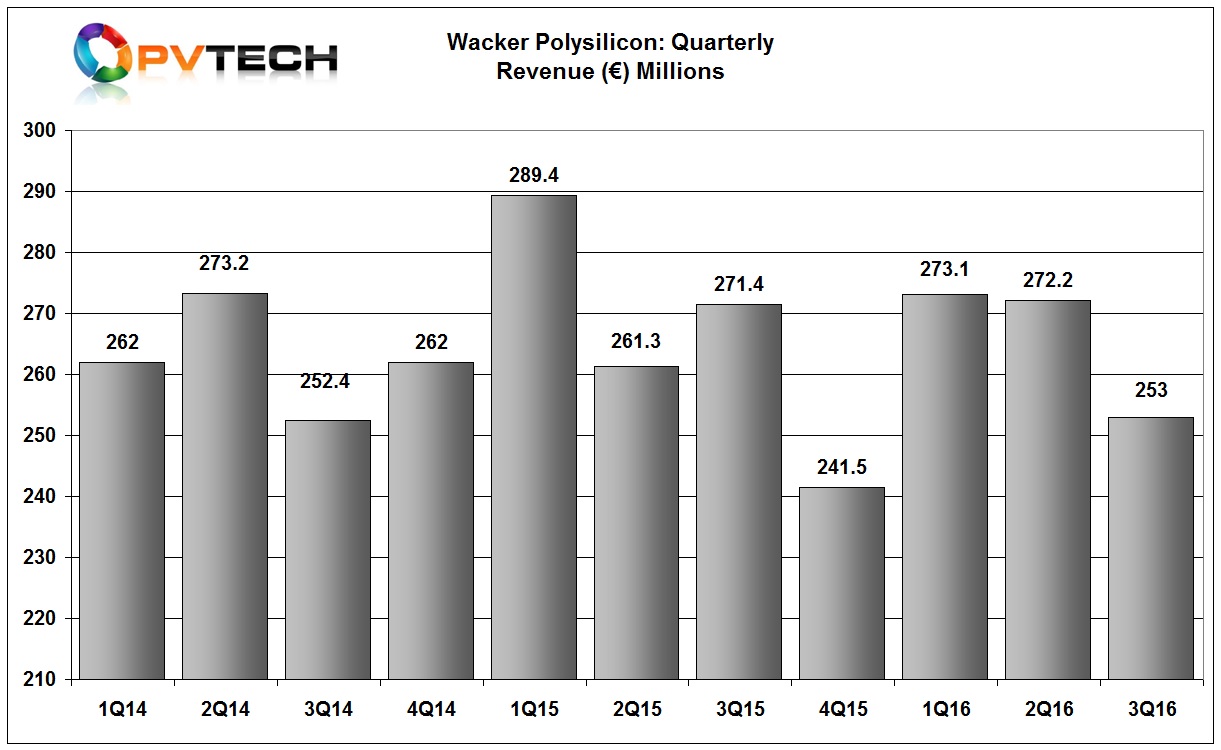

Major polysilicon producer Wacker Chemie has reported that polysilicon sales declined 6.8% in the third quarter of 2016, due to weaker demand and ASP declines, specifically in September.

Wacker’s polysilicon division reported third quarter revenue of €253.0 million, down 6.8% from the previous quarter after two quarters of flat revenues.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Polysilicon volumes were said to have remained almost unchanged versus the prior year period, while average prices declined.

Rudolf Staudigl, CEO of Wacker Chemie said, “The market environment for our polysilicon business was more difficult, with solar customers ordering substantially less material in September than in the preceding months. Since then, however, there have been increasing indications that demand for solar silicon is picking up again.”

EBITDA in the quarter was €82.3 million and EBITDA margin was 32.5%, both higher than the previous quarter as major capital expenditures ended as its new polysilicon plant in new Charleston, US started ramping production.