According to the latest report from Californian research centre Berkeley Labs, 2023 is on track to be a “record year” for solar PV installations in the US.

The latest Utility-Scale Solar, 2023 Edition, published this week, notes that, through August, the US installed 8.4GW of utility-scale solar, 50% more than in the first eight months of 2022.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Despite the stimulating effects of the Inflation Reduction Act (IRA) beginning in the second half of 2022, last year saw a decline in utility-scale installs as a result of uncertainty stemming from the antidumping/countervailing duty (AD/CVD) tariff and supply delays arising from the Uyghur Forced Labor Prevention Act (UFLPA).

Despite these concerns over the AD/CVS and ULFPA legislations, based on the Energy Information Administration’s (EIA) “Planned Capacity” estimations, the US could see over 24GWac installed by the end of the year.

Of that potential 24GW, trends have emerged relating to both technology and deployments.

Thin film and c-Si

Thin film solar modules are gaining traction in the US market, driven predominantly by the growth and expansion of US cadmium telluride thin film manufacturer First Solar, which broke ground on its fifth US manufacturing facility last month. From a developer’s perspective, part of the technology’s advantage is its exemption from many import tariffs, given that it does not use polysilicon.

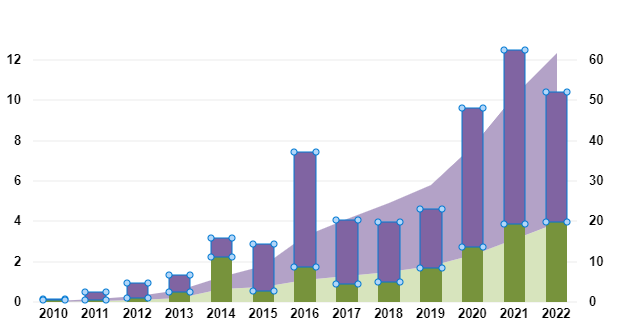

Whilst crystalline silicon (c-Si) modules still overwhelmingly dominated the market in 2022, with 62% of new installs, thin film installs went from just over 9GW in 2019 to 19.6GW in 2022. Half of that capacity consists of projects of 140MW capacity or less.

Given the smaller market share, thin film projects are somewhat less widespread than silicon ones; they are concentrated in the well-developed PV areas of the US, including the Southwest, Texas, Florida, Georgia and the Northeast.

Silicon modules reached a cumulative 41.79GW installed capacity in 2022. The highest individual c-Si market share was held by Chinese integrated solar manufacturer LONGi, followed by Solar Module Super League member Canadian Solar and Korean-owned Hanwha. All three companies have announced plans for manufacturing facilities in the US, LONGi in Ohio, Hanwha Qcells in Georgia and Canadian Solar in Texas.

According to Berkeley’s data, First Solar deployed 2.4GW, 3GW and 2.3GW in 2020, 2021 and 2022 respectively, the largest deployment figures of any known manufacturer in the US over this period. LONGi, the largest single c-Si module supplier, didn’t enter the US until 2019, and has shipped over 1.8GW to the market since.

Just over half of the deployed capacity was from what the report called “unknown” module manufacturers.

Tracking growth

Another trend was in the growth of tracker-mounted projects. In 2022, 94% of capacity additions were fitted with trackers – the highest proportion ever – due to both the increased efficiency offered by trackers and the falling premium on the technology in recent years.

New fixed-tilt projects are increasingly being built only on challenging sites, Berkeley Lab said, either due to terrain available for solar developments in the least-sunny regions of the Northeast. Indeed, fixed-tilt deployments are concentrated on the length of the US’ east coast.

Berkeley Lab found that tracking provides the greatest benefits in high-insolation areas, those with a greater proportion of solar irradiance per area of ground. Tracking adds an average of four percentage points to the AC capacity factor of a PV project.

PV Tech Premium recently examined the role that trackers can play in evolving to adapt solar PV to more challenging locations and weather conditions, speaking to US tracker manufacturer Nextracker, which recently opened another manufacturing facility in Las Vegas.

Of the US’ 61.4GW of installed capacity at the end of 2022, 50GW worth is mounted on tracking technology, with the trend only set to continue in one direction.

Imbalances in deployment locations

In terms of deployment areas, the report found that 52% of the solar capacity additions through the first six months of the year were in “Energy Communities”, traditionally coal-generating or fossil fuel-based communities that relied on the industry for survival. Projects in these areas are eligible for addition investment and production tax credits under the IRA.

These same areas saw just 26% of capacity additions in 2013/14, and though the project locations for 2023 capacity would have been designated before the IRA tax adders came in, more than half of the new capacity through July will be eligible for the bonus.

State-wise, Texas topped the bill for installations in 2022 with 2.5GW, 24% of the total US additions. California was an unsurprising second with 2.1GW, followed by Florida (1.1 GW), Virginia (0.6 GW), and Georgia (0.5 GW) in the Southeast.

Interconnection upgrades

A report from the EIA in July found that ERCOT – the Texas grid operator – needs to upgrade its transmission infrastructure if it is to avoid curtailments from its growing renewables fleet. Indeed the Berkeley report found that the Independent System Operators (ISOs) in two largest markets, ERCOT and CAISO, were the only two US ISOs to experience curtailments in 2022.

CAISO reported 2,057GWh of solar curtailed in 2022, compared with 2,797GWh of curtailments in ERCOT. Rate of curtailment was far more severe in ERCOT, however, as it occurs year-round, rather than exclusively in Spring.

Curtailments in the markets most densely populated with renewables perhaps speak to the need for grid infrastructure investment to cope with increased electricity load. Consultancy firm DNV released a report last month, saying that the US has US$12 trillion in potential investment opportunities for its grid infrastructure and renewables through 2050, with grid capacity needing to increase regularly every year to accommodate capacity.

California utility Edison International also published a white paper outlining its roadmap for a US$370 billion investment into California’s grid.

Berkeley said that there was 947GW of utility-scale solar sitting in interconnection queues at the end of 2022, 456GW of which was alongside battery storage. Two-thirds of this capacity entered the queue before 2022.