US cadmium telluride (CdTe) thin-film solar manufacturer First Solar is facing a class action lawsuit investigation into its business practices following a downgrade in its stock.

The lawsuit is currently investigating whether First Solar or its directors “have engaged in securities fraud or other unlawful business practices,” on behalf of undisclosed investors in the company.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The case is in response to a downgrade of First Solar’s stock (FSLR) by investment banking and capital markets firm Jefferies earlier this month, which saw it fall by US$27.67 per share, or around 10%, on the NASDAQ as of 7 January 2026.

Jefferies cited lowered guidance for 2025 and a compressed margin, as well as the risk of “de-bookings” in its decision to downgrade First Solar stock from “buy” to “hold”.

New York-based law firm Pomerantz, a firm specialising in defrauded investor cases, is conducting the investigation.

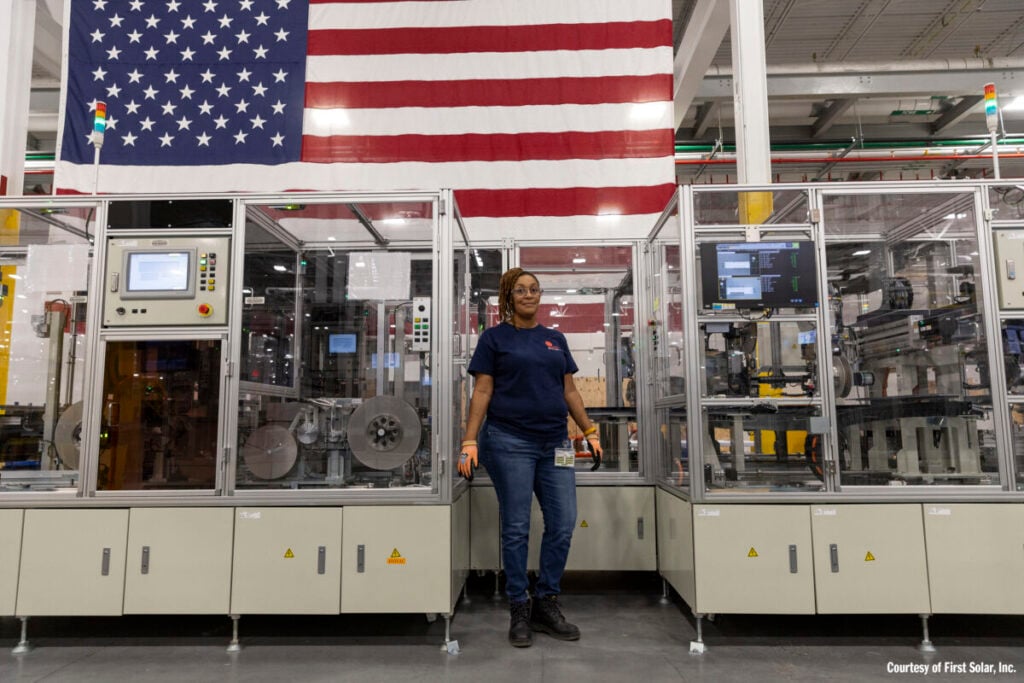

First Solar’s stock price had risen massively over the course of 2025, in tandem with its operational expansion in the US. FSLR traded at US$129.6 on 31 March 2025 and hit a high of US$284.59 on 22 December 2025. The company has also opened multiple manufacturing and research bases on US soil. The roughly 10% drop at the start of January could, then, potentially be seen as a course correction after a massive growth period.

However, in its downgrade, Jefferies cited limited booking visibility in First Solar’s operations, increasing worries over booking cancellations and the company’s heavy exposure to Section 45X advanced manufacturing tax credits. These might suggest there was more behind the decision than possibly inflated stock value.

The company has previously said it has an extensive backlog of module sales, and PV Tech reported as far back as 2023 that First Solar had sold all of its module capacity through 2026. The only public reports of module order cancellations for First Solar have been with Lightsource bp, the subsidiary of oil and gas giant bp, for which the module producer is seeking damages.

First Solar has made over US$2 billion in 45X tax credit deals to date, with its latest US$175 million credit transfer deal closing in October. Overall, renewables tax credits introduced under the Biden administration’s Inflation Reduction Act (IRA) were harshly scaled back in the Trump administration’s reconciliation bill last summer, but 45X credits remained relatively untouched. First Solar CEO Mark Widmar has also said that the current White House policies “strengthen” First Solar’s position relative to its competition.

The company did revise its guidance for the 2025 financial year down in its Q3 financial report, lowering net sale forecasts down from between US$4.9-5.7 billion to between US$4.95-5.2 billion. First Solar blamed this downgrade on a solar glass supply chain issue and the contract termination with Lightsource.

PV Tech has contacted First Solar for comment on this story.