US solar and energy storage company Distributed Solar Development (DSD) has secured construction finance worth US$150 million from Rabobank to support its commercial and industrial (C&I) development pipeline for the next two years.

The food and agribusiness bank has provided DSD with a two-year, US$150 million construction revolving credit facility, weeks after the distributed solar developer secured a US$300 million debt facility from Credit Suisse.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

DSD said in a statement that the flexible structure of the revolving credit, which incorporates multiple tax partnerships, “aligns strongly” with its Credit Suisse deal. At the time of the agreement, DSD said it expects to close “multiple financing deals” by the end of winter.

Greg Fasbo, DSD’s chief executive officer, said the construction revolver provides the developer with “a flexible back leverage solution that will enable us to continue scaling as we work to become an industry hub for the C&I market.”

The company, which was fully acquired by BlackRock last November, also received financial backing last year from Morgan Stanley, Silicon Valley Bank and Fifth Third Bank, which will be used to fund distributed generation projects developed in 2020.

Launched as a start-up business within General Electric, DSD aims to make solar power generation more accessible to commercial, industrial and municipal organisations by providing a “one-stop shop” for PV and energy storage solutions, according to the company. BlackRock bought an initial 80% share in the company in 2019, and bought the remaining 20% last autumn.

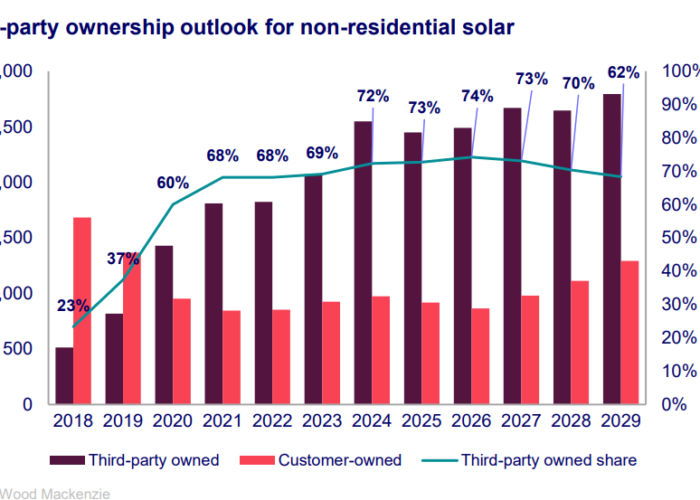

Claus Hertel, Rabobank’s managing director of project finance, said that distributed solar power generation in the C&I space is “becoming increasingly relevant” to investors. Indeed, earlier this year Spartan, a special acquisition company (SPAC) backed by funds managed by an affiliate of Apollo Global Management, announced plans to combine with residential solar lender Sunlight Financial in a deal worth roughly US$1.3 billion. Early Facebook executive Chamath Palihapitiya was one of a handful of prominent figures who led a US$250 million investment which gave institutional investors a 19% share in the new entity.

Energy giants are also betting on the growth of the C&I solar market this year. EDF Renewables acquired 100% of US distributed generation company EnterSolar in January, having taken a 50% stake in the company in 2018. EDP Renewables also recently purchased C2 Omega, the distributed solar platform of renewables investor C2 Energy Capital.

Outside of the US, French oil major Total and industrial conglomerate Zahid Group formed a joint venture in March to develop PV installations for Saudi Arabia’s C&I sector, while Asian C&I solar specialist Cleantech Solar secured a US$75 million loan last summer to fund its own expansion in the region.

On the manufacturing side, Trina Solar launched an ultra-high performance 405W Vertex S series module last year to target the global small C&I solar market. It hopes to reach a production capacity for the product of 10GW by the end of next year.