China-based polysilicon producer Daqo New Energy Corp has been impacted by weaker than expected financial results for the second quarter of 2019, due to the lack of demand in China and record low polysilicon prices.

On all key financial metrics, Daqo reported quarter-on-quarter declines.

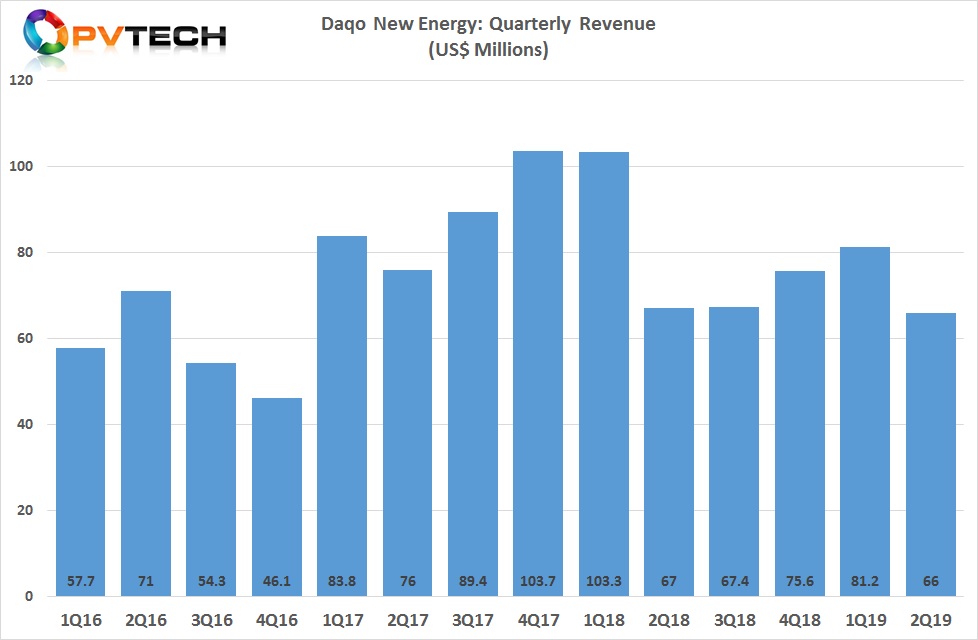

The company reported second quarter 2019 revenue of US$66.0 million, compared to US$81.2 million in the first quarter of 2019, and US$63.0 million in the second quarter of 2018. Daqo said the decline in revenue was primarily due to lower polysilicon sales volume and lower ASP.

Longgen Zhang, CEO of Daqo New Energy said, “The second quarter of 2019 was a challenging time for polysilicon industry as prices dropped to their lowest levels in history, particularly for multi-grade products. While prices for mono-grade products declined sequentially, they were relatively stable. We believe that polysilicon supply and demand will balance out and begin to improve when Chinese project developers begin to place orders by the end of the third quarter. Incremental demand from China is expected to gradually exceed the additional supply that is currently hitting the market. We believe polysilicon ASP will begin to improve in the third quarter of 2019 to a level that the majority of marginal high-cost players are able to break even on a cash-cost basis, which we estimate to be approximately US$10.5 to US$11/kg. Moreover, the pricing spread between mono-grade and multi-grade polysilicon products will likely remain significant, because output of mono-grade polysilicon still lags behind market demand and new capacities of mono wafer are still growing.”

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

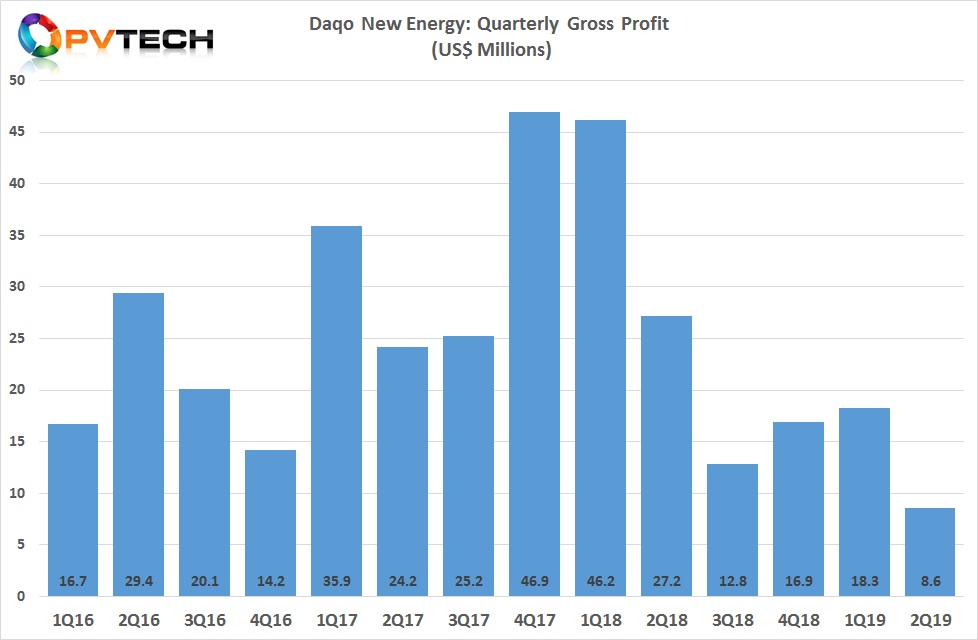

As a result, gross profit in the reporting period was only US$8.6 million, compared to US$18.3 million in the first quarter of 2019 and $25.2 million in the second quarter of 2018.

However, profits were also impacted by higher polysilicon production costs caused by undertaking annual maintenance, due to lack of demand in the second quarter rather than typically in the third quarter of the year as China demand used to peak in that quarter, due to downstream utility-scale FiT reductions in June. Weaker demand in China has been due to the major changes in PV support mechanisms in China that have only recently been ratified. Impacting profits had also been debottlenecking projects.

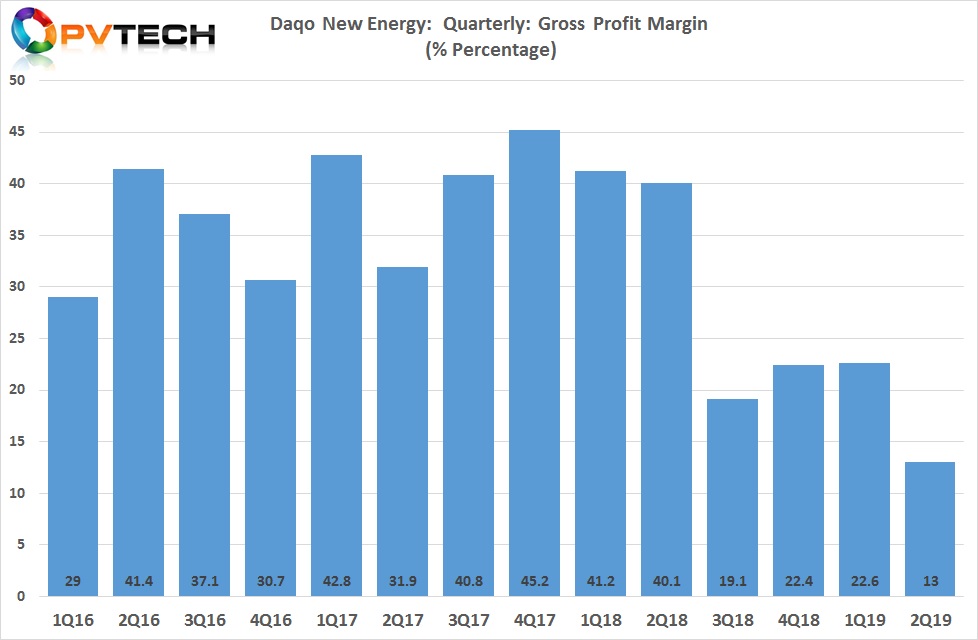

The company reported a gross margin of 13.0%, compared to 22.6% in the first quarter of 2019 and 40.1% in the second quarter of 2018.

The loss from operations was US$0.4 million, compared to income from operations of US$9.2 million in the first quarter of 2019 and $18.0 million in the second quarter of 2018.

The Company recorded an operating loss, compared to operating margin of 11.3% in the first quarter of 2019 and 28.6% in the second quarter of 2018. EBITDA from continuing operations was US$10.2 million, compared to US$20.0 million in the first quarter of 2019, while EBITDA margin was 15.5%, compared to 24.6% in the first quarter of 2019 and 43.6% in the second quarter of 2018.

Daqo reported it had US$79.6 million in cash, cash equivalents and restricted cash, compared to US$113.7 million as of March 31, 2019 and US$172.5 million as of June 30, 2018.

Polysilicon production volume in the second quarter of 2019 was 7,151MT, compared to 8,764MT in the prior quarter.

Polysilicon sales volume in the reporting period were 7,130 MT in Q2 2019, compared to 8,450 MT in Q1 2019.

Daqo said that average total production cost of polysilicon in the reporting period increased to US$8.12/kg, compared to $7.42 /kg in the previous quarter as a result of the maintenance and debottlenecking.

Polysilicon average cash cost was US$6.65/kg in Q2 2019, compared to US$6.20/kg in Q1 2019.

Polysilicon average selling price (ASP) was US$9.10/kg in Q2 2019, compared to US$9.55/kg in Q1 2019

Manufacturing update

Daqo said that its newly debottlenecked production facilities would enable production volumes in the third quarter to be approximately 9,200MT to 9,500MT of polysilicon, with the total potential costs returning to normal levels of approximately US$7.60/kg.

The company noted that during the second quarter, approximately 80% of polysilicon was sold to monocrystalline customers and that the debottlenecking projects and annual maintenance, would further increase monocrystalline customer sales to account for approximately 85% of total sales in the third quarter of 2019. Upon the full ramp up, we expect that 90% of our total production volumes will be sold to mono customers, including 40% for the N-type mono wafer market.

The company is also undergoing test with select potential customers for its ultra-high purity polysilicon for the N-type mono wafer market. This is being tied into its Phase 4A polysilicon expansion project, which is still expected to be completed by the end of 2019.

Upon the full ramp up, Daqo expected that 90% of total production volumes would be sold to mono customers, including 40% for the N-type mono wafer market.

For the full year of 2019, Daqo reiterated that it expected to produce approximately 37,000MT to 40,000 MT of polysilicon.

Combined with debottlenecking projects, the Phase 4A expansion would lead to a full annual nameplate capacity of 70,000MT by the end of the first quarter of 2020.

However, due to the current market conditions for polysilicon and its balance sheet, plans for Phase 4B expansions were said to be too early to make at that time.

Guidance

Daqo said it expected to produce approximately 9,200MT to 9,500 MT of polysilicon in the third quarter of 2019, with a total production cost of US$7.50/kg. External polysilicon sales would be approximately 9,000 to 9,300MT.

“In early July this year, China's National Energy Administration released a list of 22.8 GW approved solar projects that secured government subsidies for 2019. Combining these approved subsidized projects, grid-parity projects, residential distributed-generation projects, top-runner projects and poverty alleviation PV projects, China is expected to install approximately 40GW to 45GW of new solar PV projects in 2019. During the first half of 2019, China has already installed 11.4GW, which means the installation volumes could triple in the second half of 2019.

Realistically, it will take some time to complete the preparation work for these recently approved subsidized solar projects, which includes detailed designs and rounds of procurement bidding and contract negotiations. All of these stages have to be completed before the actual modules can be shipped. All in all, we anticipate China's solar demand to pick up significantly starting from early September,” added Zhang.

For the full year of 2019, Daqo reiterated that it expected to produce approximately 37,000MT to 40,000 MT of polysilicon.