Despite trade policy uncertainty, the price of solar modules in the US has remained fairly stable in the past three months, according to solar and storage supply chain platform Anza.

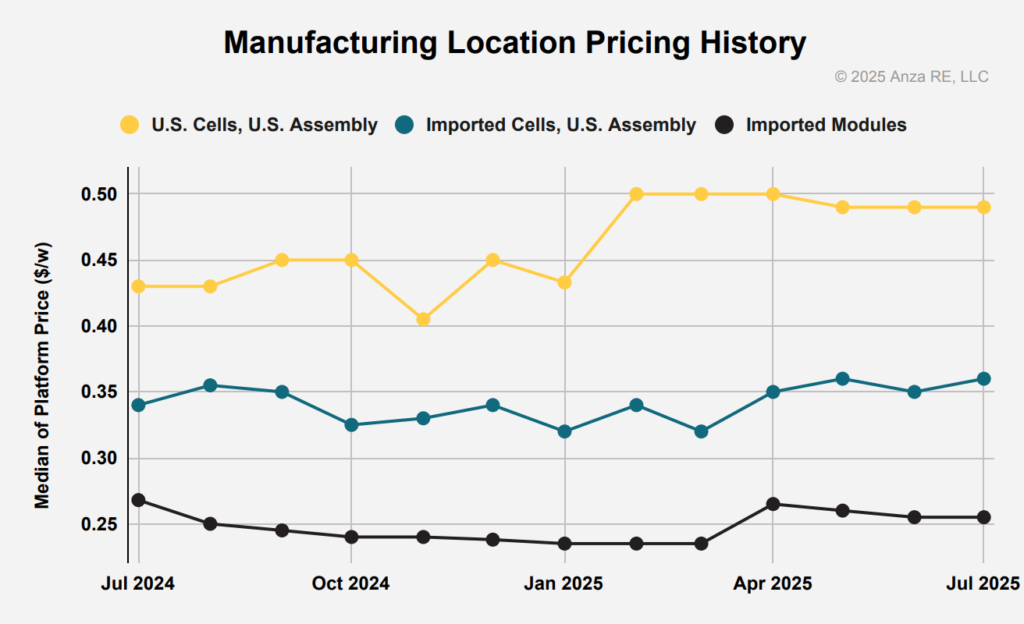

In its latest Domestic Content Report, Anza said the median price of domestically produced modules with US solar cells has only declined by 2% since April 2025, from US$0.5/W to US$0.49/W in July.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Modules assembled in the US with imported solar cells, on the other hand, have experienced a slight increase during that same period. The median price went from US$0.35/W in April 2025 to US$0.36/W in July, as shown in the image above.

Finally, the median price of imported modules has slightly decreased from April, with prices at US$0.255/W in July 2025.

However, looking further back, prices have risen from the lows of US$0.235/W registered at the beginning of the year. Overall, prices for the three categories – domestic modules with domestic cells, domestic modules with imported cells and imported modules – have all had a price increase since the beginning of 2025.

“Year‑over‑year, the premium for domestically produced cells versus imported modules widened to roughly $0.23/W, reflecting the market’s willingness to pay for tax credit, tariff, and duties certainty,” said Anza’s report.

Additional adjustments for solar manufacturers

Anza anticipates additional adjustments in the coming weeks as manufacturers finalise their foreign entity of concern (FEOC) and investment tax credit (ITC) strategies and regulation becomes clearer.

Mike Hall, CEO at Anza, recently told PV Tech Premium that the executive order signed days after the “One, Big, Beautiful Bill” introduced a fresh layer of anxiety for the solar industry (Premium access).

Among the latest developments in the short-term policy and tariff landscape are:

- The ITC safe-harbour window, with projects required to begin construction by 4 July 2026 or begin commercial operations by the end of 2027

- FEOC content thresholds for non-FEOC domestic content requirements: full credit with a 40% barrier in 2026, increasing to 60% by 2029

- New Treasury guidance – requested in the executive order signed by US president Donald Trump in July – that would revise the “beginning of the construction” rules by 18 August 2025 and limit the safe harbour strategies

- A new antidumping and countervailing (AD/CVD) petition against Indian solar companies and Chinese manufacturers with manufacturing plants in Indonesia and Laos and a Section 232 probe on polysilicon imports launched by the US Department of Commerce last month.

The US manufacturing landscape has not lain idle in the past few months, with plans continuing to shift every week, according to Anza.

“Several announced assembly lines remain on pause because of tariff reciprocity, FEOC uncertainty, and reduced production incentives under Section 45X, which begins phasing down in 2027,” said Anza.

Several manufacturing announcements have been made both before and after the reconciliation bill was signed into law in July, with mixed outcomes. On the negative side, struggling Swiss solar manufacturer Meyer Burger’s 1.4GW module assembly plant in Goodyear, Arizona, shut down in May this year.

On a more positive note, Canadian solar manufacturer Heliene opened a 500MW module assembly plant in Minnesota, while module manufacturer SEG Solar began shipments of its first utility-scale order from its Texas production plant last week.

Furthermore, materials science firm Corning recently acquired a 2GW module assembly plant in Arizona, from Chinese solar manufacturer JA Solar.

From the second half of 2025 until the end of 2027, Anza forecasts the number of domestic solar cell providers to nearly double from six to 11, while domestic module suppliers will only increase from 19 in H2 2025 to 22 in H2 2027. This is due to the recent tariff uncertainty that is prompting greater caution among suppliers, according to Anza.

Anza’s report concludes that there is an urgency to act now before there is a supply shortage, prices continue to increase and FEOC restrictions come into effect.