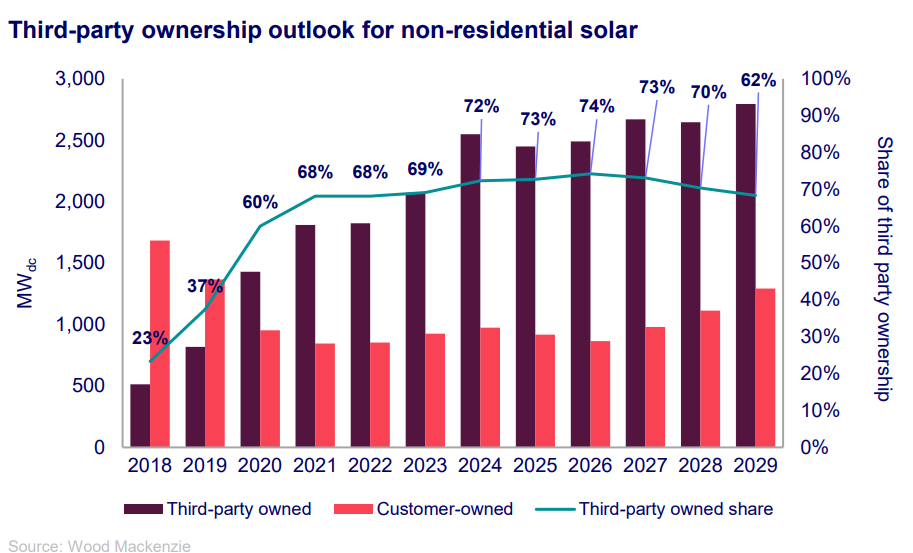

The market share of third-party ownership (TPO) of non-residential projects in the US has increased to 72% in 2024, up from 69% the previous year.

According to a recent report from energy analyst firm Wood Mackenzie, US commercial solar competitive landscape 2025, this market share is set to further increase by 2026 to 74% before decreasing to 62% by 2029. Community solar developers Nexamp, Summit Ridge Energy and Standard Solar – owned by renewable energy major Brookfield Renewable – held the largest TPO market share in 2024, with 7%, 6.5% and 5.3% respectively.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“The maturation of the tax credit transferability market is driving growth in third-party ownership,” said Amanda Colombo, research associate at Wood Mackenzie.

“Transferable tax credits offer less complex, cheaper and more flexible monetisation options for TPO projects. Small and medium-scale project developers report that transferability has simplified third-party financing.”

Moreover, the report found that the commercial and industrial (C&I) market set a new annual record in 2024, with 2.1GW of new solar PV capacity installed in the US, an 8% year-on-year growth. California, Maine and Illinois were key states driving the growth of C&I solar in the US last year.

Wood Mackenzie forecasts that the US will add over 11GW of new C&I capacity over the next five years. The key drivers for the growth of C&I solar is expected to come from rising electricity prices, growth in emerging markets and continued momentum from the Inflation Reduction Act (IRA).

“Emerging solar state markets across the country are experiencing a surge in installations, driven by favourable factors such as low development costs, untapped solar potential, and abundant available land,” said Colombo. “Notably, less established markets in the Midwest and Southeast regions are witnessing significant growth in commercial solar deployments.”

Community solar’s growth

Interest in community solar continues to grow in the US, with the sector adding a record 1.7GW of solar PV in 2024, bringing cumulative community solar installations to 8.6GW. This represents a 35% increase from 2023, according to a report from Wood Mackenzie and trade body the Coalition for Community Solar Access (CCSA) published in February 2025. Three states – New York, Maine and Illinois – accounted for two-thirds of all installed community solar in 2024.

In the first few months of 2025, several states made legislative progress for community solar. Both Iowa and Missouri moved forward to introduce a community solar programme, while New Mexico began construction of its first community solar project. More recently, New Jersey expanded its community solar programme by 250MW.

Last year, PV Tech Premium looked at how investor appetite in community solar had increased, boosted by the IRA, while the corporate world was also investing more and more in community solar projects and how these had several ways to participate in community solar.