US-based solar tracker manufacturer FTC Solar is expecting to record a loss of up to US$17.3 million in Q2 2021 as multiple headwinds combine to put a major drag on performance.

Last week FTC said that in the months following its initial purchase offering steel prices had risen another 19%, freight indexes had increased by 18% and solar module prices had risen by a similar amount, leading to slippages in project timelines and at least one major customer pushing back its order into Q3.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Speaking to investors, FTC chief executive officer Tony Etnyre said that FTC’s experience from speaking to developers was that, where possible, some developers were choosing to hold specific projects by a quarter if the circumstances allow to offset any short-term price spike.

Having recorded revenue of US$65.7 million in Q1 2021, FTC expects revenue in the second quarter to fall to between US$41 – 46 million, a performance which should see the company record an operating loss in the region of US$10.4 – 17.3 million.

FTC Solar posted a GAAP net loss of US$8 million in the opening quarter, compared to a profit of US$2.9 million in Q1 2020.

The company has responded by enacting a number of measures to address current market conditions, including a price increase on all new contracts, expanded its supply chain and implemented alternative shipping methods to reduce logistics cost and make further progress on a cost reduction roadmap previously implemented.

Furthermore, FTC said it saw an opportunity to increase revenue generation from its solar design software SunPath, given its ability to increase project profitability and mitigate cost increases.

FTC does, however, have what it described as a healthy cash position given the net proceeds from its IPO, which stood at US$181 million – far below the US$400 million+ it initially intended to raise. A significant portion of this has been set aside for enhancements to its product range, and operating expenses are set to rise to between US$9.5 – 10.5 million in Q2, partly attributable to additional R&D spend on wind tunnel testing.

Etnyre said last week that this additional spend was to help the validation of its Voyager Plus product range, which is designed for large-format modules and has nodes at 105, 120 and 135 miles per hour wind speeds.

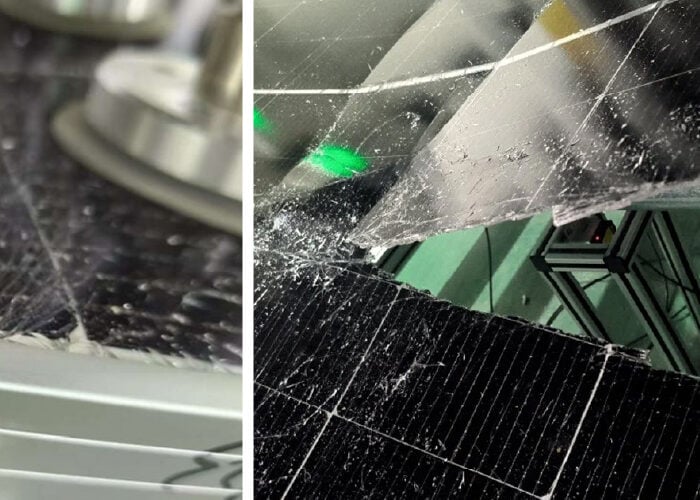

The cost of steel and other headwinds have weighed heavy on tracker firms throughout the first half of the year. Array Technologies was forced to withdraw its guidance for the financial year, labelling the increase in steel costs as “unprecedented”, while other tracker providers have witnessed similar issues.