The average price of polysilicon rose again this week, marking the 28th round of price increases this year alone, according to data released by China’s Silicon Industry Association.

This week’s price increase is because of electricity rationing across key Chinese provinces due to an extreme heatwave sweeping across the east of the country. As previously reported by PV Tech Premium, power rationing in major solar-producing provinces has caused output to drop off as companies respond to government fiats to reduce their power consumption.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Critically, the provincial government of Sichuan – the province is home to about 10% of China’s total polysilicon output, with Tongwei, GCL, JinkoSolar, TrinaSolar and JYT all having production bases there – required companies to suspend production from 15 August – 20 August, with further restrictions still a possibility.

Local manufacturers for industrial silicon, polysilicon and monosilicon were restricted and had to adjust their output expectations downwards. It is estimated that the trend of polysilicon price rises will continue into the end of September when long-term orders for October will be signed.

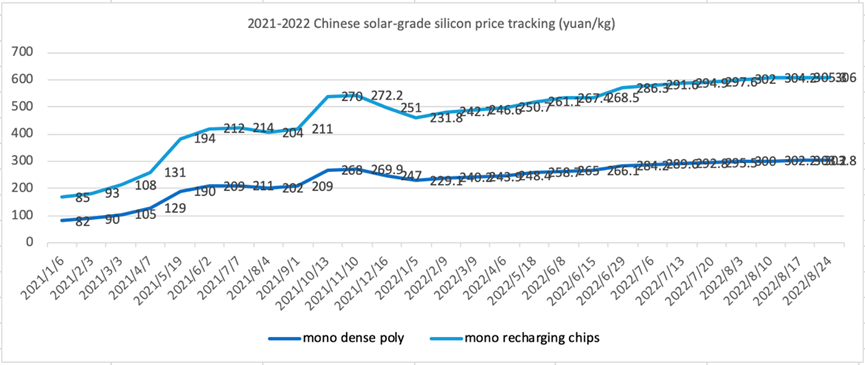

According to the latest figures available, on 24 August the price range of mono recharging chips stood at RMB300,000-312,000/MT (US$43,722-45,471/MT), with an average transaction price of RMB306,000/MT (US$44,596/MT). The price range of mono dense poly chips was RMB298,000-310,000/MT (US$43,430-45,179/MT), with the average transaction price standing at RMB303,800/MT (US$44,276/MT). The price range of popcorn chips was RMB295,000-308,000 /MT, with an average price of RMB301,100/MT.

Compared with last week, the price of mono recharging chips was up by 0.23%, mono dense poly chip was up by 0.2%, and popcorn chips were up by 0.2%. The price of polysilicon at all grades has risen by about 30% compared to the beginning of the year, according to data seen by PV Tech.

Also this week, as reported by PV Tech, various Chinese ministries banded together and issued a notice on promoting the coordinated development of the PV industrial chain and supply chain, putting forward requirements on price increases, competition and coordinated development in the field, which attracted widespread attention.

The notice said that recent factors, such as a mismatch of supply and demand and price volatility in parts of the supply chain, meant that it was urgent to deepen the industrial management of China’s PV industry and develop strategic alliances between supply firms. Local regulatory authorities should strengthen supervision and control, enhance joint enforcement practices crack down on illegal activities such as price gouging and monopolies in the industry, the ministries said.

At the same time, it urged companies to adopt the latest generation of information technology via constructing a big data platform for silicon, wafer, cell, module and system integration. In addition, companies were told to promote new services such as transparent online procurement and cloud storage to improve supply chain coordination.

It also pointed out that companies should strengthen system docking and deepen cooperation throughout the whole value chain, specifically to strengthen new manufacturing projects, coordinate product handling and approval and steadily accelerate capacity expansions to meet downstream demand.

Meanwhile, the notice encourages companies to deepen cooperation with power generation companies and power plant construction as a response to recent rationing.

PV Tech will continue to follow up on how the new mandates will impact the price of silicon products across China’s solar supply chain.