‘Solar Module Super League’ (SMSL) member Canadian Solar has just guided revenue in 2020 to be in the range of US$5.6 billion to US$6.0 billion, which is over 70% higher than revenue that was reported for 2020.

However, rather than provide a major update to manufacturing capacity expansions announced during Q3 2020, Canadian Solar’s plans have remained unchanged and, during this week’s results disclosure, no insight into 2022 was provided.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

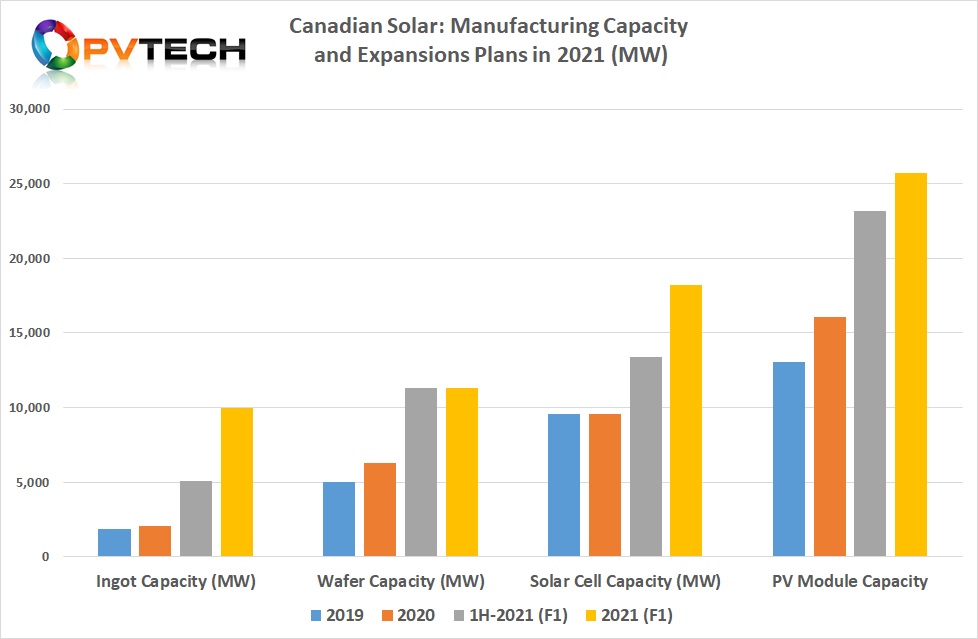

As the chart shows, Canadian Solar plans to increase in-house monocrystalline ingot and wafer capacity by 3GW in the first half of 2021 and a further 5GW by the end of the year.

This is a major strategy change as its in-house ingot production has been the smallest segment of its manufacturing operations since the company started initial production. In-house ingot production had been multicrystalline, but the roughly 8GW expansion is being dedicated to large-area ingots for 210mm square monocrystalline wafer production.

As a result, the planned 5GW wafer expansion, which will be completed in the first half of the year, is dedicated to the 210mm wafer size.

It would seem that Canadian Solar is following the likes of JinkoSolar, JA Solar and Trina Solar in having greater in-house ingot/wafer capacity dedicated to the large-area wafer size of choice, notably 182mm or 210mm sizes.

This has been seen as a strategy to de-risk possible supply chain constraints whilst also tackling cost competitiveness issues, limiting the impact from average selling price (ASP) fluctuations from wafer suppliers.

This is also true for solar cell production, having been a proponent of ‘asset-lite’ production for many years, Canadian Solar is making a significant expansion of large-area Passivated Emitter Rear Cell (PERC) production.

In-house capacity is being increased from 9.8GW in 2020 to 13.4GW by mid-year and ending 2021 with a nameplate capacity of 18.2GW. This equates to 3.6GW being added in the first half of the year and a further 4.8GW added by the year’s end. No in-house cell capacity expansions were undertaken in 2020.

Interestingly, Canadian Solar’s expected cell capacity by year-end is in line with the low end of its PV module shipment guidance of 18GW, something not seen before. The company uses major merchant cell producers such as Tongwei and Aiko Solar to match PV module production and shipments.

PV module assembly capacity expansions, the main attention of Canadian Solar for many years, are expected to reach 23.2GW, up 7.1GW from its 2020 nameplate capacity of 16.1GW in the first half of 2021. This will be expanded further in the second half of the year to 25.7GW, a further 2.2GW.

With PV module shipments heavily weighted to the second half of the year, Canadian Solar is comfortably covering the high-end of shipment guidance of 20GW for 2020. Historically, the company meets or exceeds the high end of its guidance.

At the beginning of 2021, PV Tech noted news stories emanating from China that Canadian Solar was reported to have announced its single largest solar cell and module assembly plant complex in the Suqian Industrial Park, Jiangsu Province, China.

Canadian Solar had not confirmed this expansion in any English press announcement or SEC financial filing to date. But the reports noted that the 10GW cell and module assembly project was expected to require a total investment of RMB3.6 billion (US$557 million), which would be controlled by a subsidiary, Canadian Solar Power Group Co.

In a first phase expansion, capacity would include a 5GW module assembly plant including 10 high-efficiency large-area wafer module production lines that would be put into production in September 2021.

The second phase (5GW) was said to be scheduled to start construction in August 2021 with completion and production ramp in August 2022. Details of the solar cell expansions were not provided.

With the latest publication of Canadian Solar’s fourth quarter and full-year results, it is clear that the reports out of China at the beginning of 2021 were clearly in line with published expansion figures, though lacking of any detail.

Announced cell expansions fall short of the 10GW reports, but do add-up to 8.4GW of new capacity.

Separately, Canadian Solar was also reported to have signed an agreement with the Funing, Yancheng, Jiangsu province government to build a new wafering plant with a capacity of 10GW at a cost of RMB1.9 billion (US$155 million), built over two phases.

The first phase of the project was said to start construction in January 2021 and be operational in June 2021. Canadian Solar already operates cell and module manufacturing facilities in Funing.

Again, the reports are not in line with Canadian Solar’s latest ingot/wafer expansion figures at 8GW ingot and 5GW of wafer expansions but its reasonable to assume the reports were correct as far as manufacturing facility nameplate capacity, not necessarily actual production ramp figures.

Yet, there have been other reports more recently that Canadian Solar was building or expanding module assembly capacity by 16GW. The extra 6GW is not referenced in the company’s latest public figures.

However, we may get greater transparency into Canadian Solar’s manufacturing plans as the company is in the final phase of spinning-off its manufacturing operations in China.

Manufacturing arm IPO

In July 2020, the manufacturer announced plans to publicly list its Module and System Solutions (MSS) subsidiary, CSI Solar Co, in China.

Canadian Solar has said that it owns 80% of CSI Solar with the remaining 20% owned by strategic investors who purchased CSI Solar shares during a pre-IPO transaction.

The company noted that it was working on the official listing application which is expected to be submitted to the Chinese regulatory authorities and the stock exchange in April 2021.

Whenever that happens before the end of 2021, CSI Solar should have or be able to secure separate funding from various channels to expand capacity further, should Canadian Solar revise upward shipment plans for either 2021 or when they give shipment guidance for 2022.

It will also enable the company to shed the low margin business from its balance sheet.

Rivals plans

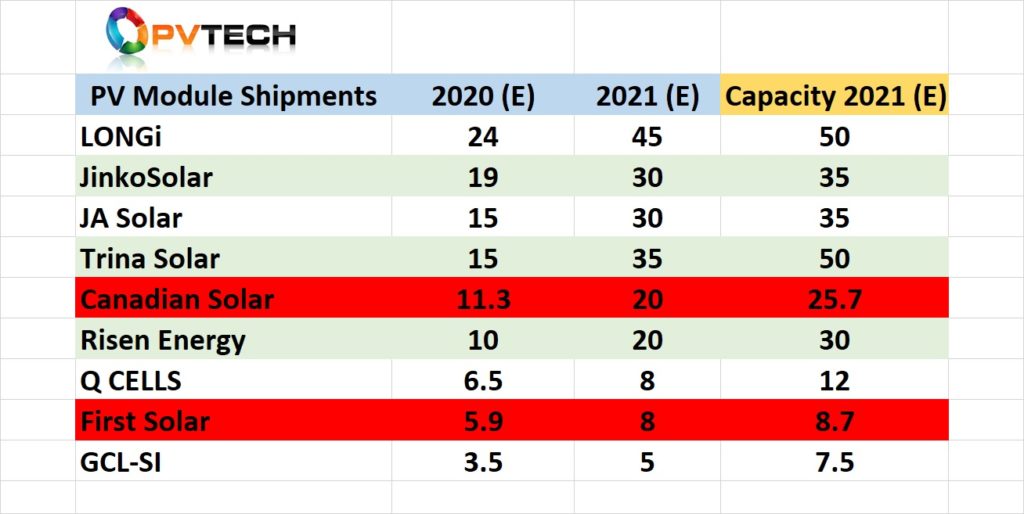

The table below highlights module shipment estimates for Canadian Solar’s major SMSL rivals throughout 2020 and 2021, as well as estimated or updated guidance (in red highlights). It should be pointed out that only First Solar and Canadian Solar have so far released full-year 2020 financial results, including actual shipments and guided 2021 manufacturing capacity and shipment guidance to date.

The table shows these two companies’ update figures, which for Canadian Solar have only changed in the estimated 2021 capacity column from 22GW to the latest guidance of 25.7GW.

Looking at the estimated PV module shipment figures for 2020, Canadian Solar was already expected to fall behind four of its SMSL rivals, and closing in on Canadian Solar is Risen Energy.

The 2021 estimated shipments column in the middle, currently indicates that the shipments gap could disappear between Canadian Solar and Risen Energy, while the key observation is the significant gap in shipments estimated for Canadian Solar’s biggest four rivals. There is at least a 10GW gap in shipments estimated in 2021 from Canadian Solar’s four largest SMSL rivals, and around a 15GW gap as far as module assembly capacity is concerned.

Obviously, we will have to wait for the other SMSL majors to publish full-year 2020 financial results and see what the actual scale of the gaps are in respect to 2021 shipments and module assembly capacity, but the data previously assembled for Canadian Solar and First Solar have a good degree of accuracy and support the trends developing today.

Risk averse

The major messaging to the investment community for quite a few years has been ‘Invest in long-term, sustainable, profitable growth.’

In the last major PV industry period of overcapacity, Canadian Solar had been vocal about being conservative in their capacity expansions and were risk averse, due to the history of bankruptcies and major financial stress experienced by the likes of Q-Cells and Yingli Green.

Management have, to a certain degree, maintained that risk averse strategy ever since, but may have notched it up a few pegs after releasing 2020 full-year results.

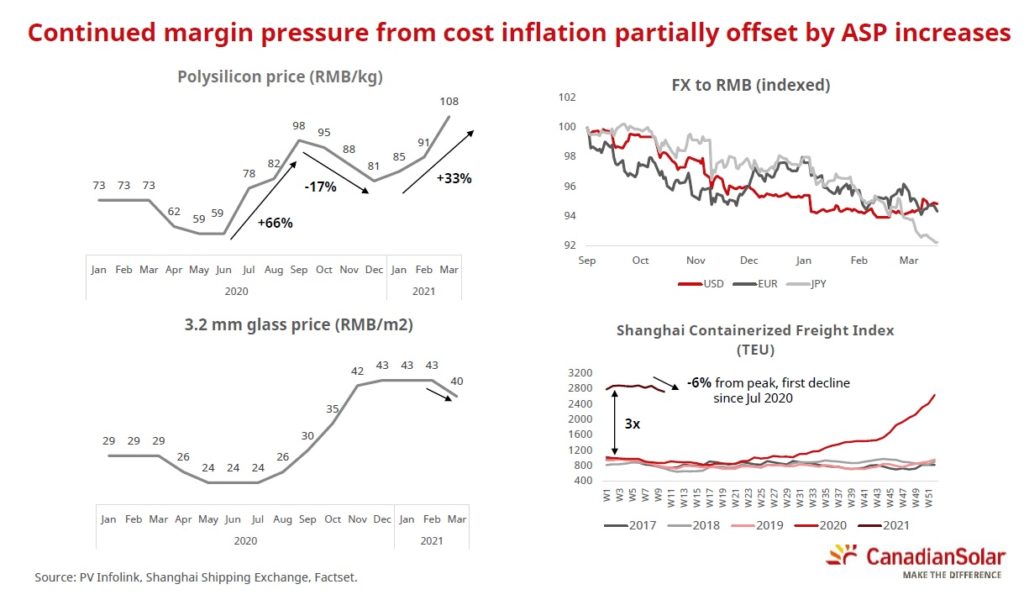

In the earnings call, management made a brave assertion that the PV industry was approaching the bottom of the solar cost curve, basically stating that module prices would not follow the trend over the last 20 years of constant decline.

It also highlighted some of the current material cost issues that were increasing in price, creating further pressure on profit margins.

Management asserted that downstream project developers or residential homeowners are wasting their time waiting for module ASPs to decline further before buying modules.

Canadian Solar used this backdrop to say it would be increasing module prices.

This was followed by the company stating that it would be increasingly focused on premium markets, segments and channels of the PV industry, most notably the distributed generation sector because more than half of Canadian Solar’s total shipments went into this channel, even though globally that market segment is probably less than 40% of the total solar market.

That said, the company highlighted at length its move into the Energy Storage System (ESS) market at the utility through to the residential market.

Currently, ESS is a high margin business for the leaders such as Tesla but that will eventually become a commodity market.

The bottom line for Canadian Solar would seem to be that it is steering itself away from competing with its larger SMSL rivals and finding a large enough niche market to prosper.