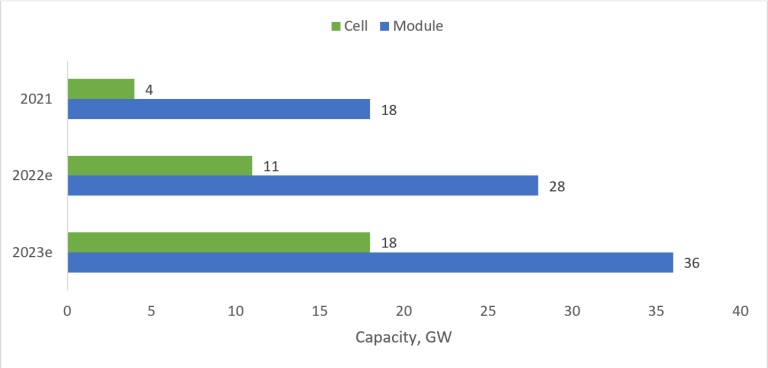

India is set to double its solar module manufacturing capacity in the next two years, with the sector boosted by government support schemes and new entrants exploring the market, according to JMK Research & Analytics.

While the country currently has around 18GW of module production capacity, this is anticipated to grow at an unprecedented rate of ~40% (CAGR) by the end of 2023, when it will reach 36GW, the consultancy said.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Domestic cell manufacturing capacity is set for an even greater expansion, increasing from 4GW to 18GW in the next two years.

Despite currently having 18GW of module manufacturing capacity, this figure is nameplate capacity, with actual production significantly lower as most Indian production facilities operate at a capacity utilisation factor of less than 50%, research published last month by JMK and thinktank the Institute for Energy Economics and Financial Analysis (IEEFA) suggested.

That report said the need for a vertically integrated PV manufacturing ecosystem in India is highlighted by a 25% rise in module prices last year due to a shortage of raw materials, a power price hike in China and a surge in international freight charges.

In addition to the capacity expansions in the next two years, the government of India’s production-linked incentive (PLI) scheme will be a “major catalyst” for the country’s solar industry and is expected to incentivise about 40 – 50GW of module production capacity, JMK said.

With an initial PLI tender last year heavily oversubscribed – with Indian conglomerate Reliance Industries and transformer manufacturer Shirdi Sai Electricals among the winners – the government has since unveiled a four-fold increase in funding for the scheme. As PV Tech reported last week, future rounds will now be open to previous winners, although their bids will be capped at 10GW, inclusive of capacity awarded during the first round.

As new entrants look to ramp up PV manufacturing in India, JMK has called on industry stakeholders to focus on upskilling the workforce, boosting R&D and adopting long-term term policies for the country’s solar sector.

“India is currently not a hub of solar manufacturing but there is great potential, and confidence, in its solar growth story,” JMK said.

Although Indian solar manufacturers are set to be boosted by the introduction of a 40% basic customs duty (BCD) on modules and 25% duty on cells as of 1 April, consultancy Fitch Solutions has warned that the country is at risk of a supply and demand mismatch for equipment if domestic PV manufacturers are unable to meet the quantity and quality required by project developers.

After independent power producer Scatec announced last month it has put on hold a 900MW solar plant it is developing in India, citing the BCD and “limited domestic capacity”, concerns have been raised that more plants under development in the country could be shelved due to the tariffs impacting their economic viability.