First Solar’s Annual Analyst Day event proved to be the most interesting in years for a number of reasons.

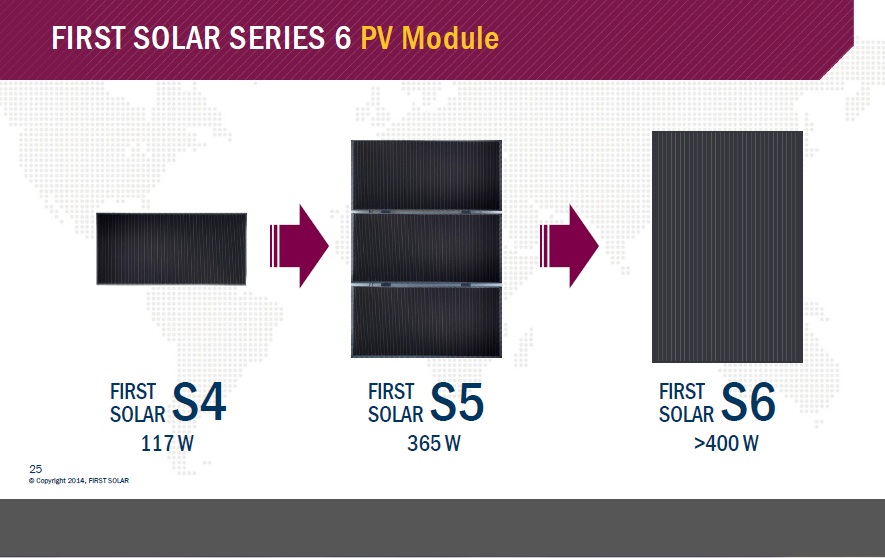

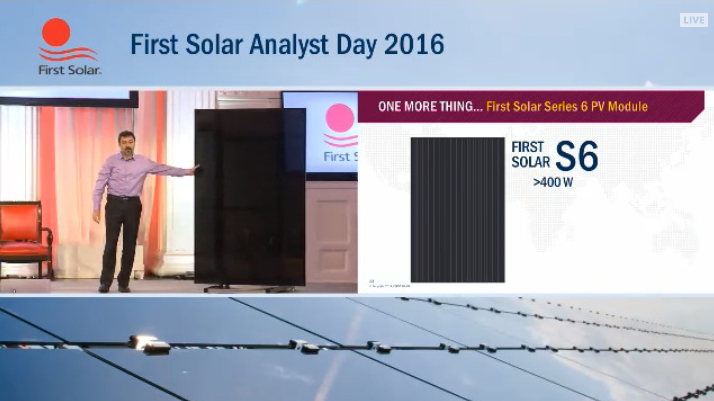

The big news was the first insight into its next-generation CdTe thin-film technology, which is literally ‘big’ as the company is planning on introducing its ‘Series 6’ modules with 400W output using a completely new tool set for a large-area module.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The Series 6 modules are in the league of those originally developed by Applied Materials under its ‘SunFab’ brand for a-Si thin-film modules, which had some of the key deposition toolset derived from the FPD (Flat Panel Display) sector.

According to Raffi Garabedian, CTO at First Solar the new technology, still under development, would be a major game changer as it would have significantly lower production costs when compared to its smaller form factor modules it had been producing to date.

The impression given during the event was that the Series 6 module would be a 2019 launch onwards and initially exclusively used on its own PV power plant projects as the modules would likely require different mounting system design for fixed, ground mount and single-axis tracker systems as well as assisted mechanical handling systems due size and weight, all things encountered by Applied Materials in the past.

Series 5 module

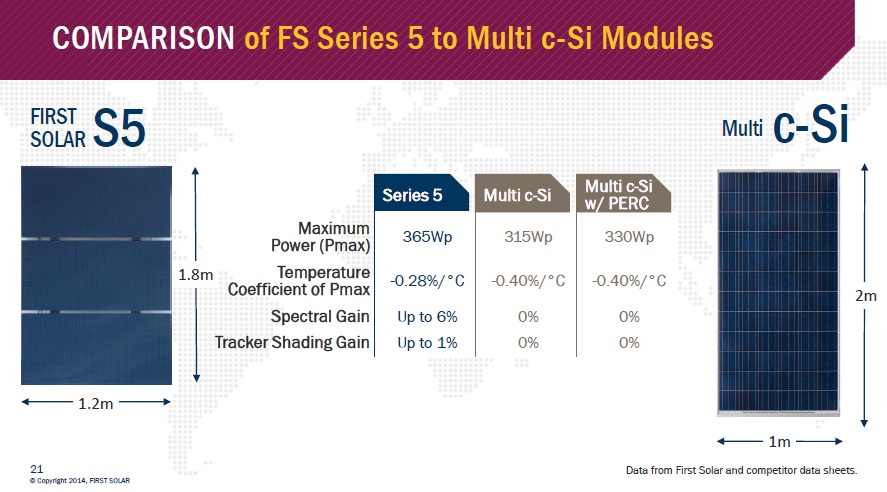

The second interesting development from the event was the planned launch of First Solar’s Series 5 module, a three horizontal stacked module unit the equivalent size and form factor of conventional c-Si 72-cell modules, widely used in utility-scale PV power plant projects.

Pre-assembled stacks at its production plants, the Series 5 was said to provide a ‘standardised’ product offering to potential customers that had previously stayed with c-Si modules to simplify BOS procurement and reduce costs.

Providing a system with an initial 365W (Pmax), First Solar expected strong interest in the new module format, enabling them to tap into EPC’s and project developers that would have liked to use its thin-film modules in the past but the non-uniform format, fixings and racking systems were deterrents. This could be a significant market opportunity, according to the company, though apart of the claimed higher energy density factor over a c-Si module, Series 5 would seem to bring the company inline rather than ahead of its 72-cell c-Si rival.

The company said that the Series 5 module system would initially be available in a late 2017, with fleet production line module efficiencies in the 17% range.

Manufacturing update

Expectations ahead of the analyst event had been that due to First Solar’s PV project pipeline and third-party demand for its modules that had combined to push all operating lines to full utilisation levels in the fourth quarter of 2015 that the company would announced a new wave of capacity expansions.

Some analysts seemed disappointed when Tymen deJong, COO of First Solar noted that despite the ability to produce one module per second that figure would not be decreasing just now.

First Solar acknowledged that it had retained the eight production lines (800MW) of equipment previously mothballed after closing its two manufacturing facilities in Germany but had not determined when these lines would be upgraded to existing line efficiency and throughput level and deployed in an unspecified location, or locations.

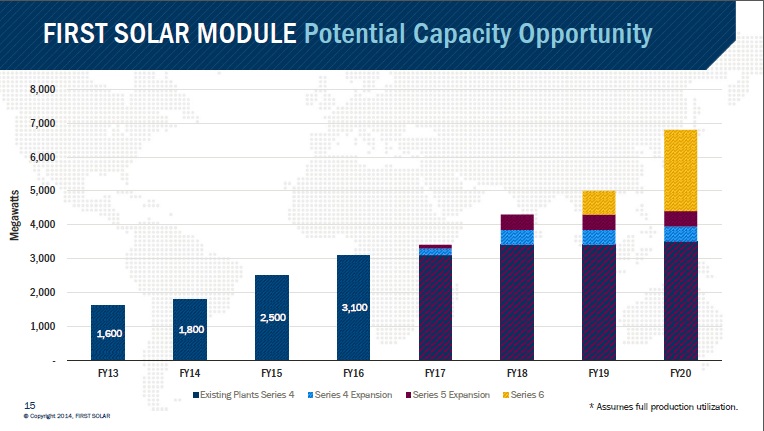

Management highlighted that it would keep all production lines running at full-capacity in 2016, which had equated to 3.1GW produced in 2015, up from 2.5GW in 2014, when lower utilisation rates and less lines were in operation.

However, a potential capacity expansion roadmap was provided that could take capacity to close to 7GW in 2020.

Beginning in late 2017, deJong noted that the company could deploy four mothballed lines (400MW) of current Series 4 modules and add a further four upgraded mothballed lines (425MW) in a new facility in 2018.

The ramp of its Series 5 module system would initially include four lines that had the stacked module assembly tools added in late 2017 with full production expected in 2018. Additional Series 5 production lines would be added based on market demand.

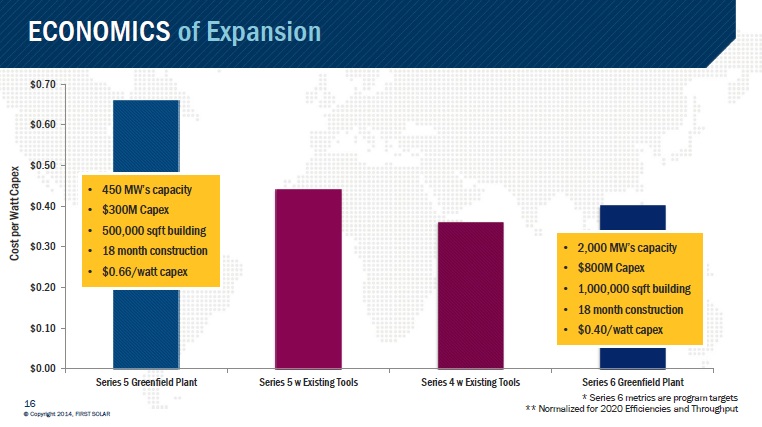

First Solar noted that a greenfield Series 5 production facility with a capacity of around 450MW would require capital expenditures of around US$300 million, and an 18-month construction timeline.

The impression given was that some existing Series 4 lines would add the assembly tools required for Series 5 modules as when required. The Series 5 module lines were said to have a calculated capital cost of around US$0.45/W, slightly higher than Series 4 at US$0.35/W, due to the additional stack assembly equipment.

In 2019, First Solar highlighted the potential to start ramping its Series 6 modules that would be housed in a new dedicated facility, but would carry only a capital cost of around US$0.40/W. Around 2GW of Series 6 production could be in operation in 2020.

Capacity of 2GW of Series 6 modules would require US$800 million in capaital expenditure and 18-months construction of a greenfield site.

Business model shift

With the significant capital expenditures required for the large-area Series 6 modules potentially ahead in 2018 through 2020 and to a lesser extent on Series 5, subject to greenfield needs and demand, increasing its PV project completions would strain First Solar’s balance sheet.

This was something management highlighted from recent well-known bankruptcies and distressed companies in the solar sector would be avoided by a strictly conservative approach to both upstream capacity expansions and downstream project development.

Indeed, the sacrificial lamb in this strategy would be keeping the downstream project development arm at around current annual completion levels, while re-emphasis from its earlier years of being a module producer and supplier with the eventual added capacity.

An advantage of emphasis on module business was claimed to be the better margins achieved with higher efficiencies, new market opportunities with Series 5 and significant margin improvement with the deployment of Series 6.

Management noted that pushing its PV project pipeline further out to the ramp of Series 5 and 6 would only add further margin improvement to its balance sheet, limiting the expected effect of its net cash balance declining through 2020 due to the capacity expansions.

With a shift to large-area thin-film modules and a shift back to module sales in targeted and controlled manner, First Solar is going back to the future.