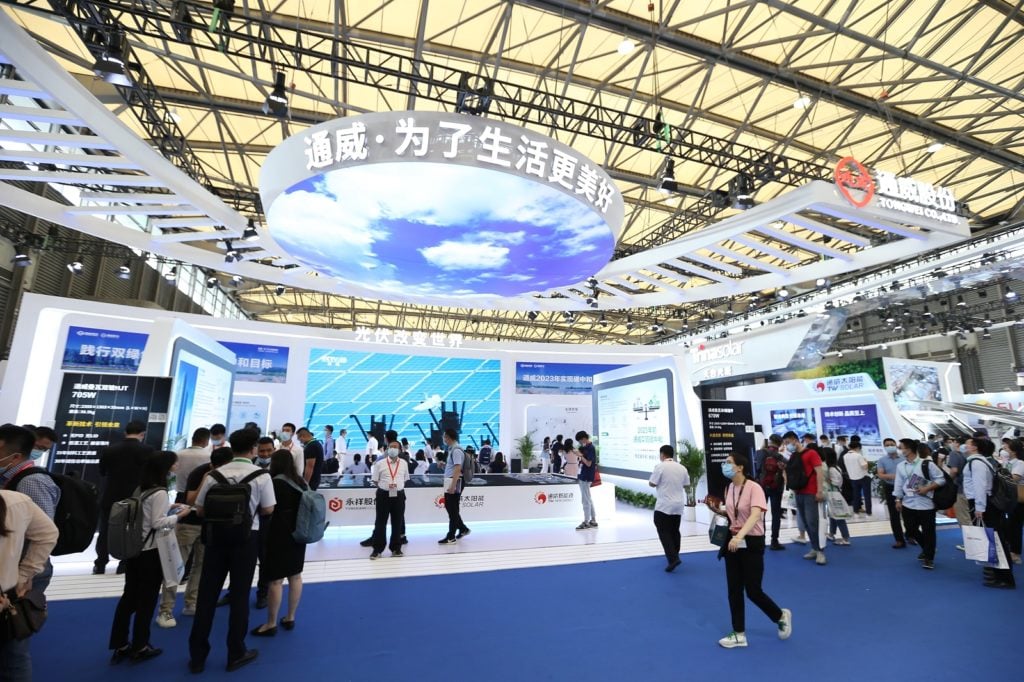

Solar manufacturer Tongwei is forecasting for a six-fold increase in net profit for Q1 2022, highlighting the impact pricing spikes are having on upstream manufacturer fortunes.

In a statement to the Shanghai Stock Exchange earlier this week, Tongwei confirmed it expected net profit in Q1 2022 to fall in the range of RMB4.9 – 5.2 billion (US$771 – 818 million), an increase of between 478 – 514% year-on-year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Tongwei noted that, in effect, the manufacturer would be making between RMB4 billion and RMB4.35 billion more than it did in the opening quarter in 2021.

It attributed this increase to installed capacity in the reporting period exceeding expectations, leading to a greater than expected demand for upstream solar products which has, in turn, maintained higher prices.

Furthermore, Tongwei said it had been able to capitalise on new production capacity that had come onstream since Q1 2021, profiting further from the maintained elevation of material and component prices.

Market prices for polysilicon in particular remain higher than anticipated, trading at RMB245/kg (inclusive of China’s 20% sales tax) in recent weeks.

Last month, Tongwei reported that its revenue had increased by more than 50% in 2021 whilst suggesting that tight material supply meant that high prices were very much here to stay, at least in the short term.

PV Tech’s head of market research Finlay Colville has meanwhile also mused that Tongwei could become the industry’s leading PV module supplier by 2025 should it pursue a vertically-integrated product strategy that would see it become the sector’s first polysilicon-to-module manufacturing entity.