Supply deals from major state-owned power groups in China and growing demand for component replacements look set to send inverter demand to new highs, PV Tech analysis has shown.

PV Tech has consolidated the bidding and winning results for the centralised procurement of inverters announced by central enterprises – state-backed power groups such as China Datang, CGN and China Huaneng – since the turn of the year. According to preliminary statistics, the total installations of inverters by these central enterprises for 2020 falls just short of 24GW (23,995.66MW).

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

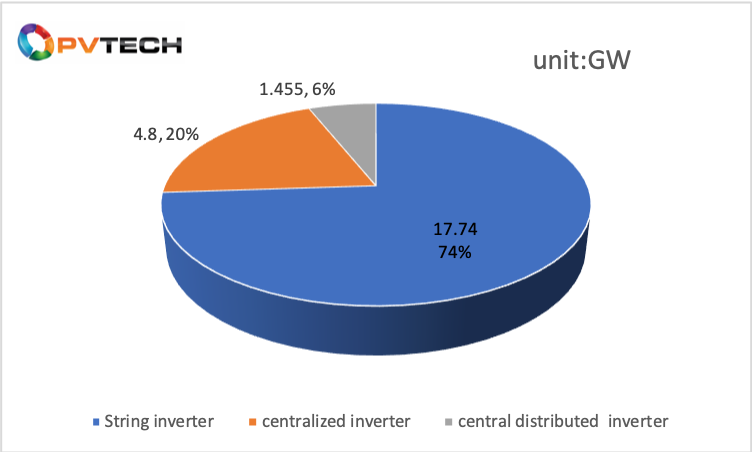

String inverters have, predictably, recorded a high percentage of bids within centralised procurement orders this year, winning 17.74GW, nearly 75%, of the total. Bidding projects of central inverters total 4.8GW, and the bidding projects of central distributed inverter total 1.455GW.

CPIA data reveals that string inverters enjoyed a market share over 59.04% in China last year, accounting for the largest share of all inverter types. In recent years, as string inverter technology applications have been upgraded and their cost approaching that of centralised inverters, string inverters are favoured by more power plant owners.

The continued development of the distributed PV market and the increasing proportion of string inverters in centralised PV power plants contribute to a more favourable market environment for the string inverter industry.

In addition, according to incomplete statistics compiled by PV Tech, several top-ranking inverter producers have signed about 7.95GW of major orders in the international market.

| Project name | Project/contract capacity | Signing partner | Inverter type |

|---|---|---|---|

| Shanghai Electric Dubai Phase 5 Inverter Procurement | 900MW | Sungrow (signed procurement contract) | TBC |

| India (IPP) Avaada Energy | 650MW | Sungrow (signed supply contract) | 1500V inverter |

| India ACME | 1.4GW | TBEA (signed strategic cooperation agreement) | Inverter and solutions |

| German Wattkraft Solar | 5GW | Huawei (signed 2020-2021 distribution agreement) | Fusion Solar smart string PV inverter |

Top inverter producers’ mid-year reports in the black

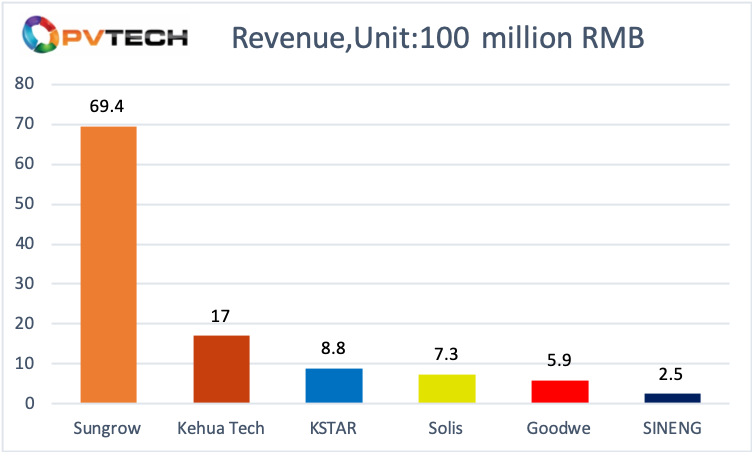

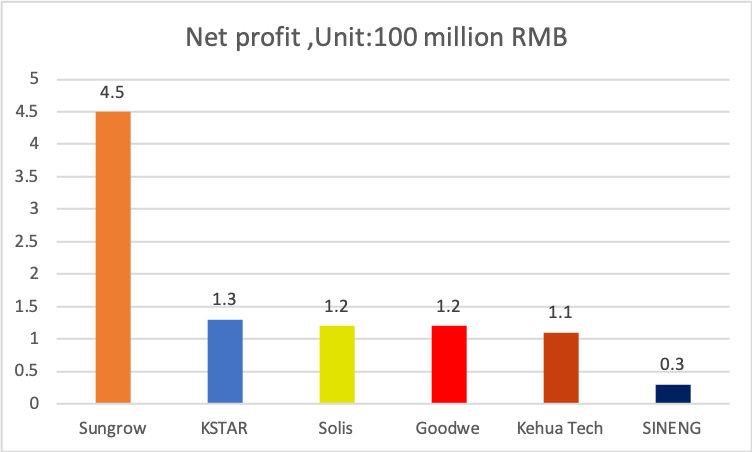

Recent financial results for H1 2020 published by PV inverter manufacturers provide more detail on the good performance from the start of the year.

In particular, Sungrow has reinforced its leading position with RMB6.942 billion (US$1 billion) in revenue.

According to the mid-year report of Ginlong Technologies, the company achieved revenue of RMB727 million (US$107 million), up 76.63% year-on-year, while net profit of RMB118 million (US$17.3 million) was an increase of 281.87%. It is reported that Ginlong's overall production capacity is 200,000 units/year, while a new facility with an annual output of 120,000 units of central distributed string and grid-connected inverters will contribute towards a total production capacity of 320,000 units/year when it reaches production. This May, Ginlong confirmed plans to increase its capacity by adding 400,000 string grid-connected and energy storage inverters in a targeted manner, which could boost overall shipments to 15GW.

Goodwe, another inverter company which made its debut on the capital market recently, performed reasonably well in H1 2020, recording revenue of RMB588 million (US$86 million), up 39% year-on-year, and net profit of RMB117 million (US$1.7 million), up 226% year-on-year. However, compared with the industry peer leaders, Goodwe's market share and sales volume is relatively small.

According to the interim report of Sineng Electric, the company recorded revenue of RMB250 million (US$36 million) and net profit of RMB30.358 million in H1 2020. It is reported that inverter revenue accounted for 85.91% of total revenues at Sineng Electric during the reporting period, with particular success in procurement rounds from state-owned enterprises such as SPIC, China Datang, China Huaneng, CNNC, CGN and CHD. At present, Sineng Electric continues to be a core supplier of inverters to major power generation groups, with more than 6GW of orders secured.

Higher expectation on Q4 demand and greater potential in the replacement market

Since July, prices have generally risen across the PV industry chain due to increased downstream demand towards the end of the year and insufficient supply of raw materials at each end of the ecosystem.

In terms of the aftermarket’s development and demand, analysts at New Times Securities have indicated that expectation on Q3 domestic demand remains high, as supported by household and extra-high voltage (EHV) usage, as well as consumption at state-fixed price and other projects. Demand in Q4 is expected to exceed expectation given the synchronised development of state-fixed pricing and competitive-pricing projects. Therefore, the whole PV industry is on the rise.

On top of new markets, and in addition to inverter demand for new massive projects, the demand for inverter replacements is also becoming a growth area not to be underestimated. Few listed PV inverter producers currently provide a breakdown of inverter replacement sales in their financial statements.

According to analysts WoodMac, solar power systems nearing the end of their inverter life currently account for 5% of the global PV market. By 2025, this figure will increase to 16%, equivalent to some 227GWdc . IHS Markit forecasts that global demand for inverter replacements will reach 8.7GW this year, up 40% year-on-year.

Unlike module-based PV products, inverters generally have a lifespan of about 10-15 years due to their internal configuration characteristics. In the European market, where solar deployment started early, string inverters users by customers in early stage have a life expectancy of 5 to 10 years. Demand for inverter replacements in Europe has been on the rise.

China's PV installations have reached GW levels since 2011, with more than 10GW of new installations in 2013. As a result, it would appear China's inverter replacement market is about to enter an era of high-growth. According to Deng Yongkang's team at EssenceDX, the global demand for inverter replacements is expected to reach 15GW and 20GW in 2021 and 2022, up 72% and 33% year-on-year, presenting major growth factors for the years ahead.