The forthcoming PV CellTech conference in Malaysia, 16-17 March 2016, is poised to unveil the key issues that will underpin c-Si solar cell manufacturing over the next few years.

Top of this list is probably how this will ultimately impact on silicon consumption levels across the industry, and the consequences on polysilicon capacity and production levels that will be required.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Indeed, while the two-day event is set to provide an unique glimpse for cell producers (and thin-film manufacturers) for benchmarking efficiency and cost values, it is perhaps the polysilicon segment of the PV industry that has most to gain by hearing where cell manufacturing is going in the next few years.

Aside from end-market demand, and the split between c-Si and thin-film module supply, polysilicon suppliers are directly impacted by a host of issues at the cell manufacturing stage, including the balance of mono and multi (on p-type), efficiency increases, and wafer thicknesses.

Each of these drives down g/W silicon consumption levels, ultimately decreasing the quantity of polysilicon needed by the industry as a whole.

While every polysilicon supplier has been drastically affected by the speed at which average selling prices (ASPs) have declined, this segment of the upstream has actually benefitted from a period of prolonged under-investment in cell manufacturing, preventing the g/W consumption from falling at a faster rate.

If one wanted to be even more broad-minded, the lack of thin-film penetration has also been a massive bonus for polysilicon suppliers. Roadmaps of yesteryear were forecasting thin-film market-share levels some 4-5 times greater than current values.

Adding new polysilicon capacity is the toughest call for any PV component supplier, by some margin, with this segment almost needing to have a sixth sense with regards pricing and material consumption rates some 3-4 years out from original investment decisions. The frequent impairment charges seen across polysilicon makers in the past few years are testimony to this issue, not to mention the number of polysilicon build-outs that are mothballed before even reaching initial test phases.

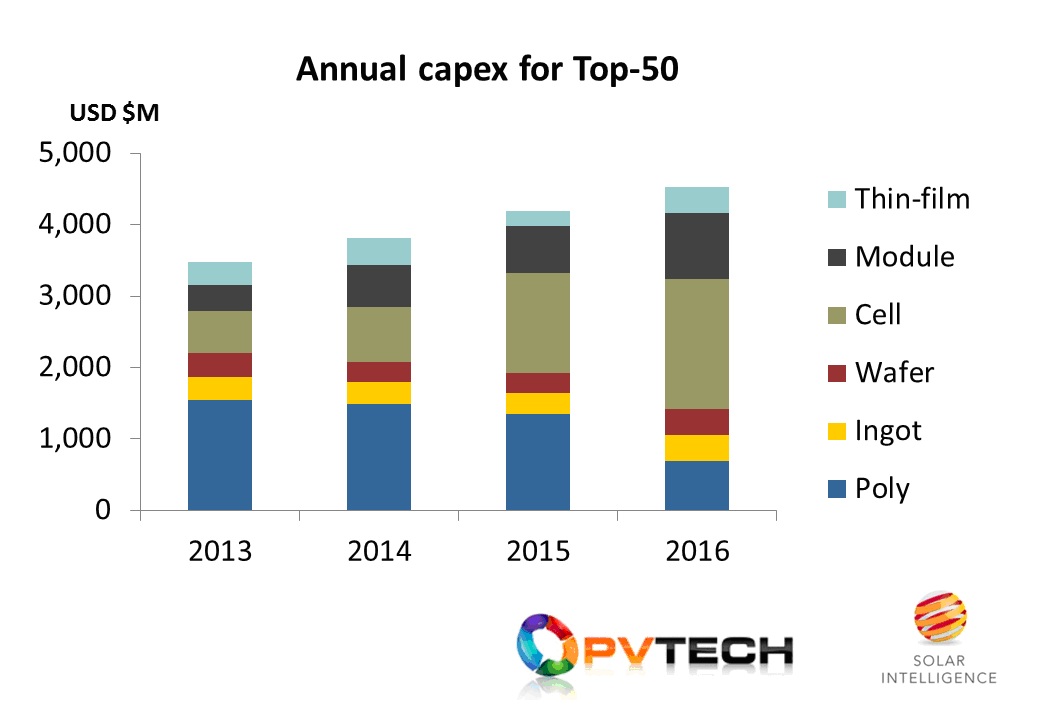

The graph below starts to shed light on why the time has now come for polysilicon makers to refocus on what is happening at the cell stage. The figure shows the capex (capital expenditure) from the top-50 PV manufacturers to the PV industry over the period 2013 to 2016, taken from the newly released “PV Manufacturing & Technology Quarterly” report from PV Tech’s parent company’s research arm.

There is a strong case for the solar industry to simply rub out PV capex activity until the end of 2012. So much of that investment has ultimately been of little relevance to the industry today, and sets quite unrealistic expectations for how PV capex will cycle going ahead. Think of the billions of dollars spent on a-Si thin-film turnkey production lines and facilities in the past decade, for example?

The graphic above clearly shows the transition of PV capex since 2013 from polysilicon spending (often capturing the tail-end of plant capex and build-outs for polysilicon expansion phases that predate 2013 by a few years) to the cell stage.

And for the first time in the solar industry’s history, much of this is driven out of R&D labs towards factors that will have a strong influence on g/W assumptions in 2017 and beyond.

Previous cell capex, in particular from Asia, was motivated by firstly getting to 1GW of in-house capacity, and more recently by a select group to have muilti-GW capabilities for cell production.

Several of the leading polysilicon suppliers to the PV industry appear to still be working with projections for c-Si consumption rates at the nominal figure of 5g/W out to 2017, something that could have a profound impact on supply/demand dynamics shortly.

There are so many issues in cell manufacturing today that are potential game-changers for g/W consumption rates, and these will dominate the presentations and discussions over the two days at PVCellTech: PERC adoption, shifts from multi to mono on p-type, and the adoption of n-type and heterojunction at the multi-GW level, to name just a few.

It may just take a couple of first-movers into heterojunction at the multi-GW level to radically change the industry for example, with the impact on g/W levels being potentially the greatest threat level to pass on the polysilicon producers, if this happens.

The latest company presentation to be confirmed at PV CellTech cannot be emphasized enough to highlight this very issue, with GCL System Integration Technology now confirmed to deliver a topic on: “Progress of GCL’s high-efficiency HIT cell & module production”.

If there is one reason for the entire polysilicon industry to be present at PV CellTech, then this alone would surely be the standout argument. The coverage from mainstream and trade media have been awash in the past few weeks on GCL’s multi-GW midstream c-Si manufacturing drive, and rumours of multi-GW mono ingot technology changes also. Unique scrutiny by PV Tech of their claims, underscores the ambitions of the company and actual large-scale gigawatts ramp underway.

Adding a module line here or there, scattered around the world, is not going to make any change to c-Si technology roadmaps, but when the most dominant company in PV manufacturing today and the company that has had more impact than anyone else for the current dominance of p-type multi – GCL Poly and its downstream affiliate GCL System Integration Technology – makes noises about multi-GW mono wafer supply and chooses PV CellTech to unveil its heterojunction activities, then almost everyone connected with PV manufacturing needs to pay very close attention.

And let’s not forget SolarCity’s former Silevo aspirations of GW level production using thin n-type wafers, coupled with SunPower’s latest g/W reductions that have now decreased by more than 10% in the past twelve months to record lows of 3.4g/W. It should also be noted that SunPower will also be presenting at PV CellTech in March.

At some point in the next few years, wafer thickness is going to return as a key issue to address by cell manufacturers. To assume the PV industry will still be stuck with p-type wafers at the 180 micron level in 2020 is somewhat naïve. Wafer thickness reduction is a massive deal for cell manufacturing and has simply been put on hold in the past 5-6 years as poly pricing fell and cash for upstream capex was taken off the agenda by most of Asia.

However, one thing that has been changing in China during this period is increased automation on cell and module lines, a key ingredient needed before any wafer thickness reduction activities are even considered.

The need to understand cell manufacturing trends by the leading producers has never been more pertinent, with the outcomes from PV CellTech during 16-17 March 2016 in Malaysia potentially forming the most compelling inputs into how the PV technology roadmap is really going to progress over the next few years, and will likely provide the real metrics needed across the polysilicon supply side for long-term strategic planning.

Details on how to register to attend PV CellTech can be found here.