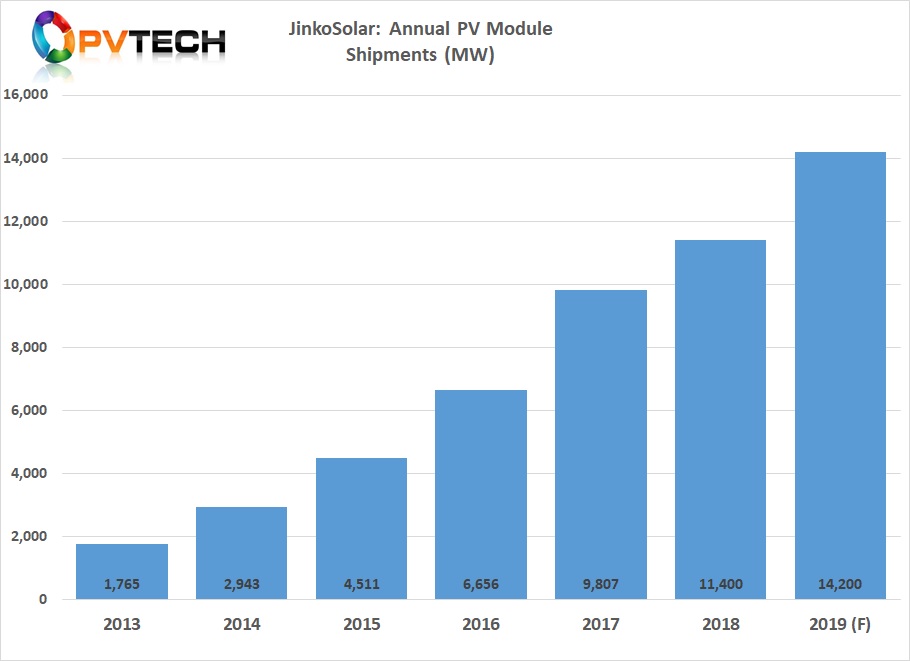

Updated: Leading ‘Solar Module Super League’ (SMSL) member, JinkoSolar has guided up to 20,000MW of PV module shipments in 2020, at least a 25% increase over new 2019 shipment guidance levels.

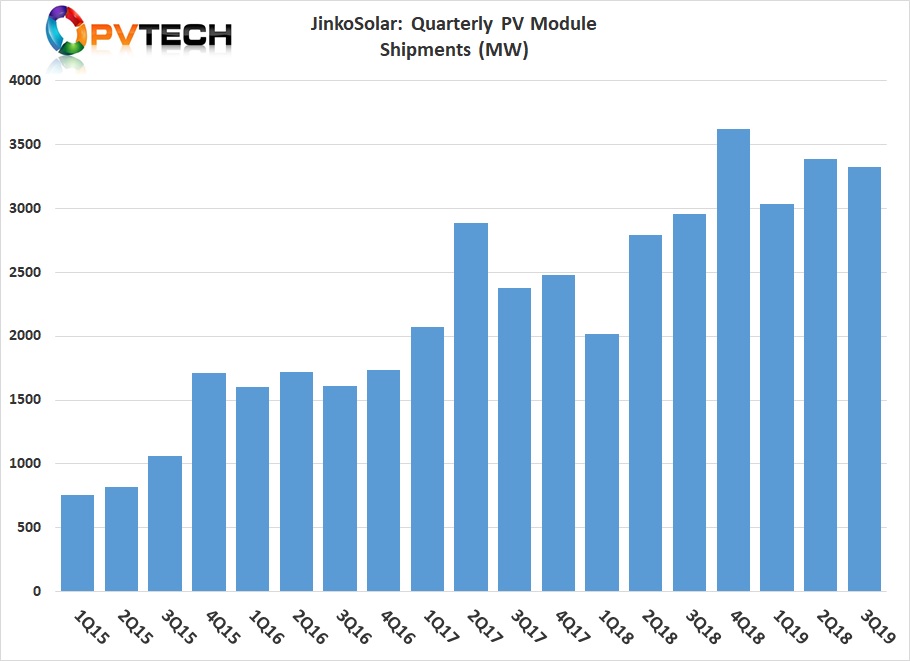

The SMSL reported third quarter 2019 total module shipments of 3,326MW, a 1.8% decline from the previous quarter (3,386MW).

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

However, JinkoSolar guided fourth quarter 2019 shipments to be in a range of 4,200MW to 4,400MW, easily setting a new quarterly shipment record. The SMSLs current quarterly shipment record of 3,618MW was set in the fourth quarter of 2018.

For the full year 2019, JinkoSolar guided total solar module shipments to be in the range of 14,000MW to 14,200MW, adjusted down from a wider range guide of 14,000MW to 15,000MW.

Despite global PV market concerns of growth flatlining in 2020, JinkoSolar provided a strong shipment forecast for 2020. The SMSL guided total module shipments to be in the range of 18,000MW to 20,000MW.

Financials

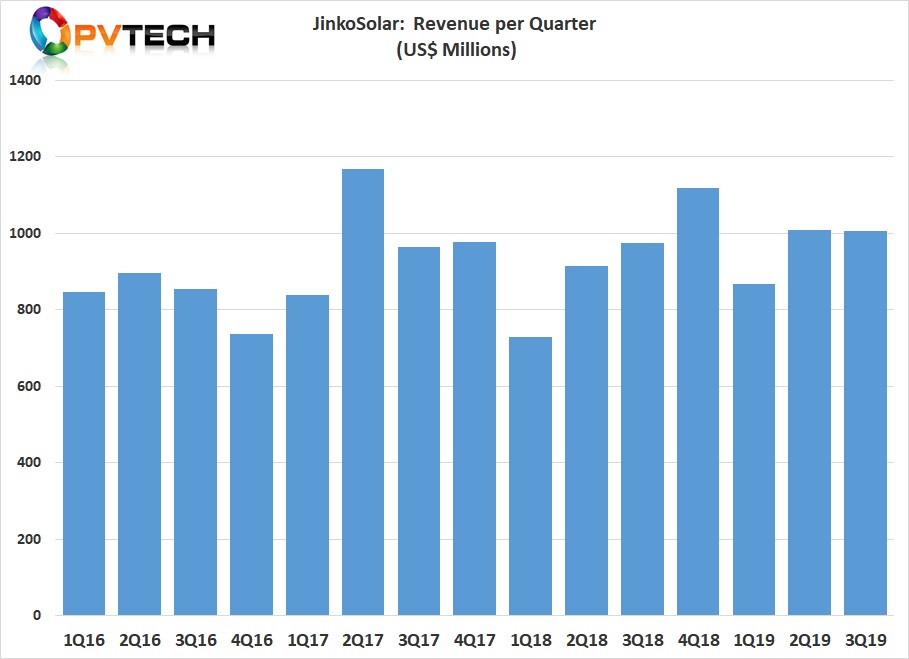

JinkoSolar reported third quarter revenue of US$1.05 billion, an increase of 8.2% from the second quarter of 2019 and an increase of 11.8% from the third quarter of 2018.

Gross margin was 21.3%, compared with 16.5% in the second quarter of 2019, and 14.9% in the third quarter of 2018. Excluding the Countervailing Duty (“CVD”) and Anti-dumping Duty (“ADD”) reversal benefit, gross margin was 18.5% in the third quarter of 2019.

Income from operations was US$89.4 million, compared to US$37.9 million in the previous quarter.

Kangping Chen, JinkoSolar's Chief Executive Officer commented, “I'm pleased to report strong operational and financial results for the third quarter which I believe marks a turning point for our business, as we begin to increasingly benefit from our technology transformation, industry-leading cost structure and expanding mono capacity. Module shipments during the quarter were 3,326 megawatts, an increase of 12.6% year-over-year and a slight decrease sequentially. Our integrated production costs continued to decrease, which, combined with our high-quality products and global distribution footprint, allowed us to initiate a reset of our gross margin, expanding it to 21.3% during the quarter, a significant 6 percentage point increase year-over-year. We are very optimistic about our growth prospects next quarter and throughout 2020 where we expect to see our overall profitability strengthen and margins expand.

Manufacturing update

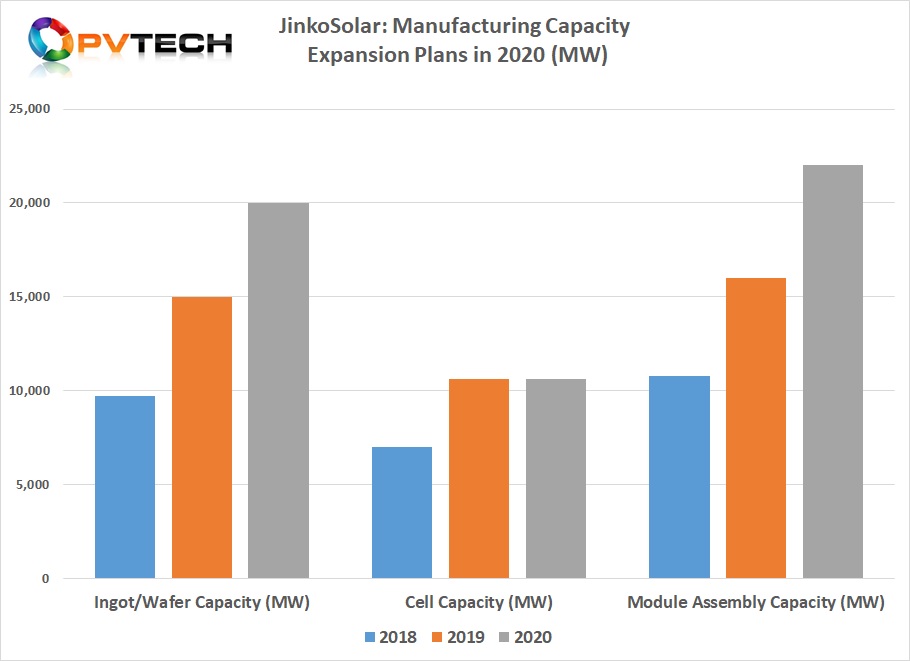

JinkoSolar reported that at the end of the third quarter of 2019, its annual silicon wafer production capacity had reached a total of 14.5GW, which included 11GW of mono wafers.

Solar cell capacity reached 9.2GW, all allocated to PERC (Passivated Emitter Rear Cell) technology. However, the SMSL also noted that it had ramped n-Type mono cell capacity to 800MW in the third quarter of 2019. The company would also be ramping up to full production of n-Type cell capacity during the fourth quarter.

PV module assembly capacity was said to have reached 15GW in the third quarter of 2019.

JinkoSolar expects its annual silicon wafer capacity to reach 15GW by the end of 2019, including 11.5GW of mono wafers.

Total solar cell capacity is targeted at reaching 10.6GW by the end of 2019, including 9.8GW of PERC cells.

Module capacity is continued to be ramped higher. By the end of 2019, JinkoSolar said it expected module assembly capacity to reach 16GW.

Further expansions in 2020 are also planned. JinkoSolar guided annual silicon wafer capacity to reach 20GW by the end of 2020.

Currently, JinkoSolar is not guiding further in-house solar cell expansions for 2020.

In-line with PV module shipment guidance of being in the range of 18GW to 20GW, the SMSL expected module assembly capacity to reach 22GW by the end of 2020.

Management said in the earnings call that capex in the first three quarters of 2019 had reached around US$410 million with full-year capex expected to be around US$500 million.

However, with capex focused on wafer and module expansions and limited up-grades in 2020, capex would be lower at around US$300 million in 2020.

“We continue to invest in product development to meet growing market demand for high-quality and efficient products. We expanded our production capacity of N-type cells to 800MW during the quarter, and are currently ramping up to full production which is expected to begin next quarter. Our N-type cells reached a record high efficiency of 24.58% in June 2019. We also recently unveiled a new Tiger module which, with its 20.78% efficiency and peak power output of 460W, offers our clients significantly improved efficiency, lower production costs and a better internal rate of return, added Chen.”

With emphasis on mono-based high-efficiency products, JinkoSolar said that mono-based products accounted for almost 75% of module shipments in the third quarter of 2019. This is expected to reach 99% in 2020, marking the rapid transition in the industry away from multicrystalline wafers to monocrystalline.

Guidance

JinkoSolar guided fourth quarter revenue to be in the range of US$1.17 billion to US$1.23 billion with gross margin to be between 18.5% and 20.5%.

As a result, 2019 annual revenue is expected to exceed US$4.0 billion, compared to US$3.73 billion in 2018.