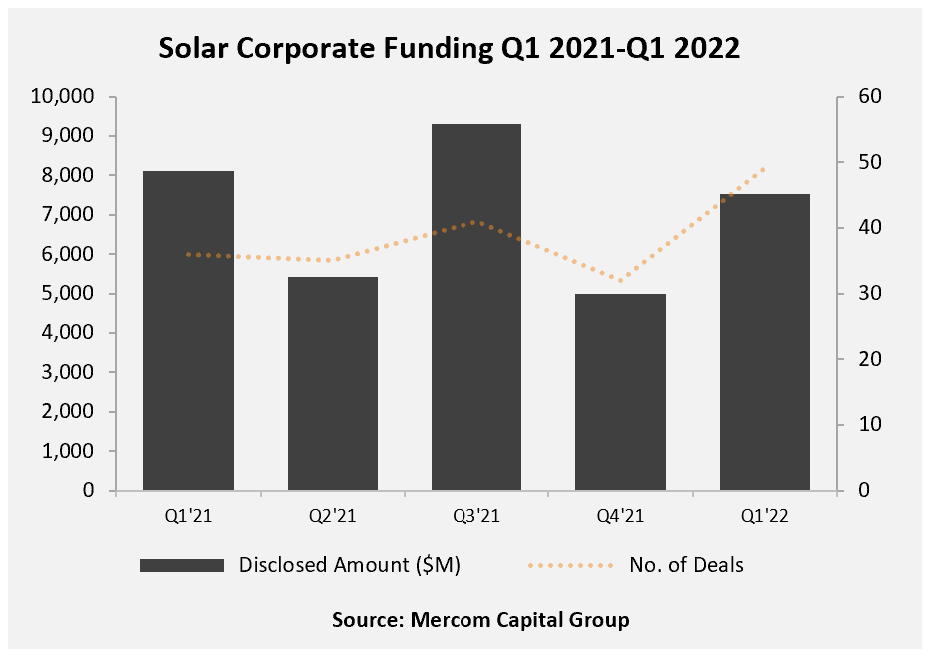

Total corporate funding of solar fell by 7% year-on-year to US$7.5 billion in Q1 2022, with Mercom Capital warning of “significant headwinds” that could slow momentum considerably.

Spiralling inflation, supply chain constraints, interest rates and the US Department of Commerce’s investigation into alleged circumvention of AD/CVD tariffs by manufacturers in Southeast Asia have all been flagged by Mercom as obstacles facing the PV industry, with the potential consequence being a significant drop-off in financing activity.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Corporate funding tracked by Mercom jumped by more than 50% sequentially, but fell of 7% year-on-year despite an increase in deal volume during Q1 2022, the total number of deals rising from 36 in Q1 2021 to 49 deals in Q1 2022.

Global venture capital (VC) funding for Q1 2022 reached US$1.2 billion from 26 deals, representative of a 45% sequential decline but an increase year-on-year.

The top five VC-funded deals during Q1 0222 were the US$375 million raised by residential solar platform Palmetto, US$200 million raised by solar software company Aurora Solar, commercial and industrial PV developer DSD Renewables’ raise of also raised US$200 million, US$120 million raised by generation distributed platform Aspen Power Partners and US$100 million raised by US installer PosiGen.

Furthermore, public market financing increased 115% Q/Q with four deals totalling US$2.5 billion, compared to US$1.2 billion raised in four deals in Q4 2021.

“Although financing activity was strong QoQ with robust demand for solar assets, significant headwinds are building up that can slow the momentum considerably,” said Raj Prabhu, CEO at Mercom Capital Group.

“Continuing supply chain issues, higher inflation, and the interest rate trajectory going forward are already major concerns. Adding to this, if the [US] Department of Commerce decides to impose tariffs on module imports from Malaysia, Cambodia, Thailand, and Vietnam, we could be looking at a substantial drop-off in investment activity.”

23GW of large-scale solar projects were acquired in the first quarter of 2022, an increase of almost 10GW compared with Q4 2021 activity, the second highest ever recorded to date according to Mercom Capital Group.

In total there were 82 large-scale solar project acquisitions, two more than the previous quarter, with project developers and independent power producers (IPP) the most active during the quarter with over 17GW of projects acquired, investment firms and funds followed with 3.6GW of acquisitions.

Finally, there have been 29 M&A transactions recorded in Q1 2022 compared to 43 transactions during the previous quarter, while only 20 were made during the same period last year.