Major China-based polysilicon producer, Daqo New Energy has taken the average total production cost of primarily monocrystalline-grade polysilicon to an industry record low of US$6.38/kg in the fourth quarter of 2019, while guiding lower costs of approximately US$6.10/kg for the first quarter of 2020.

The latest record cost reductions were achieved while Daqo was ramping production of its 35,000MT Phase 4A capacity expansion. The company expects to run all production facilities at full utilisation and produce approximately 18,000MT to 19,000MT during the first quarter of 2020. Full-year production, including shutdowns for annual maintenance, is expected to be in the range of 73,000MT to 75,000MT in 2020. Mono-grade polysilicon should account for over 90% of sales in 2020.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Longgen Zhang, CEO of Daqo New Energy, commented, “We are pleased to report an outstanding quarter to close out the year in which we delivered strong operational and financial results. Having completed the new 35,000 MT Phase 4A expansion project at the end of the third quarter, we quickly ramped its production up during the fourth quarter and hit full capacity in December 2019.”

“We completed the ramp up progress months ahead of schedule and were able to generate outstanding operational results across all key metrics including production volume, product quality, and manufacturing cost,” Zhang added.

The Company produced 16,204MT of polysilicon in the fourth quarter of 2019 and sold 13,291MT during the quarter, effectively doubling its production capacity between Q3 2019 and Q4 2019.

Financials

The earlier than expected Phase 4A capacity expansion had a major impact on fourth quarter and full-year financial results.

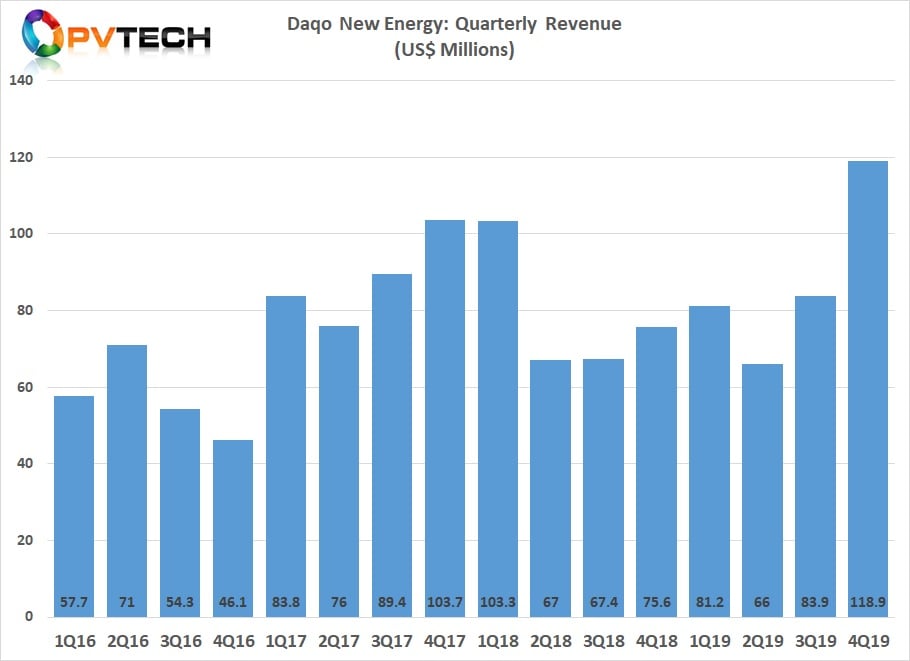

Daqo reported fourth quarter 2019 revenue of US$118.9 million, compared to US$83.9 million in the third quarter of 2019 and US$75.6 million in the fourth quarter of 2018.

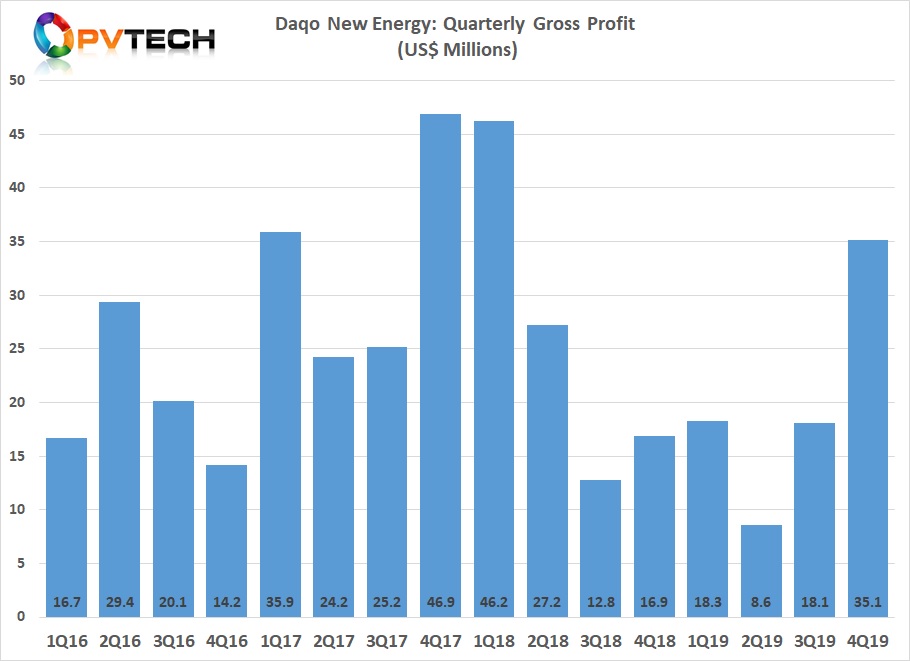

Gross profit was US$35.1 million, compared to US$18.1 million in the third quarter of 2019 and US$16.9 million in the fourth quarter of 2018.

Daqo reported a quarterly gross margin of 29.5%, compared to 21.5% in the third quarter of 2019 and 22.4% in the fourth quarter of 2018.

Total revenue in 2019 was US$350 million, compared to US$301.6 million in 2018. The small increase was primarily driven by higher polysilicon sales volume but with significantly lower ASPs in the last two years.

Lower ASPs led to a full-year gross profit of US$80.1 million in 2019, compared to US$98.1 million in 2018. Gross margin was 22.9% in 2019, compared to 32.5% in 2018.

“Towards the end of 2019 we saw the market share for multi-grade polysilicon shift meaningfully towards mono-grade polysilicon,” Zhang pointed out. “While mono-grade polysilicon continues to be in high demand with stable pricing, demand for multi-grade polysilicon wanes with prices dropping significantly.”

“While we are ideally positioned to benefit from this shift towards mono-grade polysilicon, this will adversely impact some of our competitors who produce mostly multi-grade polysilicon,” the CEO went on to say. “At the same time, we are seeing a number of major competitors shutting down their operations, exiting the market and laying off employees due to significant financial losses and their uncompetitive cost structure. We believe this trend will continue going forward unless ASPs can recover to healthy levels for our competitors to continue production.”