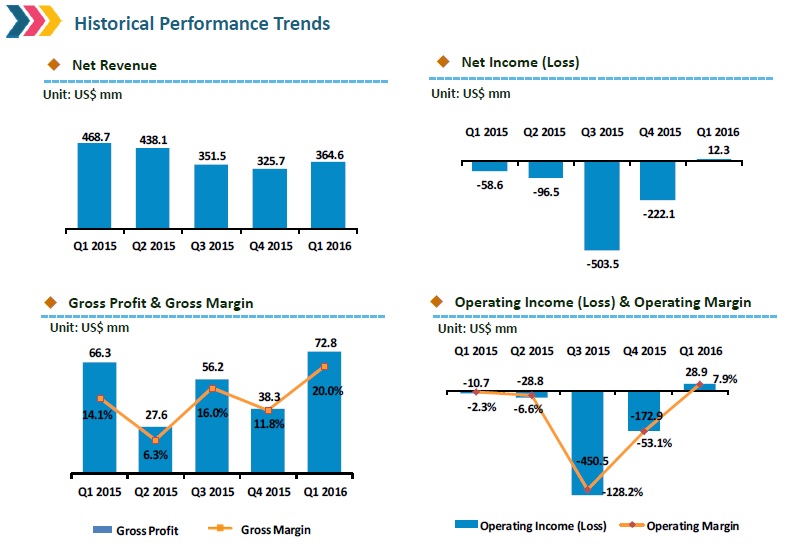

Updated: Struggling integrated PV module manufacturer Yingli Green Energy met module shipment guidance and reported a small positive net income in the first quarter of 2016, the first time since the third quarter of 2011, supported by a significant reduction in operating expenses.

Yingli Green reported a small net income of US$12.07 million in the first quarter of 2016. The company had reported consecutive quarterly losses since the fourth quarter of 2011. This was driven by flat module shipments, quarter-on-quarter but a significant shift in shipments to Japan, which carried higher average selling prices (ASPs).

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

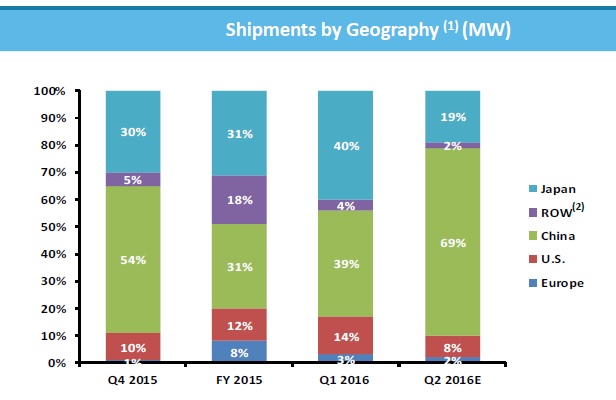

Japan accounted for approximately 40% (203MW) of total module shipments (508.1MW) in the first quarter of 2016, up from approximately 30% (151MW) in the fourth quarter of 2015, when total shipments were 504.5MW. The China market accounted for approximately 39% of total shipments in the first quarter of 2016, compared to 54% in previous quarter.

The company also slashed operating expenses (OpEx) to US$43.9 million in the quarter, down from around US$207.5 million in the previous quarter. Operating expenses as a percentage of total net revenues were 12.0% in the first quarter, compared to 64.9% in the fourth quarter of 2015.

Yingli Green said that the OpEx reduction was due to more strict and effective control on general and administrative expenses, the adjustments of marketing and sales strategies, and the decrease of research and development activities in the quarter.

However, cash and cash equivalents declined significantly in the quarter to around US$85 million), compared to US$188 million in the previous quarter. The company had US$53.1 million in restricted cash at the end of the quarter. The decrease was said to be due to the repayment of certain short-term borrowings that came due in the quarter.

Yingli Green reported first quarter revenue of US$364.6 million, compared to around US$325.7 million in the fourth quarter of 2015.

Gross profit was US$72.8 million and the gross margin was 20.0%, up from 11.8% in the prior quarter. Gross margin on sales of PV modules was 19.7% in the first quarter of 2016, increased from 13.5% in the fourth quarter of 2015 and 14.8% in the first quarter of 2015, primarily due to the higher ASPs in the Japanese market. Operating income was US$28.9 million.

The company reported a net margin of 3.4% in the first quarter of 2016, compared to negative 68.2% in the fourth quarter of 2015 and negative 12.5% in the first quarter of 2015.

Liansheng Miao, chairman and CEO of Yingli Green Energy said, “Internationally, we focused on major PV markets with relatively higher selling prices in the first quarter in order to improve our profitability. Our shipments to Japan continued to increase and shipments to Japan as a percentage of our total shipments increased to approximately 40% in the first quarter of 2016 from approximately 30% in the fourth quarter of 2015. We expect the strong demand from Japan to continue in 2016 before Japan's announced reduction of subsidies for PV power becomes effective in April 2017. We also had a solid first quarter in the United States with shipments to the U.S. representing approximately 14% [71MW] of our total shipments in the quarter as compared to approximately 10% [50MW] in the fourth quarter of 2015, and we expect to maintain our position in the U.S. with orders from a stable base of run rate customers. In China, we have secured orders of approximately 820MW by the end of May due to robust demand in the first half of 2016.

Guidance

Yingli Green guided second quarter shipments to be in the range of 580MW to 620MW, while gross margins are expected to be in the range of 18% to 20%. The potentially lower margins could be accounted for the increased shipments guided in China. The company provided full-year shipment guidance in its conference call presentation of 2.6GW to 3GW.