Nuclear reactors approaching end-of-life, a sound PV manufacturing industry and a robust legal system all make a strong case for solar PV to muscle into Taiwan’s energy mix. A new government set the tone for renewables integration by setting a target of 20GW solar by 2025 last year, but this is one of the most densely populated countries on earth, with two thirds of the island covered in steep mountainous forest and national parks; where the city ends the mountains begin. Moreover, a list of unique geographical and cultural challenges to PV development is topped off by the looming threat of some of the most gruelling typhoons in all Asia.

The capital city Taipei, to the north of the island, where population is most concentrated, also happens to have the poorest irradiation. Meanwhile, if solar deployment is concentrated in the more favourable conditions of the south, transmission infrastructure is limited. An island population of more than 23 million needs a solid agricultural industry, so the government has had to focus on releasing uncultivable land for solar, which is again in short supply. Even floating solar is being promoted in an attempt to alleviate these land constrictions. However, with many more hurdles for solar developers ahead, the proximity of Japan and the fallout over Fukushima means the appetite for nuclear has been quashed. New forms of energy are the priority.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

As the Taiwan government prepares to finalise details of how its target will be met, PV Tech examines some of the huge numbers being proposed and what it will take to realise them.

“The government is relying on solar to become the next economic engine in Taiwan”

The government has shown clear support for its clean energy transition with Chen Chien-Jen, vice president of the Republic of China (Taiwan), speaking at the opening ceremony of the PV Tawain exhibition in Taipei this year. He cited the need for more energy independence while reiterating plans to phase out nuclear by 2025 through focusing on solar and off-shore wind.

He said: “Taiwan has great resources and is in a good positon to develop PV and green energy.”

According to the green energy policy released in 2015 by the Bureau of Energy, Ministry of Economic Affairs, the plan is to have 20% of Taiwan’s energy mix coming from renewables by 2025. With all the island’s constraints, it would make sense to concentrate on the highest efficiency solar modules to make the most of every hectare of land used. As it happens, Taiwanese cell manufacturers have tended to produce some of the highest efficiency cells across the globe. It has roughly 2GW annual capacity of the higher efficiency cells, which would translate into the 2GW per year necessary over ten years to reach the domestic 20GW target.

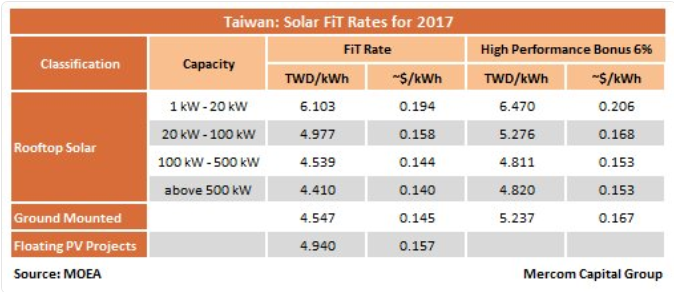

It is no wonder then that Taiwan’s new feed-in tariff (FiT) is bias towards higher efficiency solar modules by offering a higher reward.

It may also be the reason that several Taiwanese cell manufacturers including Neo Solar Power (NSP) and AU Optronics have started to focus on vertical integration, as discussed by Solar Intelligence's Finlay Colville in his two-part blog on upstream trends from PV Taiwan. For example, Alex Wen, senior vice president, NSP, tells PV Tech that with cell prices dropping as much as 33% in a period of just three months, the firm is increasing its module manufacturing as well as investing in solar PV projects to raise cash. Proximity to the sea and floating solar opportunities are also driving innovation in modules, with NSP due to release a double-glass module that benefits from water reflection.

PV Tech has already detailed how the landscape for solar in Taiwan is changing, but having canvassed industry members at PV Taiwan, here we go into more detail:

The numbers

To kick off the 20GW programme, the short target is to reach 1.52GW deployment in two years, including 915MW for rooftop and 610MW for ground mount, says Hung-Sen Wu, deputy division director of the non-profit R&D organization Industrial Technology Research Institute (ITRI).

Few people were willing to breakdown the overall target while the industry waits for the energy ministry to gradually formulate a concrete policy, however, Michael Sun, vice president and general manager, solar business group, AU Optronics, says that 3GW will be allocated to rooftop solar, with 17GW leftover for ground-mount projects. There was no indication for floating PV targets but delegates say there is potential for up to 500MW installations across the more than 2,000 lakes and ponds that have been identified.

The FiTs offer a 6% higher subsidy for better efficiency modules, as this table compiled by consultancy firm Mercom Capital Group shows:

“The government is relying on solar to become the next economic engine in Taiwan,” says, Shawn Chuang, country manager for the Huawei Smart PV Asia Pacific business. “Really in Taiwan we don’t have much booming industry. The semiconductor industry or the LCD industry electronics are all beat by mainland China so we have to find a new economic engine. Solar is the most ready one – we have the technology; we know how to build the projects. The only thing we lack is the land resource.”

This is why the government is releasing 10,000 hectares of agricultural land for ground-mount PV and dual use systems development for perhaps as much as 6GW capacity. It has also lifted the cap on project sizes of 500kW.

The case for solar is not helped by low electricity prices. Household tariffs sit generally at around NT$2-3/kWh (US$0.063-0.095) although there can be turbulence with increases to as much a NT$6.73 in peak summer times, according to Charles Lin, senior project manager, green energy, at Taipei-based firm Allis Electric. On the other hand, Commercial and Industrial (C&I) tariffs are based on contracts and in many cases solar self-consumption can compete on prices. Other delegates say the household prices are kept low for political reasons and the payback time for solar is very long.

Rooftop

Until the new Democratic Progressive Party came to power, Taiwan had focused almost exclusively on rooftop for around five years, in contrast to many markets round the world whose initial solar policies tend focus on utility-scale.

Even rooftop on Taiwan has some unique problems, says Eric Wang, Huawei sales director, Asia Pacific. Many roofs are in dusty environments or near the sea, causing salt-mist corrosion. Many households feed chickens or ducks under their roofs creating a lot of debris. There are also restrictions on deployment on buildings above a certain height and issues surrounding system ownership for those residential and C&I customers who are renting property.

Others fear that with an already high penetration of rooftop solar, the remaining potential capacity is limited and unsuitable for gigawatt-scale growth.

“I would rather invest in Taiwan than UK, Spain or Italy. That’s for sure”

“[The] residential market is not exciting potential [sic] for me because the majority of the roofs here are illegal,” says Sascha Rossmann, vice president, solar global sales at Taiwan-headquartered module manufacturer Winaico. “This is something the government needs to fix.”

Rossmann is referring to households that have a floor added to the top of the house, which makes it illegal to add solar. He says the government is considering changing this to allow for solar installations, but discussions are ongoing. However, even if the legality changes, these additional floors tend to have a poor structural design creating risks in an environment where the extreme winds of typhoons are common. Furthermore, as real estate is highly expensive, it will be very difficult to install solar on other people’s roofs as owners will charge a lot.

On the positive side, the regulatory environment is robust and can be trusted:

“FiT is good. Regulatory framework is very good. Taiwan legally is a very safe place to invest. I would rather invest in Taiwan than UK, Spain or Italy. That’s for sure,” says Rossmann. “They can never do retroactive cuts here. There is a similar culture like the Japanese; there will be a total loss of face.”

Transmission and land space

Southern Taiwan has a superior environment for solar, but the majority of the population resides in the north and most industry members say the transmission capacity is inadequate to bring energy from the south to the north at present. Discussions are ongoing with state-run utility Taiwan Power Company (Taipower) on this issue.

Landowners in Taiwan also tend to only own small parcels of one or two acres of land. This means solar developers will have to negotiate with multiple landowners for just one project while in other countries there is often only one landowner to deal with.

It is very common for one entity to own 10-20 acres in Japan and in Thailand a 50MW project may only require handling one owner, says Kai Tan, director of Taiwan-based developer and EPC New Green Power (NGP). “But in Taiwan the same 50MW project has 100-200 landowners. That’s very tough because it’s very hard to make sure everyone uses the same conditions to sign with you,” he adds.

NGP was one of the first companies to complete a solar project on so-called 'sinking land' in Taiwan, where groundwater has been withdrawn to the extent that the land is liable to sink in various locations. The government has released much of this land for solar, but there is not enough of either this land or salty land for 20GW, adds Eric Wang, so the government must also open up industrial space and even agricultural areas, especially land near the big substations. Most sinking land also happens to be located far away from quality transmission lines.

The conditions of these zones with a salty, foggy, damp, and rainy offshore climate also make it necessary to have robust solar equipment for the PV plants.

In a separate issue, while projects under 500kW do not require a license to sell electricity, bigger solar farms do and the application process can take around six months, says Wang.

Realistic target

Opinions about whether the 20GW target is achievable over the next ten years vary wildly. Some say the target could even be upgraded as a decade can be a long time in the solar industry. Efficiencies continue to improve and prices carry on reducing. Others see it as completely unrealistic. In any case, even if Taiwan manages to pull off half of the target at 10GW, it will be a huge opportunity for developers.

“The bottleneck will be the infrastructure,” says Rossmann. “If they can do half of the volume a year – maybe 500MW – that’s a realistic number, but I don’t believe you can do sustainably 1.5GW here annually.”

In any case Wang projects that big solar farm projects will start coming up in Q3 of next year with a big rollout expected in 2018/19.

Typhoon trouble:

The Taiwan market has been negatively affected by the typhoons so modules need to resist high wind loads, says Sascha Rossmann. Taiwan has wind speeds of up to 260 kmph compared to Hurricane Matthew in Florida where winds were 160-170 kmph.

“That’s nothing in Taiwan. The Typhoons are very scary here,” says Rossmann. “There is a lot of damage to the PV systems here because of the poor designs of the panels and also the mounting system. If the mounting system resists the wind speed, the panel must resist the vibration.”

The solar cells can crack as a result of high winds, so Winaico for example has developed a silicon carbide paste to print on the back of the solar cell to prevent this.

Another issue is the increasing reluctance of insurance firms to cover solar systems as the market is so small in Taiwan.

“That is also a risk to this industry because when insurance doesn’t cover […] the bank is not going to finance, so the project is not going to happen.”