Chinese trade association China PV Industry Association (CPIA) has forecast that China’s new PV installations in 2025 will be between 215-255GW.

Despite strong numbers forecast for 2025, this would represent a year-on-year decline from China’s 277GW of solar PV installed in 2024.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Wang Bohua, honorary chairman of the CPIA, pointed out that in 2025, due to the impact of policies such as the management measures for distributed PV and the market-oriented reform of renewable energy feed-in tariffs, as well as the varying timelines for the introduction of these policies by different provinces, there is a certain wait-and-see attitude in the Chinese solar industry, which increases the uncertainty of the 2025 installation forecast.

He added that China’s new PV installations in 2024 reached 277.57GW, up by 28.3% year-on-year. Based on this calculation, China’s new PV installations in 2025 will experience a year-on-year decline of 8.13%-22.54%.

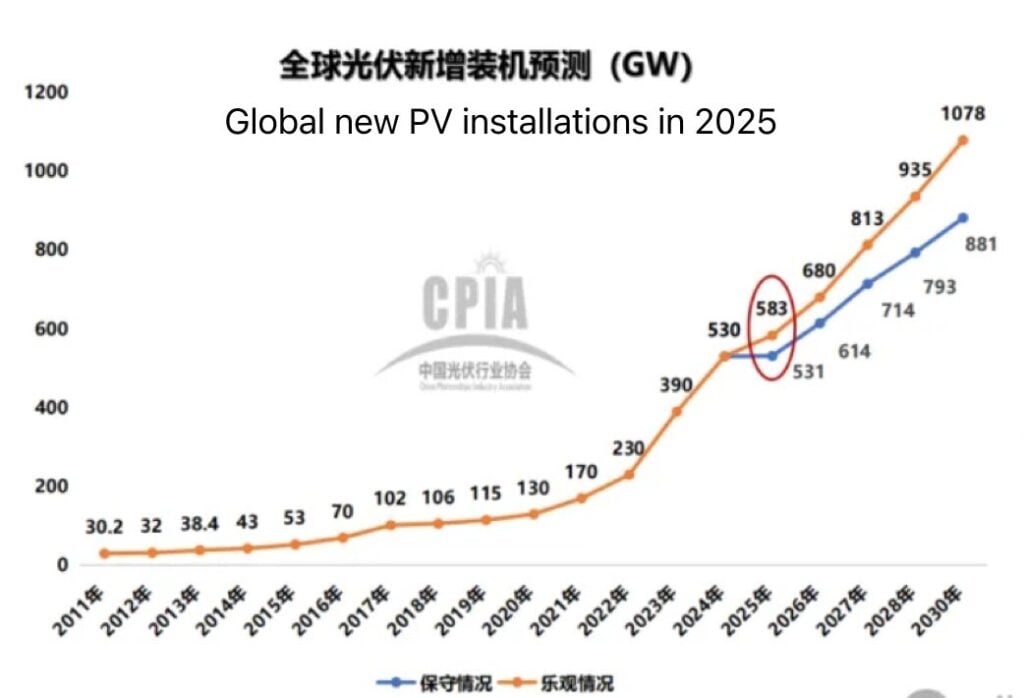

At a PV industry seminar, held today (February 27), titled “Review of 2024 Development and Outlook for 2025,” Wang Bohua stated that global PV installations increased by approximately 35.9% year-on-year in 2024, with all major PV markets maintaining a growth rate of no less than 15%. He forecasted that global PV installations would continue to grow in 2025.

Regarding the global new PV installations in 2025, Wang Bohua said that global PV installations would continue to grow in 2025. In an optimistic scenario, global new PV installations in 2025 are expected to reach 583GW, representing a 10% year-on-year increase. Emerging market demand will grow, and regions such as Latin America and the Middle East will develop rapidly.

Upstream production continues to grow

Reviewing the development of China’s PV industry in 2024, according to the CPIA report, China’s wafer production reached 753GW in 2024, up by 12.7% year-on-year; cell production reached 654GW, up by 10.6%; and module production reached 588GW, up by 13.5%.

Wang Bohua noted that despite the increase in production, the decline in prices led to a continued drop in the export value of China’s PV products in 2024. The export volumes showed mixed trends across different segments, with a decrease in solar wafer exports and an increase in cell and module exports.

“However, there are still significant structural opportunities in the export market. The top ten markets for module exports maintained a 62% market share, and the number of markets with exports exceeding 1GW increased from 29 in 2023 to 38. The Asian market, especially Pakistan and Saudi Arabia, emerged as the biggest highlights of the export market. Companies need to focus on strategic overseas layouts, including coordinated upstream and downstream overseas expansion and diversified overseas capacity strategies,” Wang Bohua suggested.