India must scale up investment in the large-scale domestic manufacture of PV products to avoid the risk of logistic complications and commodity price fluctuations posed by its current high levels of solar imports, new research has suggested.

With no current polysilicon or wafer production capacity online in India, the country’s burgeoning PV manufacturing sector is currently dependent on imports and therefore “critically susceptible” to supply chain disruption and market price shocks, according to the report, published today by consultancy JMK Research & Analytics and think tank the Institute for Energy Economics and Financial Analysis (IEEFA).

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

The research said raw materials shortages, a power price hike in China and a surge in international freight charges inflated module prices in 2021 by more than 25%, highlighting the need for a sustainable, vertically integrated domestic solar manufacturing ecosystem in India.

“Developing significant manufacturing capacities in raw materials, especially polysilicon, will be highly capital intensive and technologically complex but it is of paramount necessity,” the report said, adding that significant domestic polysilicon and wafer manufacturing capacities will protect domestic module manufacturers to some extent from international supply chain fluctuations.

To encourage vertically integrated facilities, India’s government has introduced a production-linked Incentive (PLI) scheme for 10GW capacity of integrated manufacturing of high-efficiency modules.

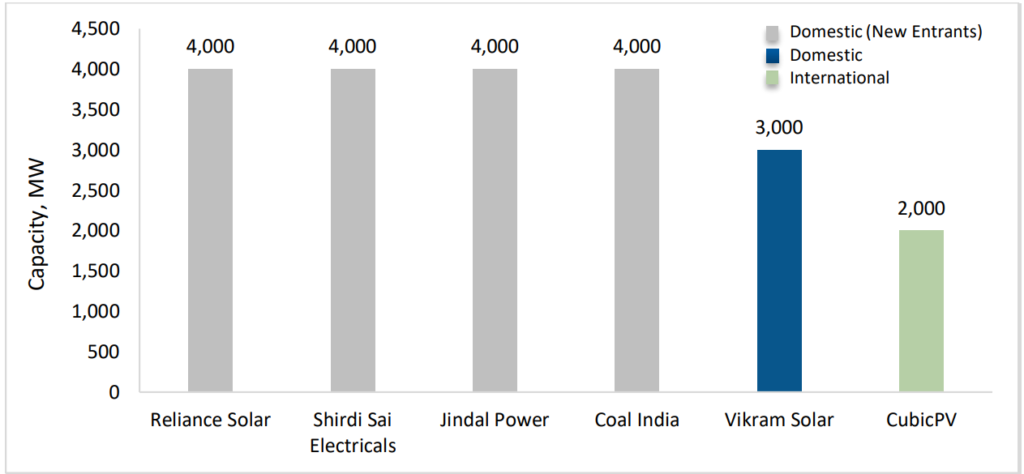

Indian conglomerates Reliance Industries and Jindal Power as well as transformer manufacturer Shirdi Sai Electricals were the winners in the first tranche of the PLI scheme and combined are looking to set up about 12GW of integrated manufacturing.

With the PLI tender last year receiving 54.8GW of bids, the government since unveiled a four-fold increase in funding for the scheme, which JMK and IEEFA said can boost India’s integrated solar module, cell and wafer domestic manufacturing capacity several times over in the next three to four years.

“Credit must be given to the PLI scheme for the immense impact it has had on how businesses, domestic and international alike, view solar manufacturing in India,” the report reads, although this idea has been contested by other analysts.

According to the research, India had a nameplate cell manufacturing capacity of 4.3GW and a nameplate module manufacturing capacity of ~18GW as of November 2021. However, actual production output is significantly lower as most Indian solar production facilities operate at a capacity utilisation factor of less than 50%.

One of the reasons for the gap between cell and module capacities is said to be a lack of vertical integration of domestic solar production plants.

Around 33GW of module and 29GW of cell production capacity are in the pipeline to add to existing domestic capacity by 2025, representing a compound annual growth rate of appropriately 30% for module manufacturing, JMK said.

To reach India’s target of having 500GW of deployed renewables by 2030, the country needs to deploy about 30GW of solar each year. While current domestic output can’t reach such demand, the report said that based on expansion plans domestic capacity is likely to be able to fulfil that requirement by the end of 2023.

Indeed, JMK Research predicts that manufacturing capacity additions, coupled with tariff and non-tariff barriers, can reduce the import dependence of India’s solar module market from 80% to 60 – 65% in the next two to three years.

Publication of the research comes just over a month before India introduces a 40% basic customs duty (BCD) on modules and 25% duty on cells as part of government efforts to support domestic PV manufacturers.

The BCD will put “undue pressure” upon the domestic solar industry in the near future as the market seeks to strike a demand-supply balance, potentially exacerbating domestic module price volatility, the report said.

Independent power producer Scatec announced earlier this month that it has put on hold a 900MW solar project it is developing in India due to a lack of supply of domestic modules and the upcoming BCD introduction.