The European Bank for Reconstruction and Development (EBRD) will provide up to US$229.4 million to ACWA Power to develop a 200MW/500MWh solar-plus-storage project in Uzbekistan.

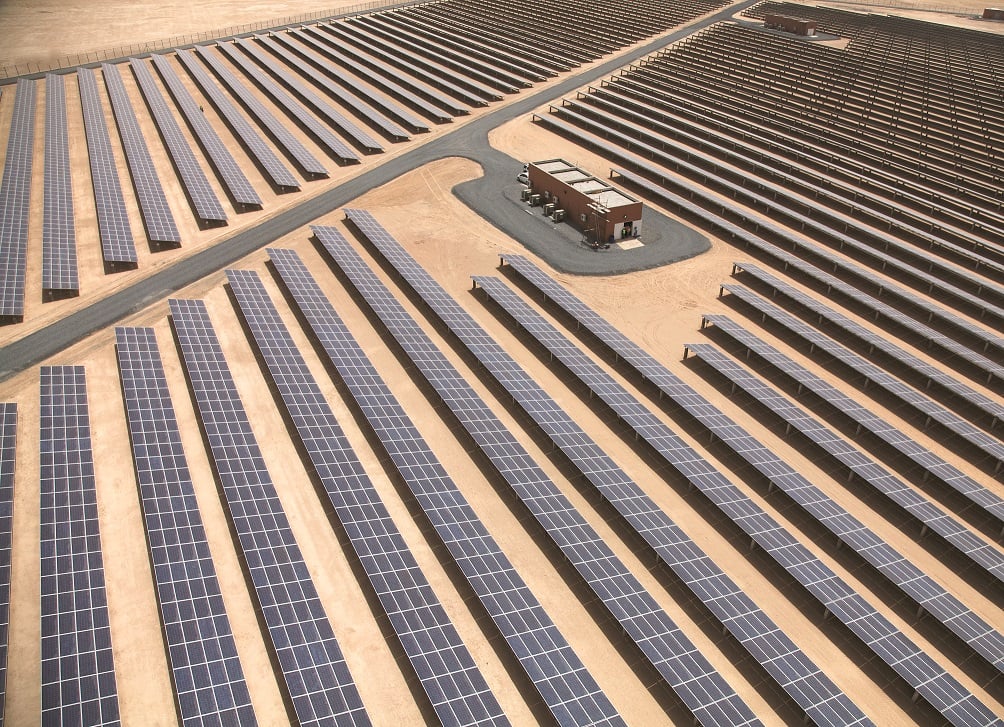

Due to be built in the eastern Tashkent region, the projects are owned by ACWA Power Riverside Solar, a special-purpose company owned by Saudi energy giant ACWA Power. It forms part of Uzbekistan’s professed target of developing 25GW of solar and wind generation capacity by 2030.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The financing will be delivered through an A-loan of up to US$183.5 million and a B-loan of up to US$40.5 million, supported by commercial co-financiers.

Nandita Parshad, managing director of the EBRD’s sustainable infrastructure group, said: “We are proud to partner with ACWA Power and co-financiers on the pioneering Tashkent Solar PV and energy storage project in Uzbekistan, the largest of its kind in Central Asia. The project is core to Uzbekistan’s ambition to install 25GW of renewables by 2030.”

The EBRD has invested over US$5.1 billion (€4.7 billion) in 162 projects in Uzbekistan alone to date; it has been the leading recipient of EBRD funding in the Central Asia region for the last four years.

Uzbekistan and the wider Central Asia region has received significant foreign investment in its energy sector, particularly from the Middle East and China.

Marco Arcelli, CEO of ACWA Power, said: “In a world that is looking for greater participation of private capital in emerging markets to support growth and decarbonisation, Uzbekistan is a case study under the vision and leadership of its government and lenders like the EBRD, DEG, Islamic Development Bank, Proparco, KfW IPEX-Bank and Standard Chartered.”

ACWA Power secured US$80 million from the Bank of China earlier this year to support the development of the Tashkent project, which forms part of wider plans for the region. The company also signed an engineering, procurement, and construction (EPC) contract with the China Energy Group Corporation for the site last year and a 240MW module supply agreement with Chinese solar manufacturing major JA Solar.

UAE state-owned renewable energy company Masdar signed a US$159 million deal with the World Bank in May for a 250MW solar-plus-storage project in Uzbekistan, following the connection of two PV projects to the country’s grid in March. Masdar also signed a deal with Uzbekistan’s government in 2023 to develop 2GW of solar and wind projects across the country.

The China Energy Engineering Corporation (CEEC) has also extended its operations into Uzbekistan, having commissioned the first 400MW of a planned 1GW solar PV site in January and developing a separate, 240MW site.