Vietnam’s near-term renewables outlook will be weighed down by regulatory and operational uncertainties stemming from a lack of clear policy and an “underdeveloped grid capacity”, according to Fitch Solutions’ latest report on the market.

The report, released yesterday (3 March), comes after Vietnam’s government said its planned 18.4GW of solar capacity for the 2021-2030 period is “too high” following issues with curtailment and grid connections, which present a major obstacle to future growth.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

While it maintains its strong forecast for non-hydro renewables capacity in Vietnam to more than double over the coming decade – reaching over 50.3GW by 2031 – Fitch Solutions expects growth to “slow significantly over the near term” after the delivery of a backlog of projects due for completion over 2022 due to “several regulatory and operational uncertainties”.

Fitch Solutions said details around the government’s new National Power Development Plan 2021-2030 (PDP8) remain unclear and that “there appears to be continued disagreements between different governmental bodies around the trajectory of Vietnam’s power development plan”, which has been revised four times since its first draft in February last year.

These revisions have included “notable differences across each revision in terms of the roadmap that government wants to adopt for the sector,” said Fitch Solutions, “We believe the lack of a clear policy direction will weigh on near-term investor sentiment.”

“We note that something similar also took place in 2019/2020 around solar feed-in-tariff (FiTs), with disagreements between the MOIT and the Prime Minister’s office, causing significant uncertainties and multiple policy reversals,” said Fitch Solutions, adding that “this sets a bad precedence for the market, and highlights the regulatory risk in the market, which may erode investor sentiment.”

In March last year, PV Tech reported that Vietnam was planning to slash FiTs available for rooftop solar installations from next month by as much as 38% in a bid to address grid pressures in the country.

After experiencing rapid growth in solar deployment – more than 9GW of rooftop solar was installed in Vietnam in 2020, around 6GW of which was installed in December alone – Vietnam has been suffering from significant curtailment issues, with many projects also struggling with connection issues.

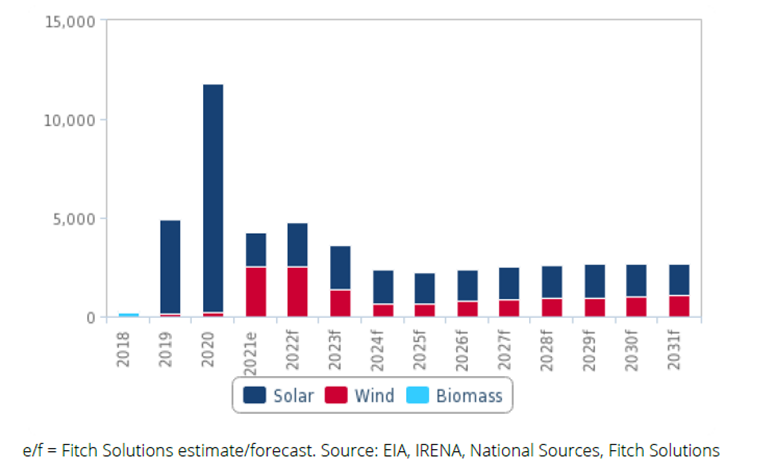

The amount of solar capacity added plummeted in 2021, far outstripped by wind, and this trend is expected to continue this year, before solar takes the lead again in 2023, accord to Fitch Solutions projections (see graph).

One of the major issues hindering greater solar capacity additions in Vietnam is the country’s “underdeveloped grid capacity”, according to Fitch Solutions.

Fitch Solutions said Vietnam’s transmission infrastructure has not kept pace with its rapid capacity growth and presents significant risk of bottlenecks.

“The rapid build out of renewable projects have already caused grid overload and renewables curtailment, with wind and solar plants across many provinces, particularly in the southern regions, reportedly forced to reduce their output to maintain grid stability in recent years,” said Fitch.

As a result of the inadequate gird infrastructure, the government is considering allowing private investments into transmission lines and substations below 500kV, which is now controlled exclusively under state-owned EVNNPT.

“We believe that if the proposal is approved, this will encourage more growth and opportunities for investors, amid the government’s commitment to develop and improve grid infrastructure,” said Fitch Solutions.