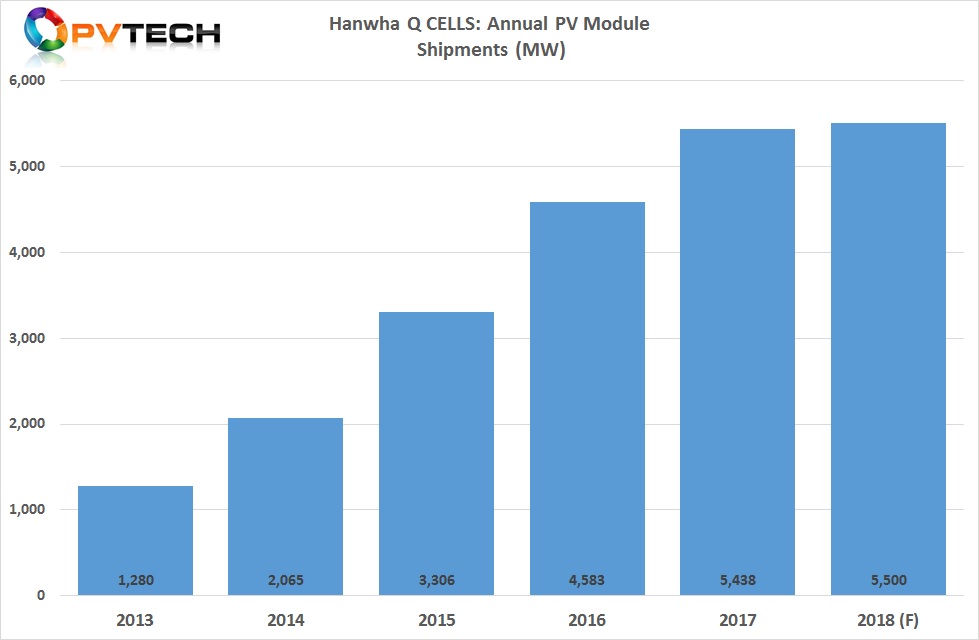

‘Silicon Module Super League’ (SMSL) member Hanwha Q CELLS has lowered its full-year module shipment guidance a second time this year as business growth slows.

The SMSL said total module shipments in 2018 would be in the range of 5,500MW to 5,700 MW, down slightly from previously lowered guidance of 5,600MW to 5,800MW. Initial guidance for 2018 had been shipments in the range of 6,000MW to 6,200MW.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Total module shipments in 2017 were 5,438MW, indicating shipment growth of almost zero to potentially 262MW for 2018.

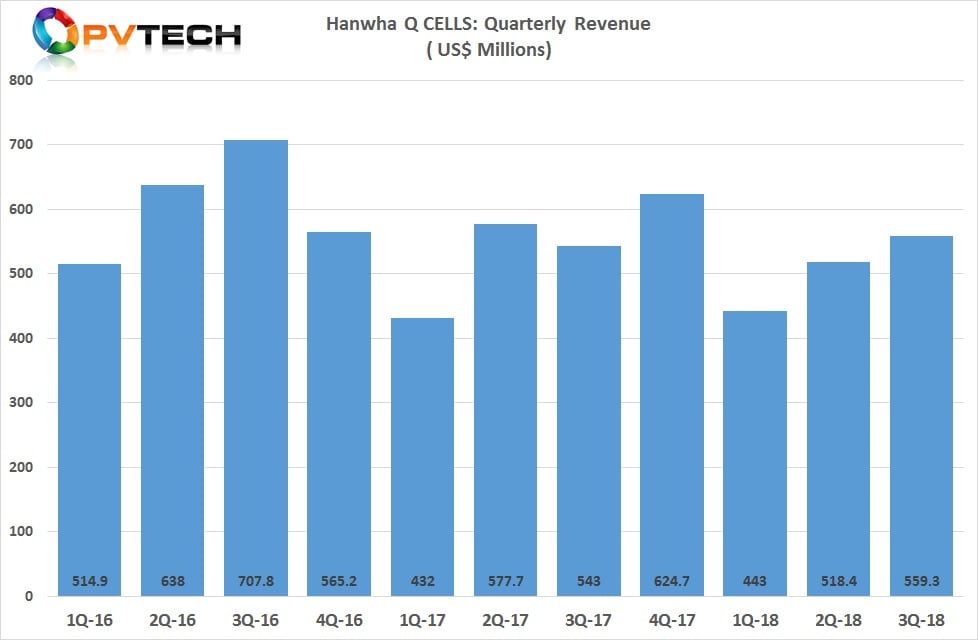

The company reported third quarter revenue of US$559.3 million, up 7.9% from US$518.4 million in the second quarter of 2018.

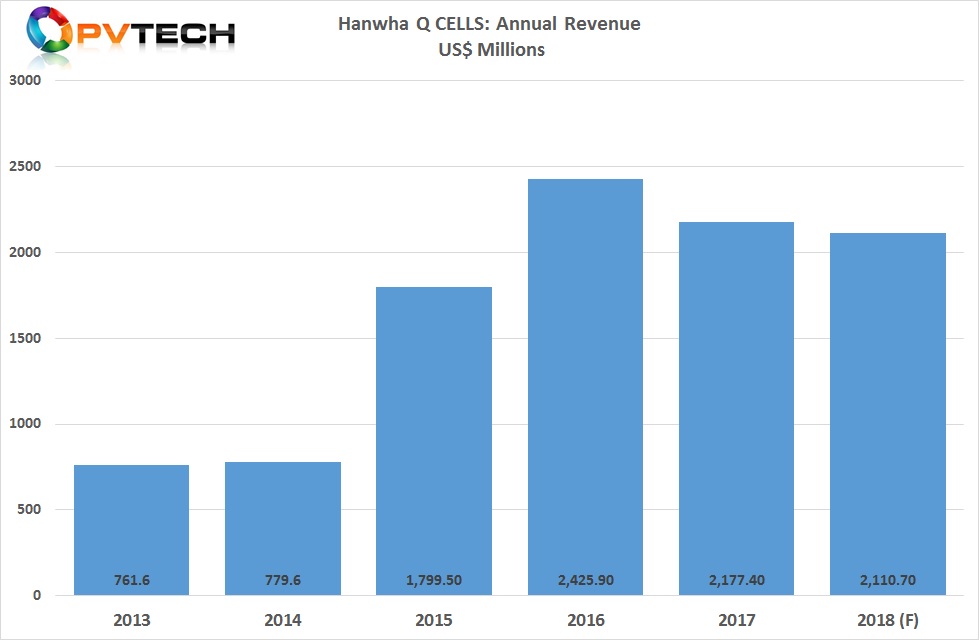

Total revenue for the fourth quarter of 2018 was expected to be in the range of US$590 to US$610 million, indicating full-year revenue to in the range of US$2,110 to US$2,130.7 million, compared to 2017 revenue of US$2,177.4.

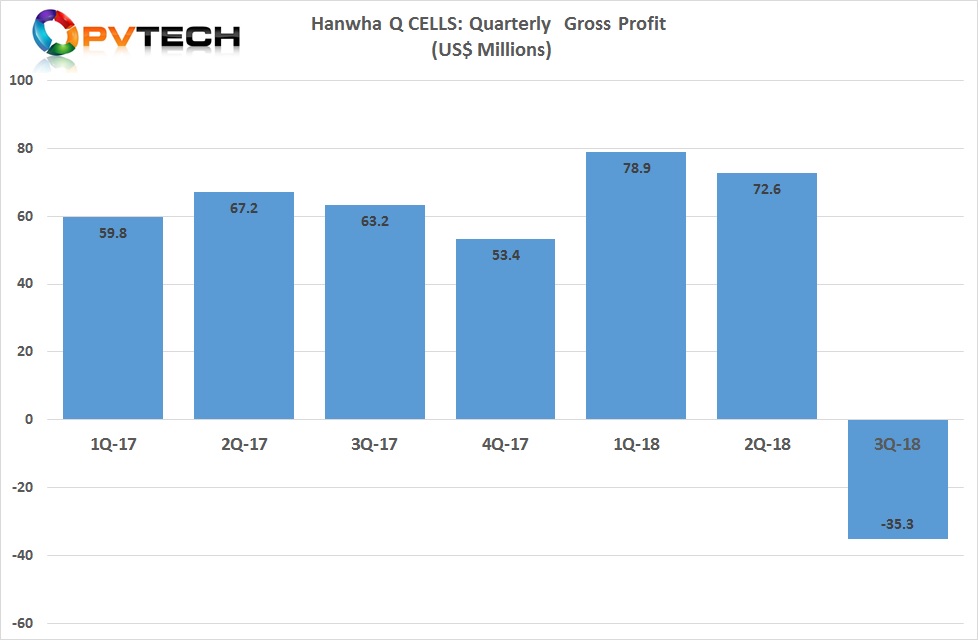

Hanwha Q CELLS reported a US$108.2 million one-time loss associated with the discontinuation of its China-based ingot manufacturing operations (1.6GW) in September, 2018.

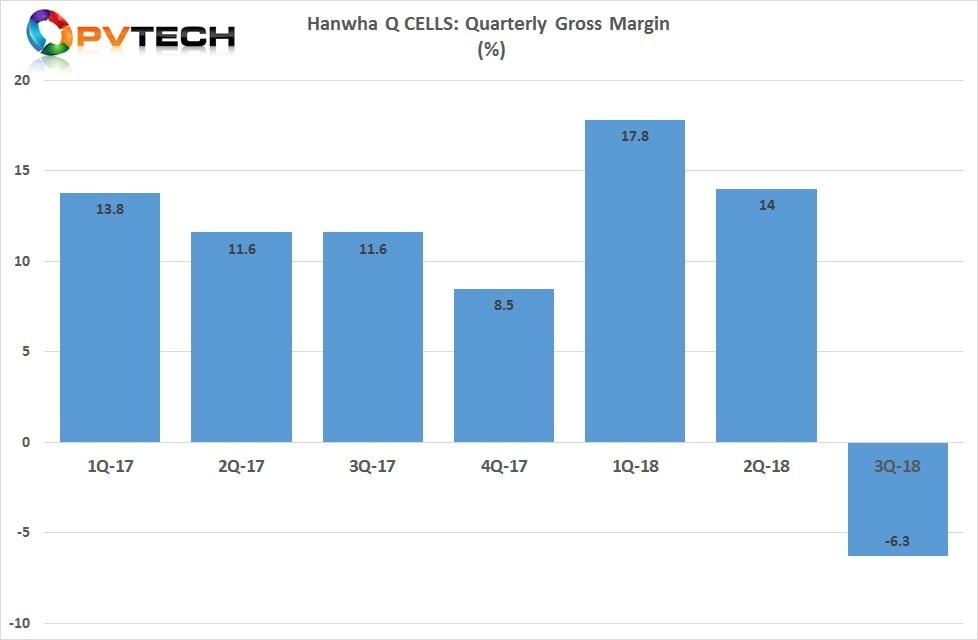

Gross loss in the third quarter of 2018 was US$35.3 million, compared to a gross profit of US$72.6 million in the second quarter of 2018.

Gross margin was -6.3%, compared with 14.0% in the second quarter of 2018. Excluding the one-time effects related to the closure of its ingot manufacturing operations, gross margin for the third quarter of 2018 would have been 13.0%. Increased shipment volume in the quarter was said to have mitigated the effects of declining ASPs.

The company reported an operating loss of US$107.0 million, compared with an operating income of US$4.8 million in the second quarter of 2018. However, excluding one-time effects, operating income for the third quarter of 2018 would have been US$17.9 million.

At the end of the reporting period, Hanwha Q CELLS had cash and cash equivalents of US$197.4 million, compared with US$156.5 million at the end of the first quarter of 2018.