Chinese solar PV inverter and energy storage manufacturer Sungrow will build a solar inverter and energy storage system manufacturing facility in southwest Poland.

Located in Wałbrzych, Lower Silesia, the planned 65,400 m² facility will manufacture both solar PV inverters and energy storage systems, with an annual nameplate capacity of up to 20GW and 12.5GWh, respectively.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

According to the company, the new facility is scheduled to begin operations within the next 12 months and represents an investment of €230 million (US$271 million).

Shawn Shi, president of Sungrow Europe, said: “Lower Silesia’s history of skilled technical expertise in electronics, automation and advanced manufacturing made it the prime location for our new factory. We intend to hire locally to tap into this expertise, as we live our commitment to grow with the communities we serve.”

Sungrow currently has three manufacturing hubs, all located in Asia: one in Hefei, China; one in Bengaluru, India; and one in Chonburi, Thailand.

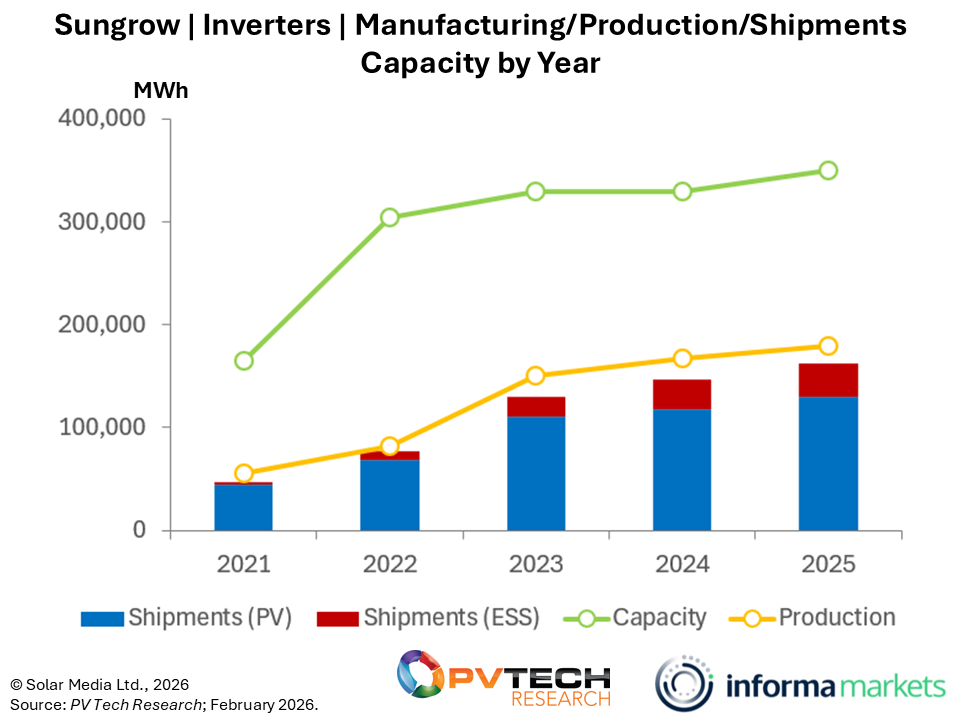

“Sungrow has the largest inverter manufacturing capacity of any company globally, with most of its operations based in China, alongside a total of 25GW of capacity overseas in Thailand and India. With the addition of the new factory in Poland, Sungrow’s total inverter manufacturing capacity will increase to 350GW,” explained Mollie McCorkindale, senior analyst at PV Tech Market Research.

Sungrow claimed that the new facility will strengthen local production, while also enhancing the company’s logistics capabilities across Europe by locating key manufacturing activities closer to customers, reducing lead times and enabling more efficient distribution.

The company has been present in Europe since 2005, and since 2011 it has expanded its presence to 25 local representative offices and two research and development centres through its own legal entity, Sungrow Europe.

“The Sungrow investment highlights Poland’s growing strategic importance within Europe’s clean-energy value stream and shows that Poland, including the industrialised and high-tech developed region of Lower Silesia, is one of the most attractive locations in Europe to scale renewable energy technologies,” said Marcin Lerner, president of the management board of the Wałbrzych Special Economic Zone.

The announcement to set up a manufacturing facility in Europe comes as the inverter market is expected to contract in 2026. A recent report from analyst Wood Mackenzie forecasts that the European inverter market will decrease from 88GW in 2024 to 83GW in 2025 and continue to fall to less than 75GW annually by 2032. This revised forecast was due to “persisting inventory challenges and reduced utility-scale capture prices in key markets like Spain.”

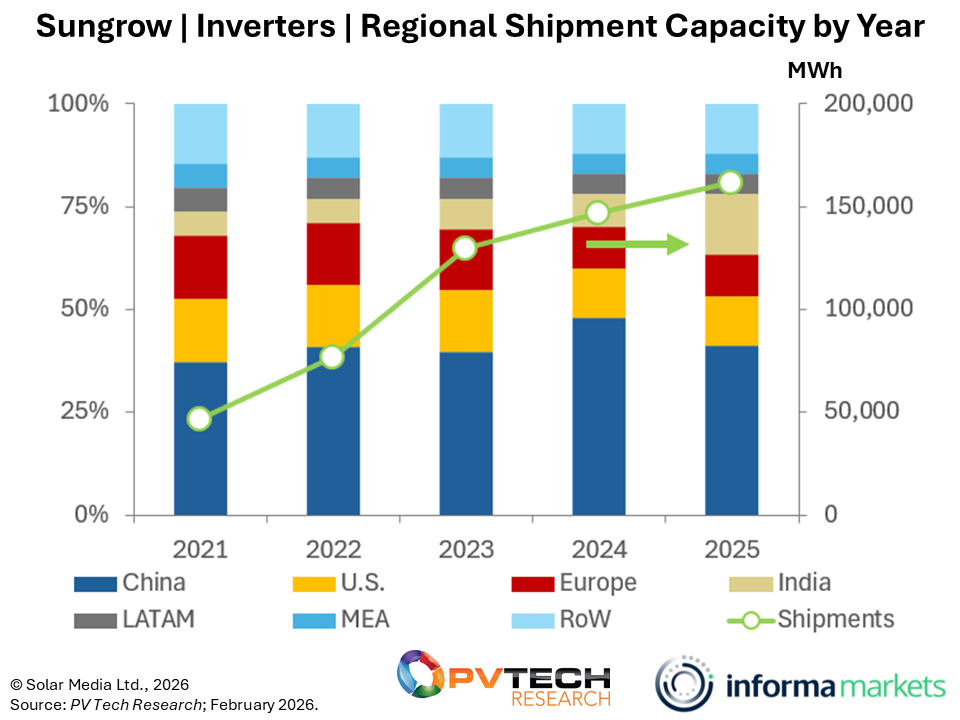

McCorkindale said that this move will allow Sungrow to strengthen its market presence in Europe, even as its share of shipments to the continent has declined in 2024 -2025, alongside its competitors’.

With this new manufacturing facility in Poland, it would make it easier for Sungrow to participate in public tenders under the Net Zero Industry Act (NZIA) non-price criteria auctions, such as the one held in Italy last year, which awarded 1.1GW of solar PV. These tenders aim to diversify the supply chain for solar PV components, such as inverters and modules, that are not made in China.

On the other hand, Sungrow’s new facility comes amid increased discussions about cybersecurity issues surrounding solar inverters in Europe. Last month, the European Commission released a proposal to revise its Cybersecurity Act (CSA), which includes provisions to exclude “high-risk” companies and components from European supply chains.

“This new facility is a crucial investment in the European inverter market, responding to the region’s demand for locally sourced products amid changing policies and a projected decline in inverter shipments. By localising production, Sungrow not only reduces costs and ensures adherence to sustainability and grid standards but also addresses cybersecurity concerns associated with importing key energy infrastructure from outside Europe,” concluded McCorkindale.