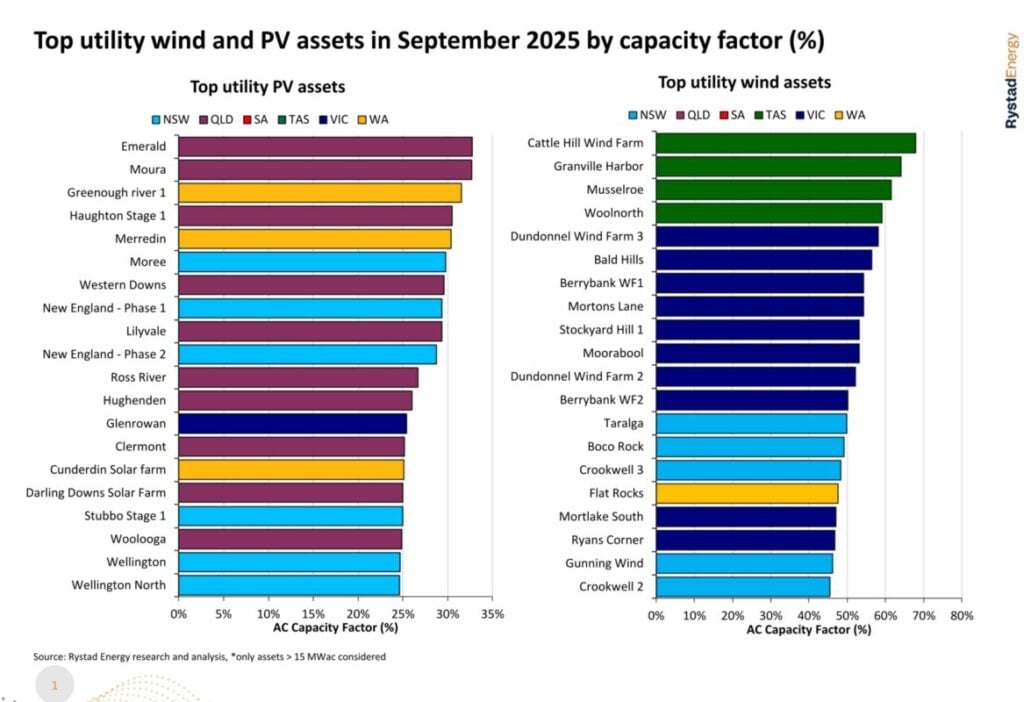

Research firm Rystad Energy has said that Queensland’s utility-solar assets were the best-performing solar PV power plants, in terms of AC capacity factor, in September 2025.

Indeed, Lighthouse Infrastructure’s 72MW Emerald solar PV plant and Metka’s 110MW Moura solar facility recorded the leading performance figures, reinforcing Queensland’s position as one of the premier solar generation hubs within the National Electricity Market (NEM).

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The continued strong performance of Queensland utility-scale solar plants builds on previous months’ results, demonstrating the consistency of the state’s solar resource quality and the technical optimisation of its utility-scale installations.

Western Australia’s solar sector also delivered strong results, with Synergy and Potentia Energy’s 40MW Greenough River solar PV power plant coming in at third. Western Australia saw another utility-scale solar PV plant break into the top five for the month, Sun Energy’s 100MW Merredin project.

Yet another Queensland-based solar PV power plant came in fourth: Pacific Blue Australia’s 100MW Haughton stage 1, which ranked first last month.

For readers unaware, the NEM refers to the wholesale electricity market where generators sell electricity to retailers, who then on-sell it to consumers. It operates on one of the world’s longest interconnected power systems, linking Queensland, New South Wales (including the Australian Capital Territory), Victoria, Tasmania and South Australia.

Meanwhile, the WEM, which is specific to Western Australia, is the system that governs the trading and supply of electricity in the state’s South West Interconnected System (SWIS). The Australian Energy Market Operator (AEMO) operates both of these.

You can explore solar generation performance in our previous NEM data spotlight, with all entries available to PV Tech Premium subscribers. The latest article in the series, exploring September, is available here.

Grid dynamics and pricing patterns

Rystad Energy analyst David Dixon on LinkedIn also noted that the NEM recorded 998 hours of negative pricing in September, down from 1,170 hours in September 2024.

Regional variations emerged in pricing patterns, with southern states including South Australia, Tasmania and Victoria experiencing year-on-year decreases in negative pricing hours. At the same time, New South Wales and Queensland saw increases.

These pricing dynamics reflect the growing penetration of renewable energy generation and highlight the ongoing need for grid flexibility solutions as Australia continues its energy transition.

Negative prices in PV technology-rich electricity markets occur when high solar power generation creates a surplus of energy, causing wholesale electricity prices to drop below zero. This means generators pay to sell power, and consumers are paid to use it.

This price signal encourages more flexible electricity consumption and highlights the need for energy storage and grid upgrades to balance the supply-demand fluctuations caused by the large-scale integration of renewable energy.

Recent project developments signal continued sector growth

The strong September performance data comes amid a wave of major project developments across Australia’s renewable energy sector.

FRV Australia brought its 300MW solar PV power plant, backed with a Microsoft power purchase agreement (PPA), to full operation, demonstrating the growing role of corporate renewable energy procurement in driving utility-scale development.

ENGIE’s 250MW solar PV power plant received registration with AEMO, adding to the pipeline of projects entering commercial operation. Meanwhile, Synergy submitted a development application for a 2GW solar, wind and battery energy storage system (BESS) in Western Australia, representing one of the largest integrated renewable energy projects proposed in the state.

Supply chain developments also gained momentum, with Fortescue signing a solar module supply agreement with China’s LONGi, securing equipment for the mining company’s renewable energy transition initiatives.

The project development activity aligns with broader approval trends, as solar and wind projects led Australia’s 1.5GW renewables approval boom in Q2 2025, indicating sustained momentum in the sector’s expansion pipeline.