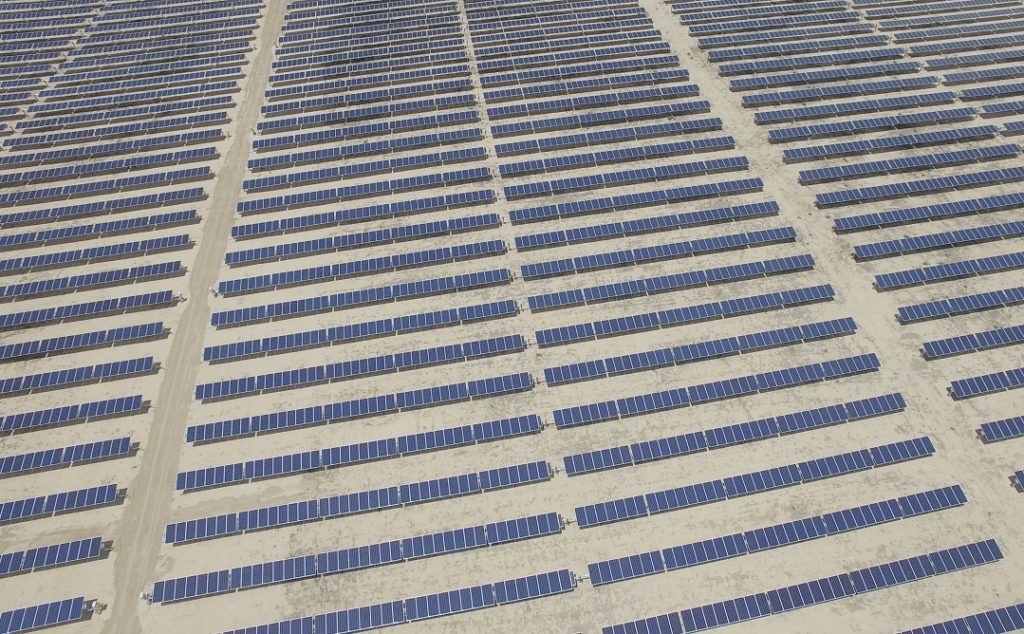

The US solar sector is set to post record deployment figures this year, but ongoing supply chain constraints, logistical challenges and price increases are expected to dent additions in 2022, a new report has said.

After installing 5.4GWdc of solar capacity in Q3 – a 33% increase year-on-year – the US is on pace to easily exceed 20GWdc of additions in 2021, according to the latest US Solar Market Insight report from trade body the Solar Energy Industries Association (SEIA) and research firm Wood Mackenzie.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

However, headwinds in the form of supply chain issues and logistics challenges, including months of disrupted shipments due to the recently dismissed AD/CVD petition, has led Wood Mackenzie to lower its 2022 deployment outlook by 25%, a decrease of 7.4GWdc.

With developers grappling with equipment delays, higher equipment costs and contract negotiations, the report projects that the online dates of multiple gigawatts of projects have been pushed from 2022 into 2023 or later.

After higher costs were noted in the Q2 version of the report, US solar system prices are now said to have increased 11.7% for fixed-tilt projects and 8.5% for single-axis tracking projects since Q4 2020.

“The US solar market has never experienced this many opposing dynamics,” said Michelle Davis, principal analyst at Wood Mackenzie. “On the one hand, supply chain constraints continue to escalate, putting gigawatts of projects at risk. On the other, the Build Back Better Act would be a major market stimulant for this industry,”

Announced by President Joe Biden in October, the Build Back Better (BBB) package includes US$555 billion for investments in clean energy and combatting climate change and is currently being negotiated on by Senate Democrats.

The House version of the bill, passed on 19 November, extends and expands the investment tax credit (ITC), allows solar projects to opt for the production tax credit (PTC) and creates a standalone energy storage ITC.

If that version is enacted, Wood Mackenzie forecasts that it would result in a 31% increase in US solar deployment by 2026, representing an additional 43.5GWdc of capacity.

The report said that while utility-scale solar projects will face supply chain constraints in the near term, an ITC extension would continue the segment’s economic competitiveness, and partially compensate for price increases due to supply chain constraints.

Q3 installation figures by segment

The US utility-scale solar sector registered its best third quarter on record in terms of deployment, with 3.8GWdc added. Texas and Virginia accounted for more than half of the solar installed.

Although SEIA and Wood Mackenzie forecast that utility-scale solar will continue growing in the double digits under the current policy environment, challenges related to high commodity prices and supply chain constraints are expected to hit full force throughout 2022 and early 2023.

They also note tax equity availability, labour shortages, interconnection limitations and siting restrictions as increasing risks for US utility solar projects over the next several years.

Another deployment record was set in the residential sector, with more than 1GWdc of solar installed during a single quarter for the first time. A total of 1,073MWdc was added in Q3, a 39% increase on the same quarter last year, despite permitting and labour constraints.

With the commercial segment impacted by delays, Q3 installs were down 4% year-on-year to 327MWdc. In terms of community solar, 180MWdc was added, a 56% increase on Q3 2020.