On December 18, at the 2025 PV Industry Annual Conference, Wang Bohua, honorary chairman of the China PV Industry Association (CPIA), said that the polysilicon production in China experienced its first year-on-year decline since 2013, while wafer production has registered its first year-on-year decline since 2009.

At the conference, Wang Bohua delivered a report titled “Analysis of Development Changes in China’s PV Industry”. According to the report, from January to October 2025, China’s polysilicon production reached about 1.113 million tons, down 29.6% year-on-year; wafer production totalled about 567GW, a 6.7% year-on-year decrease. Solar cell production reached about 560GW, up 9.8% year-on-year, while PV module production totalled about 514 GW, up 13.5% year-on-year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

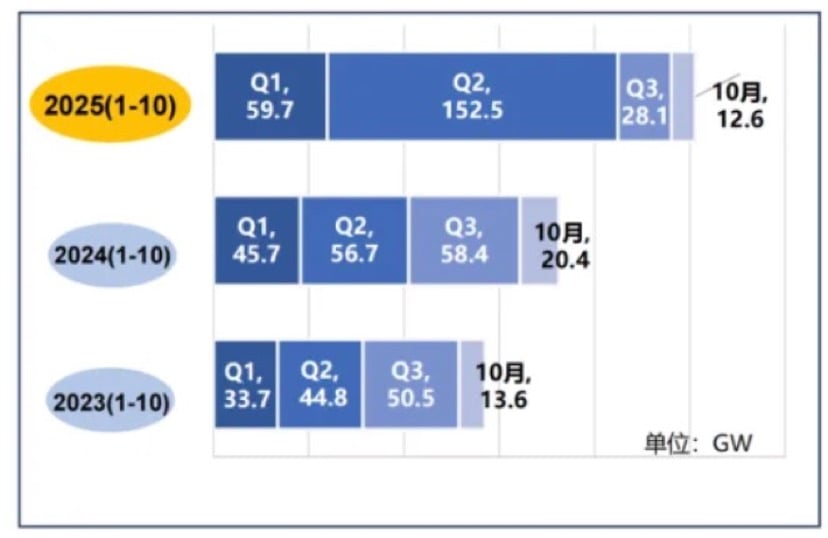

From January to October 2025, new PV installations in China reached 252.87GW, up 39.5% year-on-year. The figure saw a 150% year-on-year growth from January to May, but a 46% year-on-year decline from June to October.

The growth in the first half of the year was due to the implementation of a new grid reform legislation at the beginning of June, which marked the end of fixed feed-in-tariffs and led to a rush in commissioning projects before the deadline. In May alone, new solar PV installations nearly reached a record 100GW, bringing the cumulative installed solar PV in the country to more than 1TW.

In terms of exports, from January to October 2025, the export volumes of wafers, cells, and modules rose by 8.3%, 91.4%, and 6% year-on-year, respectively. However, export values have posted year-on-year decline for two consecutive years. The export value of PV products dropped by 3.2% year-on-year from January to October.

Wang Bohua noted that in H2 2025, despite a sharp decline in demand, PV product prices remained largely stable. In November 2025, the average module price edged up 1.34% year-on-year and remained flat month-on-month. As of the end of November, the average ex-factory polysilicon price climbed 34.4% year-on-year and inched up 0.2% month-on-month. The PV module bidding price rose by 1.26% year-on-year and 1.3% month-on-month. The average ex-factory module price edged up 1.34% year-on-year and was nearly flat month-on-month.

According to Wang, the PV industry is in a transition period towards high-quality development, and the demand side still retains great potential. However, the key tasks during the transition period are as follows: first, to reject vicious price competition and lay a solid foundation for the industry’s high-quality development.

Enterprises should further uphold and participate in industrial self-discipline, resolutely refrain from engaging in cutthroat competition through below-cost pricing, and firmly oppose blind capacity expansion and production activities that violate market economic principles, laws, and regulations.

Second, the application side should embrace the concept of high-quality development, which includes refraining from bidding below full cost, further reducing unreasonable resource-related fees, and proactively adapting to the new market dynamics.