Another high-level, inter-departmental symposium on the PV industry was held in Beijing last week.

On the evening of 19 August, “MIIT WeReport”, the official WeChat account of the Ministry of Industry and Information Technology (MIIT), announced abruptly that a joint symposium on the PV industry had been held that same day by the MIIT, the Central Committee for Social Work, the National Development and Reform Commission, the State-owned Assets Supervision and Administration Commission of the State Council, the State Administration for Market Regulation and the National Energy Administration. The symposium aimed to further standardise the competitive order in the PV industry.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

According to the official statement, representatives from relevant PV manufacturing enterprises, power generation companies, the China PV Industry Association, and relevant local industry and information technology departments attended the meeting.

The meeting focused primarily on four key areas.

The first was strengthening industrial regulation, involving enhancing the management of investment in PV projects and adopting market-oriented and rule-of-law approaches to facilitate the orderly exit of outdated capacity.

Second was curbing low-price competition, involving improving price monitoring and product pricing mechanisms and cracking down on illegal practices such as below-cost sales and false advertising.

Third was standardising product quality. This includes combating practices such as lax quality control, false labelling of product power and intellectual property infringement.

Fourth was supporting industry self-regulation. This entails industry associations playing a role in promoting fair competition and orderly development, strengthening guidance on technological innovation, strictly abiding by quality and safety standards and effectively safeguarding a favourable development environment for the industry.

According to a report by business news outlet Yicai, given the highly confidential nature of this meeting against internal competition organised by MIIT, participating companies have signed non-disclosure agreements. As such, specific details discussed at the meeting and its outcomes are yet to be officially released.

In fact, MIIT has on multiple occasions mentioned strengthening the governance of key industries such as the PV industry and convened symposiums. Last month, the ministry also organised a PV symposium, which brought together 14 industry giants and representatives from PV industry associations. Those in attendance included Zhu Gongshan, chairman of GCL Group, Liu Hanyuan, chairman of Tongwei, Li Dongsheng, chairman of TCL, Li Xiande, chairman of Jinko, Gao Jifan, chairman of Trina Solar and Cao Renxian, chairman of Sungrow.

Wang Tieshan, director of the Industrial Development and Investment Research Center at Xi’an Polytechnic University, said: “Tackling ‘internal competition’ has become a key regulatory focus for decision-makers. Preventing supply-demand imbalances and unruly price wars is beneficial to multiple industries, including the PV sector.”

Polysilicon prices surpass RMB50,000 per ton

Driven by the “strong expectations” regarding anti-internal competition, the self-regulation pact of “not selling below cost” and some production reduction measures, prices of silicon materials and wafers have risen sharply, while prices of cells and modules have also rebounded.

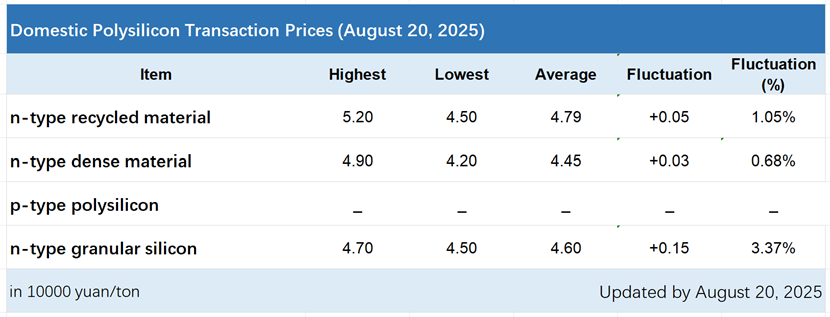

On 20 August, the Silicon Industry Branch released the latest polysilicon prices.

This week, the transaction price range for n-type recycled polysilicon materials stood at RMB45,000-52,000 per ton (US$6,306-7,286/ton), with an average transaction price of RMB47,900 per ton, up 1.05% week-on-week. The transaction price range for n-type granular silicon was RMB45,000-47,000 per ton, with an average transaction price of RMB46,000 per ton, up 3.37% week-on-week.

The Silicon Industry Branch highlighted two main reasons for the continued price rise of polysilicon this week are as follows. On one hand, the joint symposium on the PV industry held by six ministries clearly demonstrated the resolve to further standardise the competition order in the PV industry, sending a positive market signal of a firm stance against internal competition. On the other, polysilicon enterprises are collaboratively limiting production and sales, easing supply-demand pressure in the market.

Regarding production restrictions, the Silicon Industry Branch said that various polysilicon enterprises have implemented production reduction plans to varying degrees, with the two leading companies making the most significant cuts. A decline in operating rates will directly lead to an increase in comprehensive costs, and the regulatory rule of “not selling below comprehensive costs” has fuelled market expectations of further price hikes.

In terms of sales restrictions, limited shipments of silicon materials have further reduced polysilicon supply on top of production cuts. Coupled with the “buying in anticipation of price rises rather than falls” mindset amid rising price expectations, downstream stockpiling and procurement demands have grown.

In terms of modules, the bidding prices for large-scale module procurement projects by central state-owned enterprises have rebounded. For example, the recent 3GW PV module procurement by China Resources Power opened for bidding on 18 August, with the average bid prices for all three lots surpassing RMB0.7/W.

Overview of China’s PV “anti-internal competition” policies

Since late June 2025, under the central government’s policy guidance to tackle disorderly low-price competition and curb internal strife, various ministries and associations have actively rolled out “anti-internal competition” measures. They have also been actively conducting industry research and holding symposiums to lay the groundwork for the introduction of well-considered policies.

On 27 June, the revised Anti-Unfair Competition Law explicitly banned low-price dumping. On June 29, People’s Daily specifically highlighted the issue of “internal competition” in the PV industry.

On 1 July, the Central Financial and Economic Affairs Commission called for the regulation of disorderly low-price competition. On 3 July, MIIT held a symposium with PV enterprises. On 18 July, MIIT announced that it would roll out stabilisation and growth plans for ten key industries. On 24 July, the State-owned Assets Supervision and Administration Commission emphasised opposing “internal competition”, and the National Development and Reform Commission sought opinions on the revision of the Price Law. On 30 July, the Politburo meeting noted the need to “promote the continuous optimisation of the market competition order and regulate disorderly competition in accordance with laws and regulations”.

On 1 August, MIIT issued the Notice on the 2025 Special Energy Conservation Supervision Task List for the Polysilicon Industry, mandating energy conservation inspections for 41 polysilicon enterprises. The list covers major players in the silicon material sector, including Tongwei, GCL Group, Daqo, Xinte Energy, Qinghai Lihao, Asia Silicon, East Hope Group, Qiya Energy and their subsidiaries engaged in silicon material production.

Additionally, on 3 July and then again on 19 August, the Ministry of Industry and Information Technology held two symposiums, as reported at the top of this article.