After the passing of the Inflation Reduction Act (IRA) into law, solar PV and storage are expected to create up to 115,000 manufacturing workers in the US by 2030.

That is according to a paper from the trade body the Solar Energy Industries Association (SEIA) that sees the possibility for the US to reshore the PV supply chain in the medium and long term to build a domestic solar industry which could itself lead to more than 507,000 jobs across the entire industry.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

“The tides have turned in the solar manufacturing business landscape thanks to the IRA, and the announcements already made will create up to 80,000 high-quality, family-supporting jobs,” said Abigail Ross Hopper, president and CEO at SEIA.

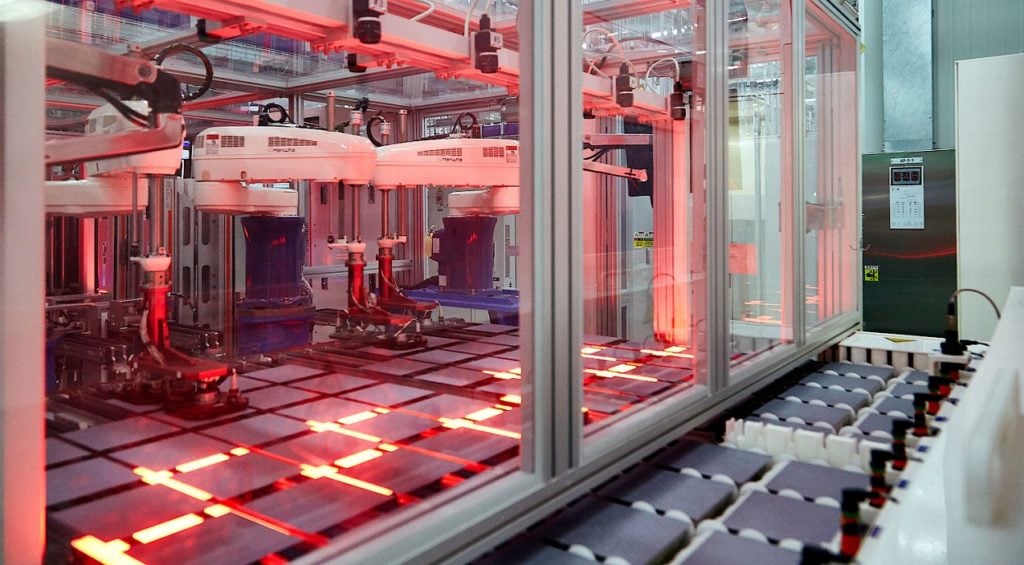

The country is currently able to produce metallurgical grade silicon, polysilicon, steel, aluminium, resins, racking and mountings and other key materials but in the short term, US module factories have to rely on importing cells and wafers while cell, wafer and ingot facilities are built to provide domestic production.

Southeast Asia is at the moment the largest supplier of solar cells and modules to the US. However, China currently represents more than 80% of the solar PV manufacturing supply chain and is expected to increase in the coming years.

Less than a year after the IRA was signed as a law, US announcements for domestic manufacturing have boomed with companies planning to add 47GW of annual solar module capacity, over 16GW of cell capacity, more than 16GW of ingots and wafers and almost 9GW of inverters, on top of 20,000MT of annual domestic polysilicon capacity added to the current 40,000MT already available in the US.

Many of those announcements, even those made ahead of the IRA, will require between six and 24 months before the facilities are operational and able to ship the products at commercial volumes, with other facilities taking three years or more to be brought online.

In 2021 the annual capacity the US solar PV manufacturing industry could produce was 7GW across the supply chain; however, as of October 2022 the number raised to more than 42GW, with capacity additions in ingots, wafers and cells that were non-existent before, according to data from SEIA.

This is on top of more than 11GW of planned thin film solar manufacturing which does not require the use of cells, ingots or wafers.

Among the companies that plan to fill the current gaps in the US silicon solar value chain are CubicPV, which will establish a 10GW mono wafer manufacturing facility in the US, and Qcells, which will invest US$2.5 billion investment to establish a fully integrated supply chain of ingots, wafers cell and modules in the country.

According to the paper, even more capacity announcements for domestic manufacturing are expected to be revealed in the coming months.

The paper outlines the importance of reshoring a domestic solar manufacturing industry that would reduce further risks of supply chain issues that have hampered the deployment of solar PV capacity in the US in the past.

Earlier this week PV Tech Premium looked into the IRA’s tax credit transferability which is creating a whole new market in the energy industry.

PV Tech publisher Solar Media will be organising the second edition of Large Scale Solar USA Summit in Austin, Texas, during 3-4 May. With the Inflation Reduction Act (IRA) targeting US$369 billion for clean energy and US$40 billion for manufacturing, the prospects for the US solar industry have never been brighter. The IRA, securing financing for future projects and supply chain bottlenecks will be among the discussions at this year’s event. More information, including how to attend, can be read here.