With a growing wait-and-see sentiment emerging in the market, the prices of silicon wafers and silicon material at the upstream end have started showing signs of falling.

Prices last week for G12 mono wafers (210mm/150μm) were between RMB9.7-9.73 (US$1.35) per piece, with the average transaction price dropping to RMB9.71 per piece, a weekly decline of 0.1%.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

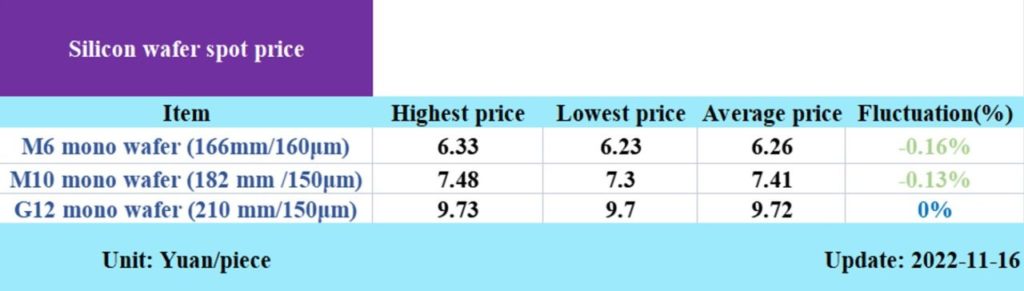

The price range of M6 mono wafers (166mm/160μm) was RMB6.23-6.33 (US$0.87-US$0.88) per piece, and the average transaction price was stabilised at RMB6.26 per piece. The price of M10 mono wafer (182mm/150μm) was RMB7.3-7.48 (US$1.01-1.04) per piece, with the average transaction price stabilising at RMB7.41 per piece.

Although prices for M6 and M10 wafers remained flat week-on-week, both showed a small decline the week before. The price range of M6 mono silicon wafer (166mm/160μm) was RMB6.23-6.33 (US$0.87-0.88) per piece, and the average transaction price dropped to RMB6.26/piece, a weekly decline of 0.16%.

Prices for M10 mono wafers (182mm/150μm) were RMB7.3-7.48 (US$1.01-1.04) per piece, and the average transaction price dropped to RMB7.41/piece, a weekly decline of 0.13%. G12 mono silicon wafers (210 mm/150μm) were RMB9.7-9.73 (US$1.35) per piece, with the average transaction price stabilising at RMB9.72 per piece, the same as the week beginning 14 November.

The Silicon Industry Branch of China Nonferrous Metals Industry Association (CNIA) said that the slight drop in the quotes last week was mainly due to price cuts by some wafer companies. Meanwhile, domestic demand showed signs of becoming weaker.

As for cells, due to the supply and demand mismatch of the industrial chain caused by differentiated technical routes, mainstream wafer sizes faced more pressure in a declining market. At present, the trading price for mainstream cells is 1.35-1.37 (US$0.19) per watt. As for modules, demand for centralised types is going down while distributed variants remain popular.

It is worth noting that, in addition to wafer price drops, there is also a slight loosening of silicon prices at the upstream end.

According to the latest quote from PVinfolink last week, polysilicon prices also fell. The highest price decreased from RMB307/kg (US$42.66) to RMB306/kg, down by 0.3%, while the average price declined by the same amount.

It is reported that although there was no significant decrease in the mainstream price of mono dense poly, there were growing gaps among quotes from different manufacturers, and the quotes from second-tier manufacturers gradually declined.

Although the decline was very subtle, the signal is noticeable enough given the persistence of strong silicon prices since the beginning of the year. Entering the fourth quarter, the focus of the PV market has shifted from the global level to within China, and the local market is becoming more urgent to insert pressure on the product prices.

Previously, Three Gorges Energy said in reference to its PV module procurement and construction that module pricing has always been maintained at a high level in 2022. The average purchasing price was RMB1.9-2 (US$0.26-0.28) per watt and currently remains at a high level. The latest procurement quote shows that RMB2 per watt or higher is still in sight.

If supplying and installing modules according to current prices, some projects will face unplanned risks and narrower returns, which will have certain impacts on the construction schedule and the internal rate of return.

Subject to current problems of fluctuations, procedure delay, high module prices and slowed project construction, large-scale PV projects may find it difficult to proceed as the end of the year approaches, especially for large-scale module installation.