Integrated PV module manufacturer SolarWorld has reported preliminary third quarter 2016 financial results that reflect the impact of overcapacity and global solar panel price declines after recently discarding both its revenue and profit guidance for the year.

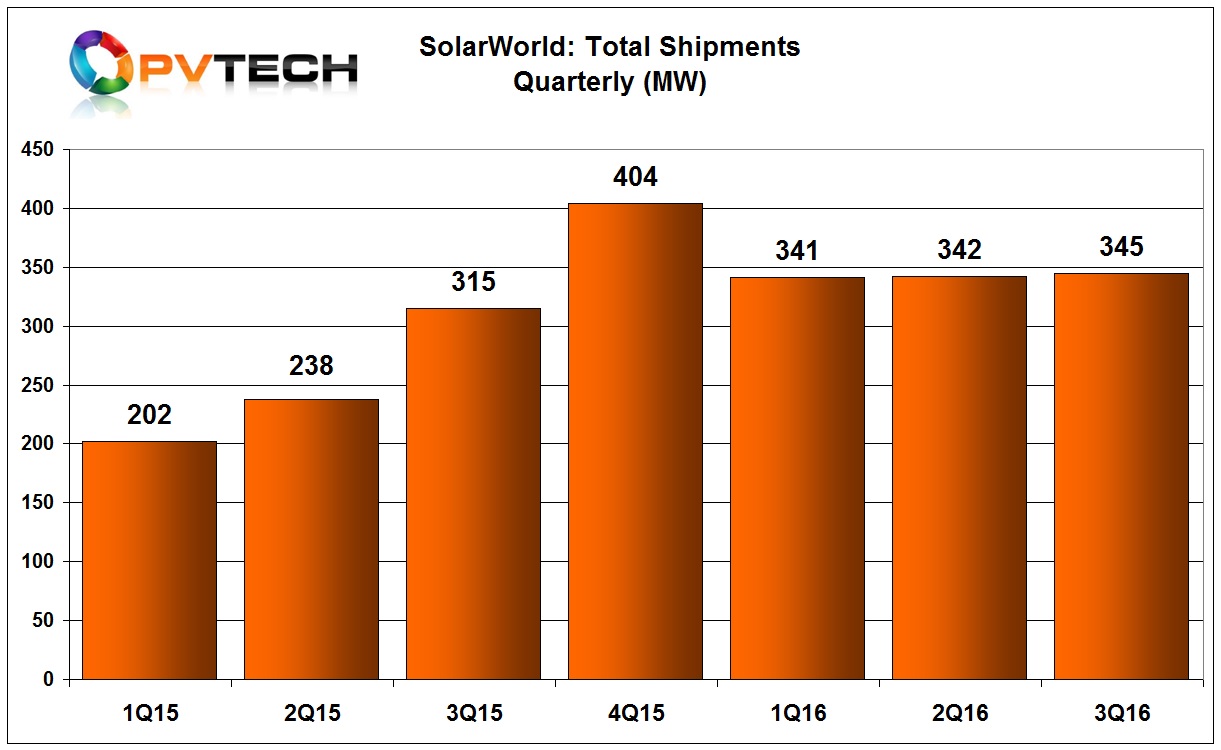

SolarWorld reported total product shipments (modules, mounting systems & inverters) of 345MW in the third quarter of 2016, compared to 342MW in the previous quarter.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Total product shipments have flat lined throughout 2016, although shipments are up significantly from the first nine months of 2015 when shipments reached 755MW, compared to 1,028MW in the first nine months of 2016, a 31% increase.

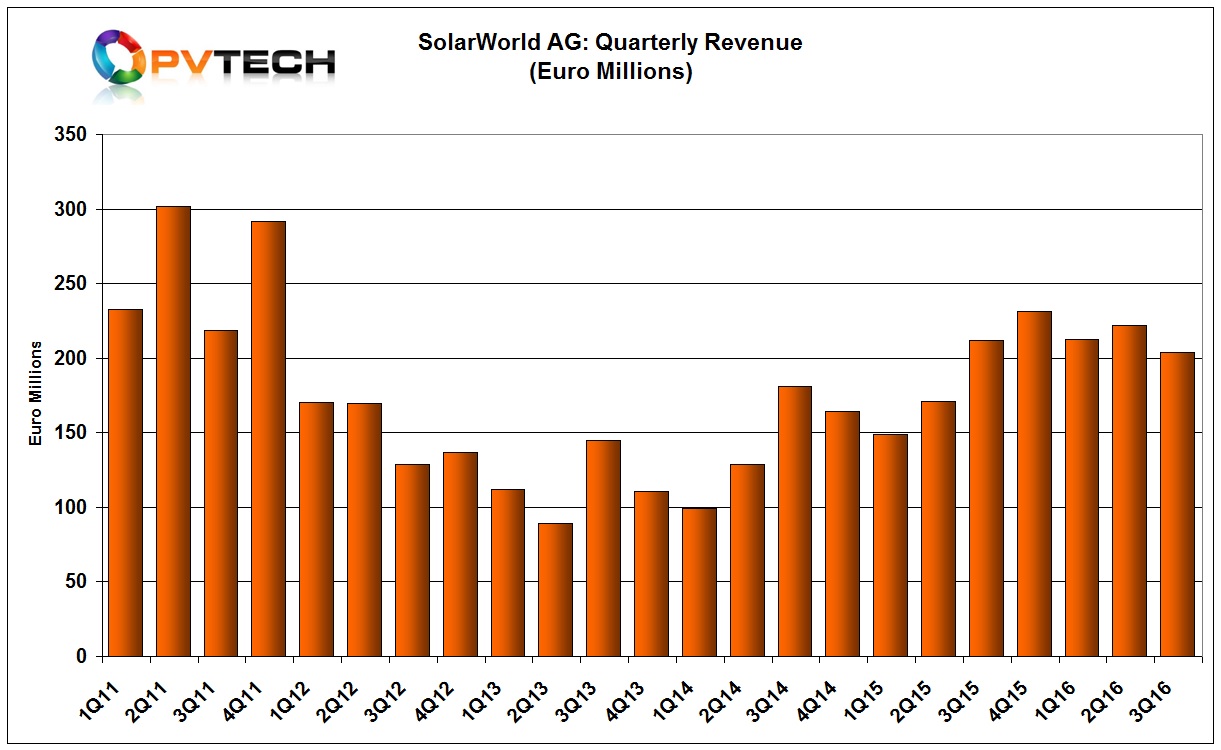

SolarWorld reported third quarter 2016 revenue of €204 million, down 8% from the previous quarter. Revenue in the first nine months of 2016 reached €639 million, around 20% higher than in the prior year period.

The company cited ‘increasing dumping by Chinese manufacturers’, for the ASP erosion in the quarter. This led to the company making an inventory write-down of €13 million in the quarter, increasing negative EBITDA to €12 million, compared to an EBITDA of €5 million in the prior year quarter. EBIT loss in the quarter was €25 million.

SolarWorld reported a negative EBIT €30 million for the first nine months of 2016, compared to a negative EBIT of €5 million in the prior year period.

Due to the quarterly losses and inventory write-downs, SolarWorld reported cash and cash equivalents of €84 million at the end of the third quarter, compared to €148 million at the end of the previous quarter, a 43% decline.

SolarWorld highlighted: “The group has taken measures to adapt its production volume more flexibly to demand, lower costs further and thus to improve liquidity in Q4”.